I have been using Lending Club since 2009 to try to make the best return on my investment. I have been able to easily beat bank savings accounts, and can often beat the stock market. My current annual return is 11.63%. Here’s how I do it and how you can do it too.

What is Lending Club?

Lending Club is a leading social lending service. The site allows investors to directly lend money to borrowers, circumventing the banking system completely.

Each time you deposit money at a bank, the bank is allowed to lend out a percentage of that money to borrowing businesses and individuals. That is the money that funds mortgages, car loans, new business loans, and other loans.

When the bank makes a new loan, they are accepting a certain level of risk that the borrower may stop paying, also known as default, the loan. To make money, they charge an interest rate to help offset the payment risk.

Lending Club allows you to make that decision as part of a community. You are able to choose borrower applicants from a large pool of potential borrowers and help fund their loan in $25 increments. Think of it like Kickstarter for borrowing money.

Here’s the best part for you. Just like the banks make money from lending their money, you can now make money like a bank. That’s right. You are paid the interest for the loans you invest in, less a small fee.

With Lending Club, you are taking the place of the bank. It is win-win for both borrowers and lenders. Without the middle man to squeeze out profits, they can borrow at sometimes lower rates than the bank, and you can invest for higher returns than bank interest.

How to Sign Up for Lending Club

Joining Lending Club is a quick and easy process. You simply head to the Lending Club website and choose to sign up as an investor. If you choose to sign up as a borrower, you are directed to a loan application.

As an investor, you simply fill out your basic information that you would supply for any investment account. As it is a financial institution, your information is completely safe with Lending Club, just as it is with a stock broker or a bank.

Make sure to supply a correct social security number and contact information, as your investment returns are reported for tax purposes.

How to Deposit Funds into Lending Club

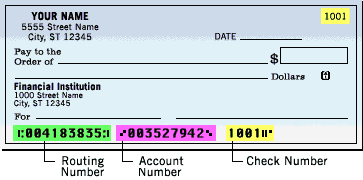

Depositing funds into Lending Club is as easy as setting up a direct deposit. You need two numbers to connect your lending account to your bank account. Transfers are made via automated clearing house transfer.

You need two pieces of information to link your account, and both can be found by contacting your bank or looking at a check.

The first number is your bank’s routing number, the second is your account number. See the check image below for an example.

How to Browse Loans

Lending Club offers an easy way and a hard way to invest. I prefer the hard way, because I have more control over my loans. I don’t trust an algorithm to vet out the best and worst risks for me. Here’s how both work to get you started.

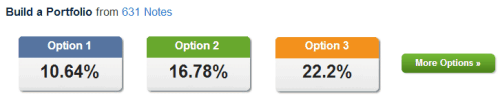

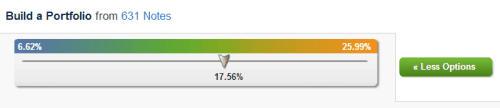

The Easy Way – Lending Club Picks For You

With the auto invest tool, Lending Club creates a portfolio for you based on your criteria. It will only pick loans that match your rules, and you can set criteria and decide how risky you want to be.

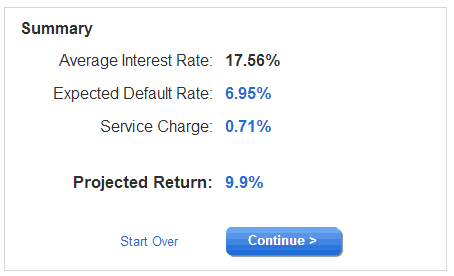

You can also get even more control by using the interest rate slider. That allows you to generate a portfolio while choosing a target interest rate. That rate is net of the Lending Club fee and estimated default rate for your chosen risk level.

At the end of the process, you can review your loan selections individually and see a breakdown of your expected return on investment.

If you go this route, ALWAYS look through your loan selections and remove anything that doesn’t add up or pass your gut check. You can also use the criteria that I share with you below.

The Detailed Way – Choose Each Loan Yourself (This is What I Do)

If you really want to pick the best loans, you have to do what the banks do. Scrutinize the loan and the borrower for every loan. I know how it works, I used to work in a bank and was responsible for making new loans.

When you go to “browse notes,” you are first given a listing of every single loan available. On the left sidebar, you can limit down the loans by defining specific criteria. Here’s what each one means and how it works.

Credit Score – This is the borrower’s FICO score. To qualify for Lending Club a borrower must have a credit score of at least 660. I generally pick borrowers with a score of at least 680. I don’t put a ton of weight on credit score because everyone has fair credit or better. To learn more, read my post on what makes up a credit score.

Term – You can choose 36 month or 60 month loans. The five year loans have higher interest rates than the three year loans, but I usually ignore the term and focus more on the borrower qualifications when deciding how to invest.

Interest Rate – This is the first filter I always turn on when I am looking for a new loan. The interest rates are in ranges based on a Lending Club assigned rating. An A rating is lower risk, and has a lower interest rate. A G rated loan is much higher risk, and pays a premium for that risk. I started only investing in A-B rated loans, but as my portfolio has grown and become more diverse, I have added mostly C rated, and some D rated, loans.

Months Since Last Delinquency – Past behavior is the best predictor of the future, and I don’t want to lend to people who are likely to pay late or miss payments. While you do get a portion of the late fee when someone pays late, I would rather be conservative and pick loans where that will not happen. You can filter on 12 or more months, 24 or more months, or 60 or more months. I almost always use 60 or more months as a filter.

Revolving Balance Utilization – Revolving balance utilization is the percent of outstanding credit card lines in use. In general, people with a higher utilization are a higher risk, and I don’t want to give money to someone who is already in debt and not actively trying to fix it. I usually use about 25% as a cutoff, but have gone up to 35% if the intended loan proceeds are paying off existing credit cards.

Review Status – Borrowers go through an approval process. If you select a loan before it is approved, it may still be rejected. In those cases, you just get your funds credited back to your account to pick a new loan.

Verified Income – Borrowers report their income as part of the application process. This is used to calculate the DTI – debt to income – ratio for the loan. Once Lending Club receives a pay stub or tax records, they mark the income level as verified.

Revolving Credit Balance – This category allows you to filter people with high credit card debt. You can filter for less than $100,000, less than $50,000, and less than $15,000. I always filter for people with less than $15,000. I am not going to enable someone with huge credit card debt to have more debt.

Maximum Debt-to-Income Ratio – This filter allows you to weed out borrowers who will have a monthly payment that is a high percent of their monthly income. If someone’s income is 50% going to this loan, they are going to have a tough time paying it. I don’t usually toggle this filter, but I do look at it when vetting the loan on the next step.

How I Choose Loans – Past the Filters

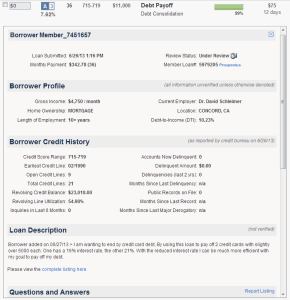

Once I get my list whittled down to those that meet my criteria, I examine each loan one-by-one. This loan was listed toward the end of June, 2013 as an “A3” loan with an interest rate of 7.62%. I added a screenshot below, and will explain what everything means below that.

Loan Listing Summary

At the top, in the listing line, you can see the interest rate, term in months (36 in this example), loan amount, title (entered by borrower), category (picked by borrower), percent funded so far, amount remaining, and number of days remaining in listing.

Loan Information

In the next section, you can see the application date, review status, monthly payment, and loan number. The only really important information here is the payment amount. I always compare that to the income level to determine whether I think the loan will be a real strain on the borrower.

Borrower Profile

Here you can see the borrower’s monthly income (gross, before taxes and deductions), whether they own or rent their home, where they work and how long they’ve been employed there, and the DTI ratio for the loan. To me, the important parts here are income, length of employment, and home ownership. If someone makes a lot and has been employed by the same employer for many years, they are a lower risk of losing their income. Owning a home is another indicator of a stable borrower.

Borrower Credit History

This is the meat of the borrower’s credit record, and should be given the most scrutiny. Here, you can see the credit score, number of credit lines, balances, inquiries, delinquencies, public records, and derogatory information. I give this section a lot of weight in my decision. We’ve already discussed credit scores and balances, so I’ll skip that here.

The number of credit lines open shows if they have experience with debt. More history here is usually an indication of a more responsible and experienced borrower. If the borrower has only a few credit lines, they are more risky.

Inquiries in the last six months tells you how much new credit the borrower is trying to get. A whole lot of recent inquiries is a bad signal, and I would avoid someone out for lots of new credit. More than 1-2 is a bad sign.

Delinquencies and public records are a no-go for me. Someone with any public records will never get a loan from me, and any delinquencies during the last two years are another elimination point for me. The same goes for any major derogatory marks on their credit report.

Loan Description and Q&A

This is the borrower’s opportunity to explain what the loan is intended for and why you should pick them. Most people don’t put much weight here, but I do. Bad grammar, bad spelling, or an incomplete explanation are reasons I have turned people down. If they don’t take the application seriously enough to do a good job with the description, they might not take it seriously enough to pay me on time.

The Questions and Answers section used to allow for freeform questions, but now lenders are limited to a handful of pre-written questions. This can be a bit helpful, but I don’t spend much time reading the Q&A.

Diversification is Important for Success

Just like with any type of investing, diversifying is very important when trying to control risk and return. If you only have four loans, and one doesn’t pay, you are out 25% right away. If you have 20 loans and one doesn’t pay, you are only out 5%, which can easily be made up by the 19 remaining loans.

The more loans you have, the lower your risk. If you have only a few loans, I would suggest only investing in A-B grade loans. If you have more loans, you can diversify into more C-D grade loans that pay higher interest rates.

Account Types

Regular Account

Lending Club’s standard account is a regular investment account, and is taxed as such. You can add and withdraw funds at any time, and you are responsible for taxes on any investment gains, just like when you invest in stocks through an individual account.

IRA Account

Lending Club also offers an IRA. The Lending Club no-fee IRA is another great option. Your investments are subject to the annual limits, in aggregate, with any other IRA account you have, but this may be an even better option for some people to diversify outside of the stock market. If you can get consistent 10%+ returns on your investment, and withdraw tax free (Roth) or invest pre-tax (traditional IRA), you are in great shape. Just don’t put all your eggs in one basket, with loans or investment types.

How Much I’ve Made

In my time using Lending Club, I have made 52 investments. Of those, 11 have been fully paid, 39 are issued and current, and 2 are in funding. My account value is $859.20, and I have made $110.33 in interest. My current net annualized return is 11.63%. That’s pretty great, especially when you realize that the compound annual growth rate of the S&P 500 over the last 30 years is about 10%.

I partially have a great return because I’ve never had a loan default. Not once. Even if I do, I am still up in total, and would not worry much because I have so many loans now. I have such a great record of picking loans because I stick to my conservative guidelines. I use what I learned working in a bank when choosing loans, and now you are in on my strategy.

Automatic Deposits

To keep my portfolio growing and diverse, I automatically add $25 to my account each payday. Lending Club has not built the functionality to accept a direct deposit, but it can do an automatic withdrawal via ACH. I set that to match each payday.

Adding enough funds for one loan every two weeks isn’t a big cost to me, and I don’t miss the money, but adding 26 loans per year, or $650 per year in total, can help you build up your investment account quickly.

Secondary Market

So what happens when you want out early? There’s an app for that. Okay, not an app, but there is a system and website that can help you sell early into a secondary market.

The note trading platform, run by FOLIOfn, allows you to buy or sell loans before they are due. I have not used the trading platform, so I can’t speak to how well it works. I have heard good stories anecdotally from other finance bloggers, so I would trust it if I need to sell.

If you live in a state where Lending Club is not yet allowed, you may still be able to invest via the secondary market.

Competitors

Prosper is the main competitor for Lending Club. I do have a small account there, and, like Lending Club, can only give it good reviews. I will skip a long explanation here, because the platform is very similar.

It was a later entrant to the game, after fighting through some legal hurdles, but it is another great product and I have been happy with my experience there as well.

Your Questions

I’ve you’ve made it this far. Congrats! You are now well versed in social lending and know enough to get started and succeed. This link to Lending Club gives me credit for sending you, so if you do choose to give it a try, I would appreciate if you go from my site.

If you have any questions at all about how Lending Club works, let me know in the comments. I’ll be sure to respond so I can help you get started making money!

I’ve been meaning to check out Lending Club. I used to invest in Prosper, but then I had to stop because they didn’t comply with my state’s guidelines. Not sure if Lending Club is the same or not in that regard.

I hate it when laws get in the way of legitimate entrepreneurs (like Lending Club and Prosper) trying to do something innovative. Hopefully you can give Lending Club a shot!

I’m really excited about investing with Lending club. Once I have my debt paid off it will be one of the first places that I invest. I love the concept.

Very smart to focus on high interest debt first. If you only have a mortgage left and the interest rate is low, it could be worthwhile to invest while paying it down.

I have been postponing getting on board with it for months now. Thank you for the detailed explanation on how to pick good borrowers, that is the tough part and required dedication or you can end up with a huge default rate. Your return is really amazing!

Very true. If you don’t take the time to invest right, you may end up with big losses. It is just like the stock market. It takes a bit of research and patience to make good investment decisions.

Those seem like awesome returns! Do you have any concern how the rate of return might change if we hit another financial downturn? That would be my main concern.

I’ll have to check it out!

I have been using Lending Club since the last recession, and I never had a default. I think as long as you are diversified, everything should work out in the long run.

Wow, that is definitely good to know. I will be sure to check this out. Thanks for the info!

Wow. This is a fantastic summary!

I’m a LendingClub member and this is a really great analysis of LC. I used LC to consolidate debt years ago and quickly pay off. Now I’m on the investor side.

That’s a great story! Taking advantage of both sides of what Lending Club has to offer is wonderful! Were you able to save big and pay off your debt faster because of Lending Club?

Very in depth breakdown. i currently use Prosper but have heard a lot about Lending Club. Never used them though but I will give them a lot over and see if this is something that will work as well. You are right about being diversified. At first I didn’t want to have 100’s of loans but those work best.

I am not in the hundreds of loans yet, but I’m steadily building a bigger portfolio. My biggest first goal was to have enough loans to be able to add one new one each month from interest payments. Now I am adding 2-4 per month every month.

Hi Eric, curious if you have an update since Lending Club essentially got rid of the loan description and Q&A section. I assume you still use Lending Club, but focus on the other available information?

Hi Kathryn, this was written after the changes to the loan description and Q&A was removed. I focus more on the borrower’s credit history than anything else when making lending decisions. If a loan is for credit card consolidation or payoff, I do look at credit card balances compared to loan amount, but I look at credit card balances anyway.

I would spend time reviewing things like employment, home ownership status, and history of late payments and public records in lieu of the old borrower questions.

hi everyone I was curious if anyone has started with 100 or think its a good idea to take my 100 and split it 4 ways 25 a piece and get 4 notes and then reinvest as I get my earnings back

That’s exactly how I started Kyle. I had $100 and split it four ways. The downside to starting with $100 is that one bad loan can wreck your total portfolio return, where starting with more loans distributes the risk a bit more. However, starting with $100 to test things out isn’t a bad idea at all!

awoesome i think iam going to put my first 100 in today sorry if this is a personl question but do you know by chance how much you got in return after that 100 so can kinda see were i would land. and i know that if i do profit at all to reinvest it.

and by chance can this create a nice revenue a month to sit on for paying bills if i even profit or lets say save up to buy a car

??

I generally see returns around 7%-12% in my account. Not a great option for shorter-term savings like buying a car or bill payment, but great for long-term investing. Each $25 loan will return less than $1 per month, so it would take a lot of loans to get to a point where you can passively earn income to pay your bills, but it is plausible as a long-term strategy.

that is extremly helpful i apprciate it

ive really been trying to find ways to flip an income would you recommend to just start day tradeing cause thats what i was considering before i found this lender club website

I would avoid day trading like the plague! Most day traders don’t know what they are doing and have similar odds to Vegas, where you are certain to lose if you play long enough. Here is a guide I wrote about the stock market that you may find useful: https://personalprofitability.com/stock-market/. But I don’t think the stock market sounds like the right place for you to focus on increased income right now. I would look at a side hustle.

Side hustles helped me double my income and then some compared to my old day job. Here are some ideas to get you started: https://personalprofitability.com/side-hustle/

It’s extremely misleading to say you’ve made an 11.6% return when you’ve only invested $800 (that’s around $8 a month, folks). With such a small amount of principle, a default or two could have just as much of a skewing impact… you’re only 3 defaults away from losing all your return, and only 1 default away from a typical 5-7% return. A realistic return with P2P stands right around 5% if you’re investing more than $50k. Hand-picking can help, usually around a 0.75% boost if you’re really good at it (keep in mind every note even offered on the platform was already “hand picked” by their increasingly strict algorithm). Of course, being selective makes it a lot more difficult to invest more than a couple thousand dollars. So the question is: do I want to make a high dollar of returns ($2,500 at 5%), or bragging rights to a high percentage return ($90 at 11%)? When investing a “normal” amount ($10 to $20k), a reasonable return sways from 3%-9% based off the whims of your borrowers — of course, it’s always possible for it to be negative, too, but diversification makes an overall negative return very rare.

Keep in mind this is during a period of record low unemployment (2018), when these P2P loans are supposed to be performing their best. Nobody knows what’ll happen during the next recession, but I strongly feel LendingClub should start popping their rates up to provide more than a 3-5% margin, especially on their 5 year notes. They are actually issuing notes at 4% right now for the most qualified borrowers… even in a best performance scenario, that ridiculously low rate might be at or even below the rate of inflation before the note matures… it’s “free money” for the borrowers! One can invest in guaranteed US treasuries at only marginally lower rates, or fairly safe (and far safer than P2P) corporate debt at marginally higher rates. Corporations pay their bonds much more reliably than Sue the waitress/housewife (who ironically may lose her job at the whim of AppleBees just so they can make their corporate bond payment to that other investor). So where’s the reward for the fairly high risk LendingClub investors are being asked to take? Is the supply of borrowers really that tight? The company still seems focused on increasing originations at a breakneck pace with fire sale rates, which is becoming reckless on the backs of investors (lets not forget LC makes its money off the volume of cash lent/paid, not off interest rates). People are refinancing their 19% credit card debt at 4-10% plus getting the convenience of only one monthly payment (and very loosely enforced late fees). They will pay more – give it a try, LendingClub! Your platform investors (that you paid lots of bonuses and perks to obtain back in ’09/’10) are about to dry up and not look back… irreversibly hurting your origination volume.

Anyhow, best of luck to all who invest, regardless of the amount! Hopefully my comments can help add to this article’s balance.

I strongly disagree that it is misleading to share my actual results, though this article is a bit dated now and my returns have gone down quite a bit from that rate. Thanks for adding these thoughtful and detailed insights. These are excellent points and considerations before investing.

What are your returns now? I have been investing with almost 30k over the last year and am around 6% interest, but had a bunch of defaults in the beginning as I figured out how to screen and vet people a bit more. Try to make an automated screener with all filters Eric is talking about and you will not find many loans to invest in.

I’ve drawn down my account quite a bit, only a couple hundred bucks left in there. Because I’ve stopped reinvesting and have only been holding (including some losers), my rate has trended down. Now it’s around 6.8%. I noticed the same thing with the filters. Fewer and fewer high quality loans like I wanted!