No one wants to be broke, living paycheck to paycheck, or struggling with money. Everyone wants to succeed with their finances. But many people struggling with their finances don’t know how their money works. If you really want to succeed in personal finance, you have to treat your finances like a business with personal financial statements.

Think of yourself like a business

Successful businesses do not just guess how they are performing, they perform detailed analyses regularly. As a corporate accountant and financial analyst for nearly a decade, I spent my work days looking into the details of products at multibillion-dollar companies. We didn’t guess how our finances worked, we understood everything from revenue sources to expenses for every product and customer.

We should take the same approach to our personal finances. In “the business of you,” you have the same concerns as any corporation. Businesses have to generate enough revenue to cover all expenses and have leftover cash to reinvest or pay owners as profit. You also need to earn each month to cover your expenses and have enough left over for savings, investments, and a little fun.

To understand how your personal business is performing, you need the same financial reports that business managers and investors use to make the best decisions. These financial statements are the balance sheet, income statement, and cash flow statement. Lucky for us, with some great, free tools at our disposal, putting together our own personal financial statements isn’t all that difficult or time-consuming.

If you follow along, you will end with your own personal balance sheet, personal income statement, and personal cash flow statement. You will have enough information at your fingertips to understand where your money comes from, where it is going, what you have, what you owe, and if you are on track to meet your financial goals.

Get your financial information in one place

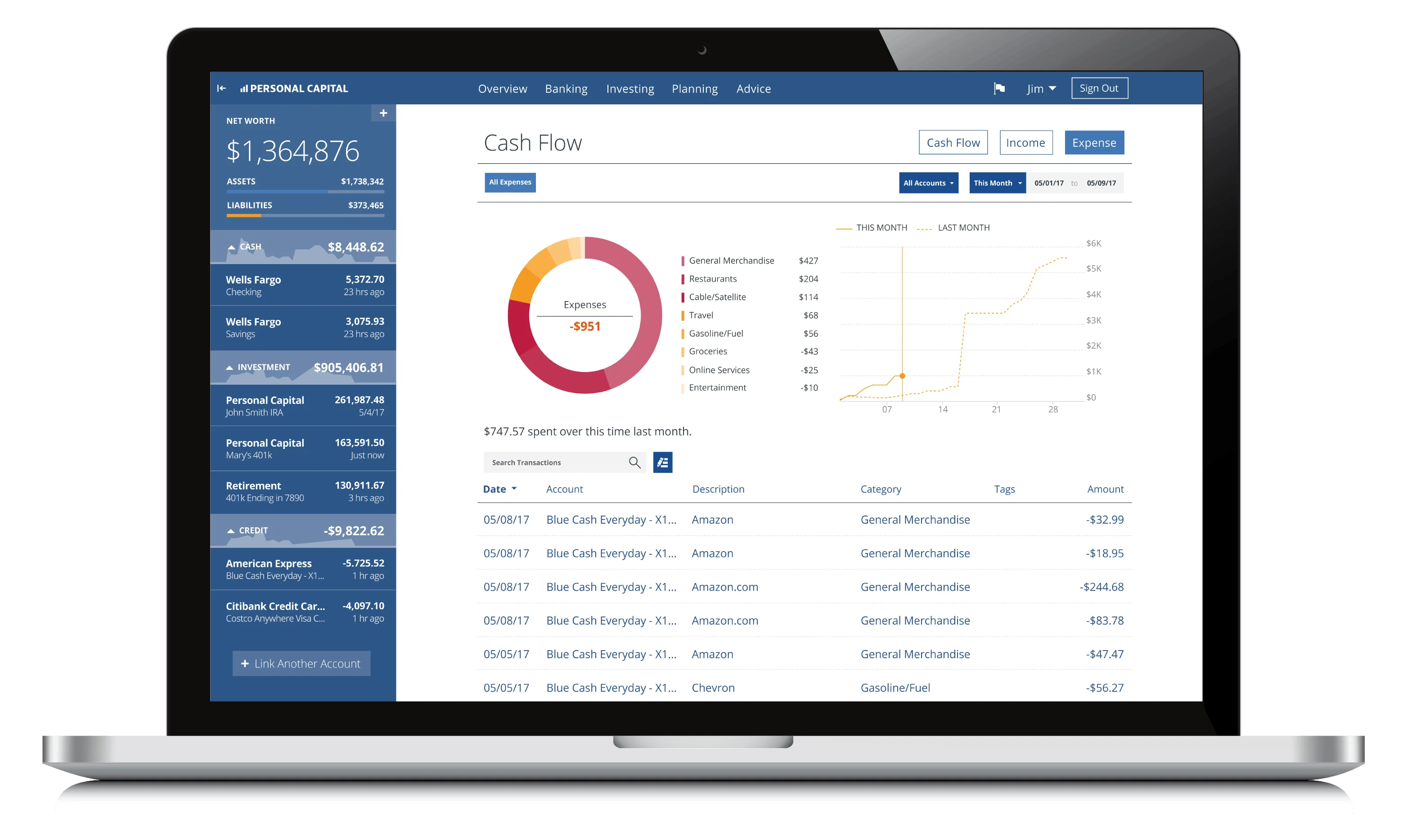

To start, you need all of your financial information in one place. Some people might gather a stack of paper financial statements, but I prefer to log into one website or app and have everything quickly available. I have used similar sites since 2007, and my longtime favorite is Empower. When I log into Empower, I can view a snapshot of all of my financial accounts. I can view balances in one place, or click to view recent transactions and more account details. Take a look at a sample dashboard below.

Empower tracks my spending by category and calculates my net worth automatically. While it is incredibly useful for all of these features, and that’s why we need it today, the most powerful features focus on your investments. Empower will conduct an automatic investment analysis for every connected account. I used information on investment fees to shift to similar, lower-fee mutual funds to save over $300 per year in investment fees. Over the years, that is thousands of dollars I will have for retirement I don’t have to give away to big companies.

So start out by heading to Empower and connecting all of your bank, credit card, loan, and investment accounts. If you connect every financial account, you’ll have the big picture of your finances you need to build all of the financial statements below. Everything we’ve discussed is completely free of charge, which is awesome!

If you have more than $100,000 in investable assets, you may be contacted by Empower for additional investment services. They offer a great advising product, but you are not obligated to accept and can always use the Empower dashboard and tools for free.

Personal Financial Statements: Balance Sheet

In personal finance, we discuss our net worth or the total value of our assets fewer debts. Businesses have the exact same thing, but they call it a balance sheet. A balance sheet shows the net worth of a business, but on a balance sheet, net worth is called shareholder’s equity.

For those of us who have not taken accounting, here is a quick rundown. Assets on the left, liabilities on the right, and shareholder’s equity below liabilities. Assets + Liabilities = Shareholders Equity.

A personal balance sheet is a snapshot in time. From month to month as you earn money and spend money, your personal balance sheet changes daily. If you make a purchase on your credit card, your liabilities increase. If you get paid, your assets increase. If you buy something with cash, your assets go down. This type of change in your balance sheet happens every time you make a purchase or enter into any type of financial transaction.

How to Build a Personal Balance Sheet

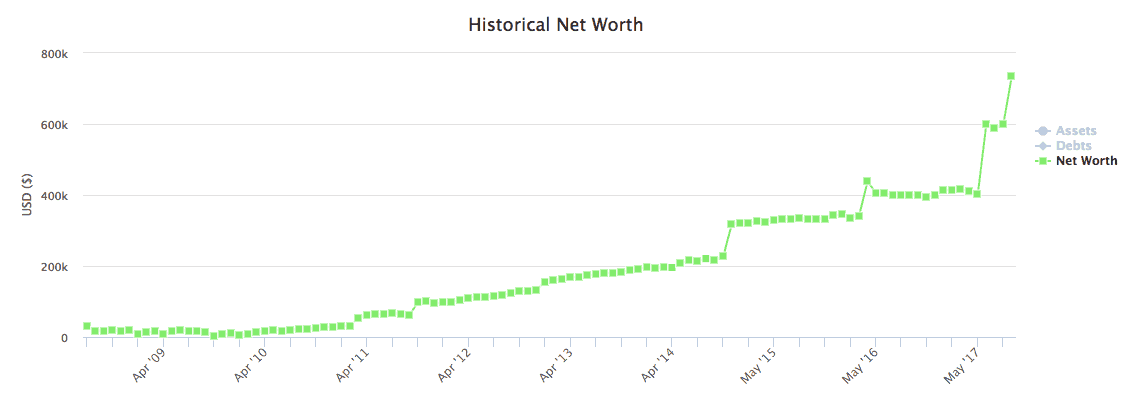

I have built a monthly personal balance sheet every month since July 2008. I use a free website called NetWorthShare to track my net worth, which I do every month. I have an epic tracking page of all monthly net worth entries from 2009 to 2011 here. Thanks to the built-in charts, you can watch my net worth slowly build before grad school, drop to near zero as I finished my MBA program, and slowly climb with some real estate-related jumps.

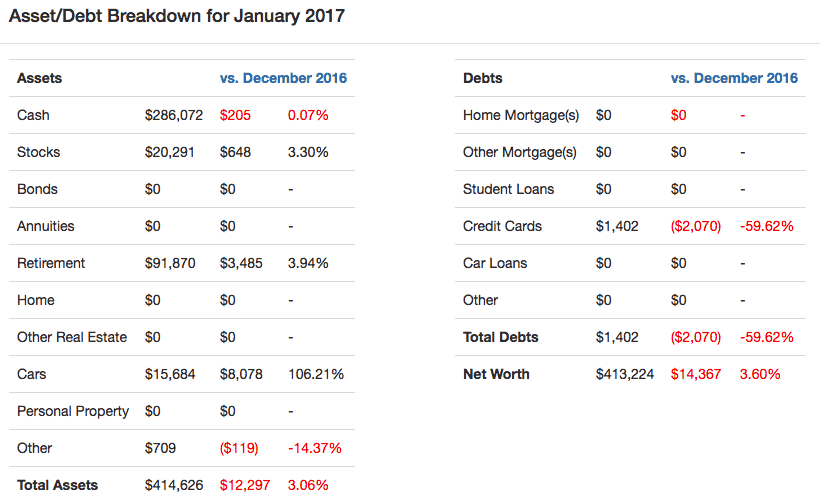

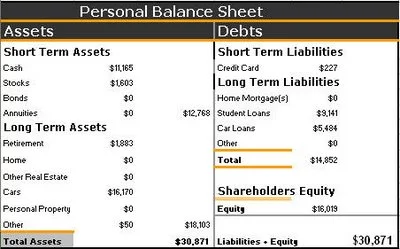

To gather the data for my personal balance sheet, I use my account balances at Empower, the home value from RedFin, and update my car values annually from Kelley Blue Book. Here is a screenshot of my update from January 2017, before I bought my current home.

As you can see, this month my cash went down, other assets (Lending Club loans that I cashed out) went down, and my credit card balances went way down. I pay my credit cards off in full every month but do to all of my spending on credit cards to maximize travel miles and points for free trips. My stocks and retirement balances were up thanks to a good month in the stock market, and this was the first month I started tracking my wife’s car in our net worth.

This month my net assets were up $12,297 and my debts were down $2,070. My net worth was up $14,367 for the month, or 3.60%.

I started tracking my net worth shortly after leaving college, which makes this a nearly complete view of my net worth over my career. The biggest jumps were all related to buying and selling homes. They make it seem like the big swings from grad school tuition were not so big after all!

Understanding Your Balance Sheet

Assets as a positive number plus liabilities (a negative number) give you your personal net worth. This snapshot from an earlier net worth update shows how equity fits into the balance sheet and makes the personal balance sheet look more like a business balance sheet.

Ultimately, the goal is the grow your equity, or your net worth, over time. Remember that your personal finances are a marathon, not a sprint, and you won’t see your net worth skyrocket instantly. If it was easy to get rich quickly, everyone would be rich! The chart above tracks my net worth for more than nine years!

Analyzing Your Balance Sheet

If you look at business balance sheets for public companies, you will find that most have a positive value for shareholders equity on the balance sheet, but not all. Some have a negative net worth, which is not sustainable in the long run. The same is true for our personal net worths. If you have more debts than you do assets, you have a negative net worth.

This is not uncommon. As student loans and other debt balances rise across the country, more people find themselves buried under debt owing far more than they have. If you have a negative net worth, flipping that balance from red to black should be a top priority. When you budget well and spend less than you earn, higher net worth is inevitable.

Stock analysts and financial analysts use some financial ratios to measure a business’s financial health. We can use the same math for our personal balance sheet to get a better view of your financial health. For example, the quick ratio, also known as the acid test, shows the ability to pay bills over the short term.

To calculate the quick ratio, we divide current assets over current liabilities. “Current” assets are cash and equivalents, while current liabilities are any debts owed in the next month. Large businesses use debts due within one year when calculating the quick ratio.

Using the snapshot of the balance sheet above, the quick ratio is calculated as follows: 12,768/227. In this case, the quick ratio is 56.25. That means I could cover my current liabilities 56 times with my current assets. This is a great result. A quick ratio of 1.0 means you are living literally month to month, or paycheck to paycheck. A quick ratio below 1.0 means you are dealing with immediate liquidity issues and can’t make all required payments.

While the short-term assets category for companies is anything due within a year, I am using within one month as current as that is more appropriate for a person making regular bill payments. From big swings in income or big debt payments, you can undergo a big change in a month’s time. That is why I like to track my finances every month.

Personal Financial Statements: Income Statement

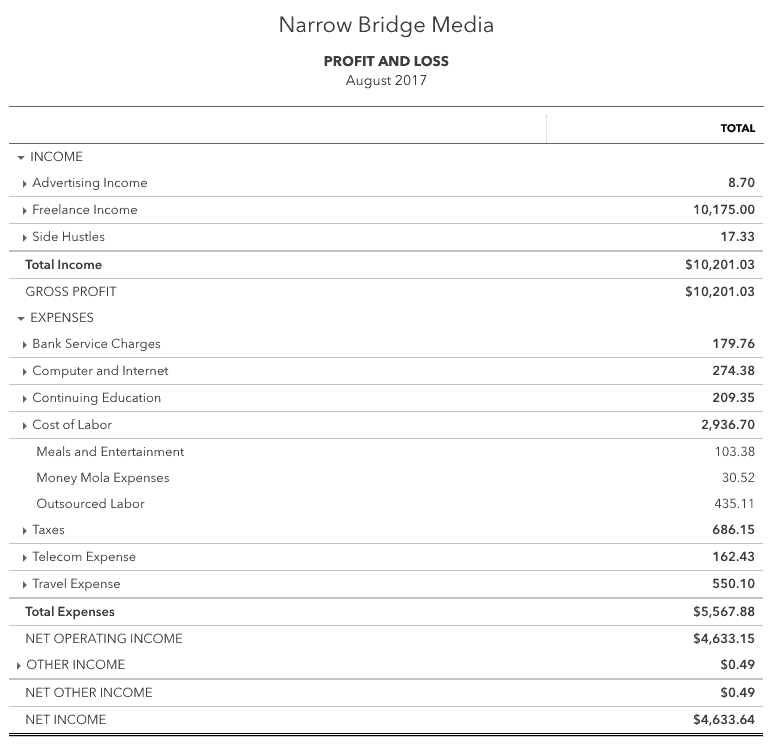

Next, we are going to look at our earnings and expenses over a period of time. This is measured with the income statement or in our case a personal income statement. I actually put together an income statement every month for my business. I give a high-level view every month in my monthly income reports. An income statement is also called a profit and loss statement, or a P&L. I can view my business P&L quickly in Quickbooks.

Below is a screenshot of my business income statement for August 2017. In my regular income reports, I take out my own paycheck (included in the cost of labor) and taxes. This is the full version I use for accounting, income taxes, and financial planning.

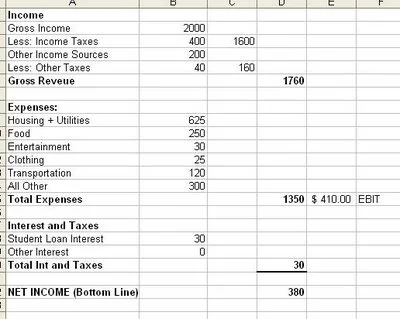

While you could use Quickbooks for your personal finances, it may be overkill. But again, Empower has you covered. But before we look at that, let’s look at an old-school spreadsheet example I put together in Microsoft Excel. Here is a personal income statement based on a hypothetical situation. These are fabricated numbers just for this post, and any resemblance to anyone’s actual finances is purely coincidental. I made this spreadsheet publicly available here in Google Sheets.

So, a net income is what you keep after everything you earn and spend. Your net income at the end of a time period rolls into your balance sheet as cash or assets. There is no right or wrong net income. There is only one rule, IT HAS TO BE GREATER THAN ZERO! The bigger the better. You should put that net income into savings or retirement. You could even put savings as a category under expenses or a deduction of income in the revenue section to build in your savings.

The Empower income statement is displayed as cash flow. Here is a screenshot of the expense section from Empower. When your accounts are connected, your cash flow is automatically calculated for you without doing any work!

Getting details from your income and expense category breakdown is even more helpful. You can look for opportunities to cut expenses, improve your budget, pay off debt, and boost your savings. Your personal income statement is a valuable tool. Use it to make sure you always spend less than you earn so your net worth will rise every month.

Learn More Best Budgeting Apps: Mint Alternatives

Personal Financial Statements: Statement of Cash Flow

The last major statement is the statement of cash flow. For personal financial statement purposes, this is very similar to the personal income statement, so we won’t spend as much time here as we did on the other two. However, it is still an important concept to understand.

In business, the statement of cash flow shows all cash in and out of the business broken down into three categories: operations, investing, and financing.

For personal purposes, the traditional cash flow statement breakdown is not quite as useful. However, every month we all have cash come in (hopefully) and cash goes out. At the end of the day, the accounting statements above show us what assets we have and what liabilities we owe, but not our cash position. That is what the statement of cash flow is for.

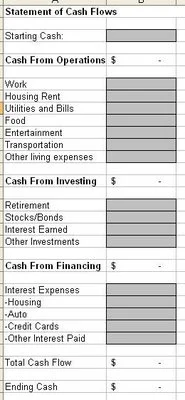

Anytime you use cash or an equivalent like a check or debit card, cash changes hands. The following template helps you sort out where your cash is going and the net change.

The goal here is to minimize cash outflow from operations (living expenses). You also want to see the final “Total Cash Flow” be positive, indicating a net increase in cash.

I have saved this template as another Google Spreadsheet that anyone can access. Feel free to copy it to your own Google Drive account or into a spreadsheet file on your computer. The only cells that you need to fill in are the grey ones. Everything else is automatic.

What Do Personal Financial Statements Mean?

To wrap up this guide to personal financial statements, we will explore the results and what they really mean for your finances.

The Personal Balance Sheet gives us our liquidity position. To analyze the information here, look at the quick ratio and acid test. If your current assets do not meet or exceed your current liabilities, you need to make a quick change to your financial situation.

The Personal Income Statement tells you how much you make in a given period as a net income. A high net income means you have a good income/spending gap. A negative net income means you are spending more than you make and should make a quick lifestyle change.

The Personal Cash Flow Statement gives you a breakdown of your cash position in a period. It is okay for you to have a negative cash flow in some instances, such as paying down debt. If you do this for too long, however, you will end up in trouble with debt.

Stock analysts grade companies every day and give them ratings for creditworthiness and investment grade. Compare yourself to publicly traded companies by calculating their quick ratio, return on assets, and profit margin. It is a fun exercise to see your financial health, putting you on track to living a more profitable life.

What is your stock worth? Would an investment in your business be a smart bet? Make your finances something you can be proud of. Take advantage of income from your job and side hustles. Your money should be helping you live the life you want, not holding you back. If your personal financial statements say otherwise, it’s time to get profitable.