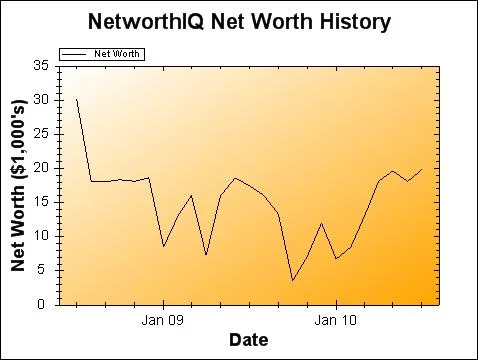

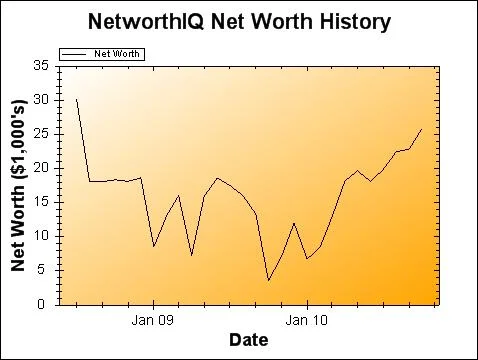

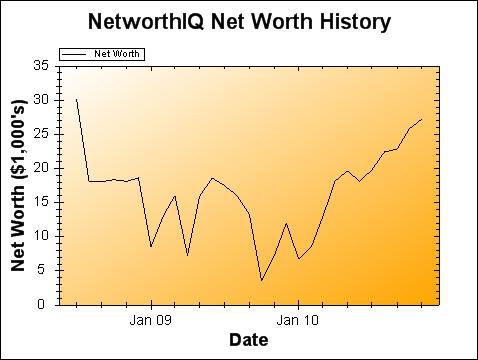

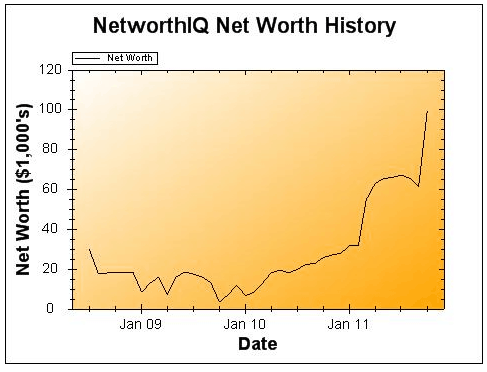

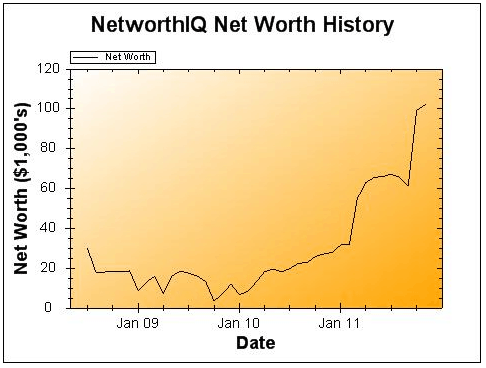

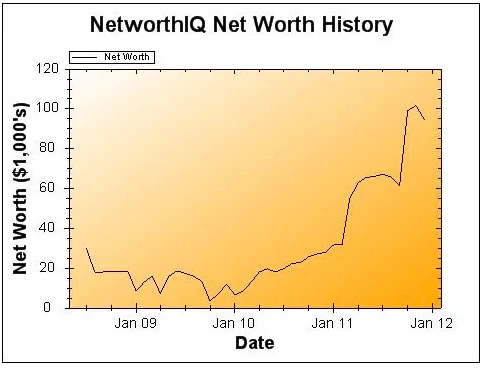

In October 2008, the first month this website existed, I started publically tracking my net worth. I made updates here every month, which eventually included and led to my popular monthly income reports. These began as a monthly series, but in the spirit of a better navigation and reading experience, I merged the early versions into this single article. Now you can browse and watch my net worth develop over time as I went from a near zero net worth in grad school to the $500,000+ net worth I enjoy today.

These also do an interesting job of tracking my writing skills and how I format blog posts over time. If you are turned off by the lower quality in the beginning, keep on going and you will see me get better and better!

If you get into the details and read the monthly updates, you can find fun tidbits about my beginning with side hustles and how I paid my way through grad school. In here, you can find major milestones in my MBA program, auto loan payoff, student loan payoff, and more.

This covers the time from when I started tracking my net worth in 2008 until I started reporting my side hustle income report in 2012. Starting in 2012, I began writing more detailed updates including a transparent look into how much I earn online every month. This online side hustle started at a few dollars a month and has grown to a full-time income as of April 2016.

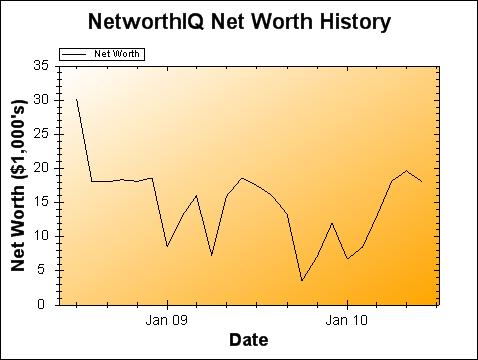

October 2008 Net Worth Update

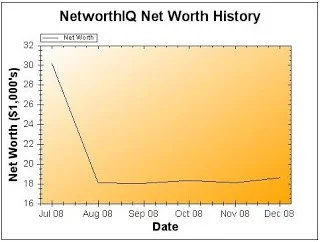

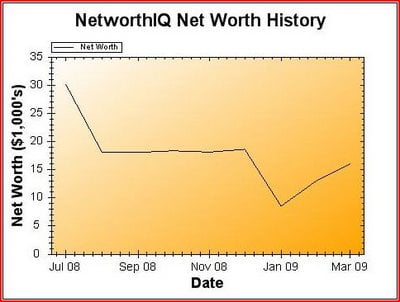

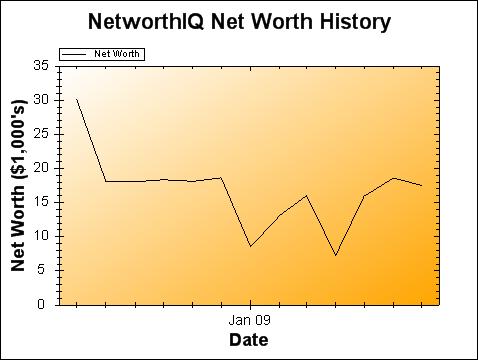

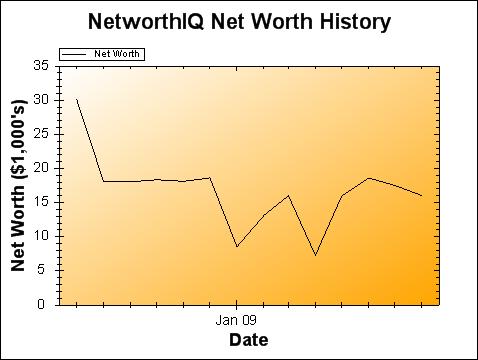

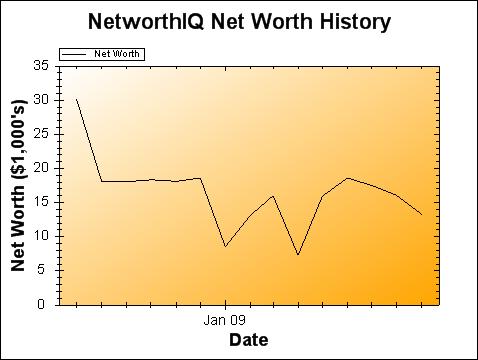

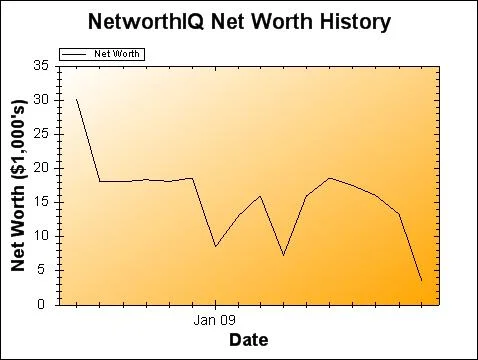

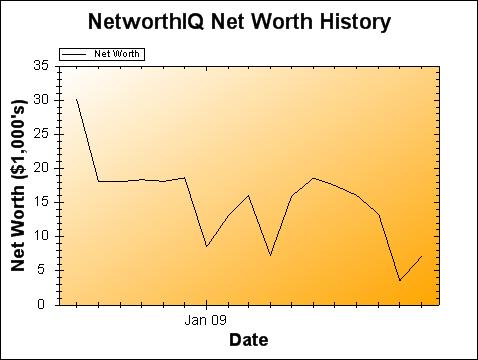

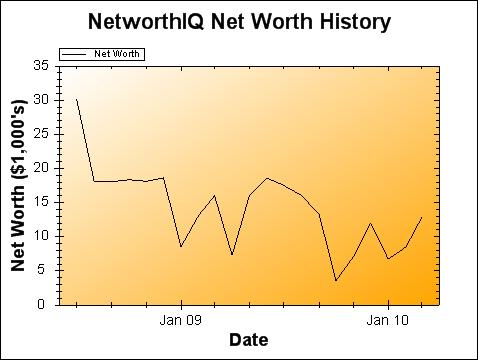

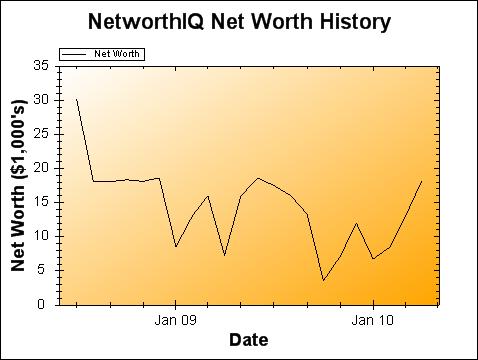

As you can see from my Net Worth widget, I just had a big dive. I started tracking my net worth just before my first tuition payment. My first quarter cost about $13,000. I paid about half cash and took out a student loan for the other half.

Why would I take out loans when I have enough cash on hand to pay them off? I have enough saved to do roughly the same each of my six quarters of school. At the end I will have about nothing. I have two loans right now. One is a car loan, the other is my student loan. I will get into the ups and downs of car loans in a later post.

In the future, I expect my net worth to go down and down six times throughout school. At the end, I plan to watch it go up and up. While in school, I am working and saving for retirement. With fund prices so low, it is a good time to buy.

November 2008 Net Worth Update

This month I had a few unusual and unexpected large expenditures. I bought a new bike (hit by a car), I bought a dental night guard (one time purchase for life), paid a year of renter’s insurance, and paid my annual car taxes. This led me to a… negative savings rate.

My net worth decreased by $223 to $18,119.

I never mentioned that I have secret money put away for school. I am only spending it on school so I don’t include it here.

December 2008 Net Worth Update

My net worth went up $504 in November! Yay. I was able to reverse the trend while making comparable loan payments. I expect a big drop next month when I pay tuition and increase my student loan. I hope all of you are tracking your net worth. As you can see, I have a slow upward trend when I am not paying for school. I pay about $13,000 per quarter in my MBA program. It is a big expense but one that I consider an investment in my future.

January 2009 Net Worth Update

My net worth took a hit of about $10,000 this month. Ouch. I paid about $5000 for tuition and my student loan increased by about the same amount. Other than that it was business as usual in December.

February 2009 Net Worth Update

I got more money! That is what it looks like after all. I received a big reimbursement from my company that I applied directly to my student loan. It was nice to see that number drop.

March 2009 Net Worth Update

I made my monthly net worth update calculation this morning and it went up again! Yay! I was paid my bonus on Friday. I spent a bit more than usual, but the bonus offset that plus much, much more. Next month I have to make a tuition payment and my student loans will increase again. Sometime in the near future I will get my tax refund which will drive up my net worth again.

April 2009 Net Worth Update

I just finished updating my net worth for the month. I spent a lot of money. It almost all went to my school. My student loan balance increased as well, as the bank paid in my last loan payment of the year.

The result was a roughly $8,000 drop. At least I am still even with my last payment in January.

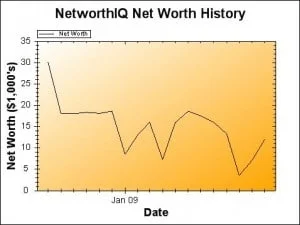

June 2009 Net Worth Update

I just put together my net worth for June, and it looks good. My assets are up and my debts are down. That is always the goal. You can see the whole picture on Net Worth IQ or by taking a look at the “profile badge” on the right column.

I am looking at my summer tuition bill right now. $7,530 for two classes. I am wait-listed for, and anticipate getting into, a third. That would take it up to about $11,295.

In the meantime, I am working hard trying to pay for school as I go.

July 2009 Net Worth Update

Here is my Net Worth update for July 1st. I wrote a check for about $8000 for summer tuition. Yesterday I gave them a check for nearly $4000 more. School is expensive. I had a little extra income this month that helped to offset come of the cost of school, but not all of it. In all, my NI was down about $1,100, or about 6%, in June.

I did make some dents in by student loan and car loan. In all, nothing too exciting this time around. In July I expect my Net Worth to be down again. I figure it will be down $1,000-$2,000.

August 2009 Net Worth Update

In a month that I spent a whole lot on school and whatnot, I was able to keep my net worth from going down too much. I will have to pay for seven more classes (I almost done!) at $4,000 a pop between now and March. Those are the big killers on the net worth. Other than that, all is pretty smooth.

September 2009 Net Worth Update

Surprisingly, spending $5,000 on a class/trip in New York lowers your cash and net worth! [sarcasm] But seriously, $1,000 per credit hour is expensive tuition for anyone. I am only two quarters from graduation! That means I also have two quarters left to pay for. About half of my tuition goes to student loans, I pay for the rest.

Just remember, your net worth is your personal balance sheet. Your “net worth” is your equity in your own personal finances. Here is this month’s update, which included one class paid for out of pocket.

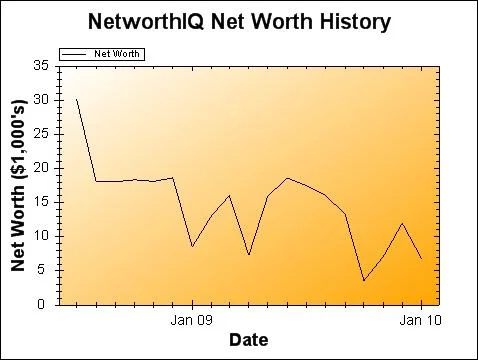

October 2009 Net Worth Update

October 1st update. I had to pay for school and updated the value of my car. That made a big hit on cash and a big hit on overall net worth. My student loans increased too. This is not looking quite as good. Only one more school payment left, ever! Starting in March my net worth should start going up.

November 2009 Net Worth Update

I made my entry this morning and had little significant change. (I did update the value of my car to the taxable value I received from the county last month). Cash is up a bit, so is the credit card debt. Every time I look at this, I start to think: geeze, school is expensive.

Expect a big hit next month when I have to begin furnishing my new apartment!

December 2009 Net Worth Update

It looks like a good month, but that is partially inflated by two events. 1. I bought a share of Berkshire Hathaway class B with funds from an account for school and a future house down payment that is not included here. 2. I received a large gift and put it directly into my car loan.

January 2010 Net Worth Update

January 1st Update. Student loans increased for the last time! January I make my last grad school tuition payment. This should be the pivotal bottom. I plan to pay off the car in the next two months and being to pay down the student loans more aggressively in the near future.

February 2010 Net Worth Update

I have paid for school for the last time! Yay! Only 10 more years of student loan payments to go and I am free and clear, unless I pay early, which I plan to do.

I have also used all of my extra cash to pay down my car loan. I plan to have it paid off by the end of the month! In all, it was a pretty good month. When your net worth is below $10,000, it is not too tough to have a 25% increase in a month.

March 2010 Net Worth Update

No More Car Loan! That’s right. It is paid in full. The title came in the mail last week. I own my car outright. I now plan to pay $500 every month to my car loan. I also received a bonus at work in February. I have set up a payment for this week for the amount of my bonus to my student loan.

I hope to pay down the student loans in far less than the 10 years I am given. If I put my tax return, bonus, and $500 per month, I should be all paid off in two to three years.

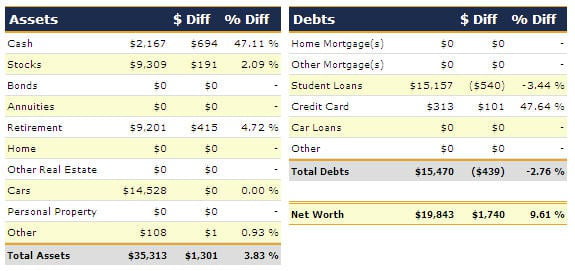

April 2010 Net Worth Update

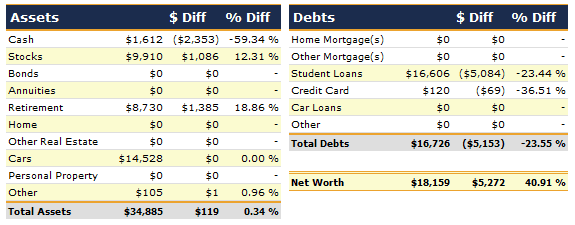

I got my annual bonus at work in March. I got my tax refunds as well. I took my extra income and put it all directly to my students loans in addition to the $250 per paycheck I normally do. My assets were about even, but my debt is down about 25%.

This month, I decided to pull my details off the net worth site as well. Here is my situation today.

May 2010 Net Worth Update

My net worth was up during April, but less than I usually like to see. Buying a $1600 plane ticket to Israel was the biggest dent in my cash, but I am sure the expense will be worth it. Other than that, it was a fairly normal month on the spending and income fronts. My total net worth is now $19,647, which is an increase of $1,488, or 8.19%.

June 2010 Net Worth Update

Paid off the expensive plane ticket and tried (unsuccessfully) to cut back on spending. I took a beating in the stock market this month. I took $500 from my investment account and moved it to cash, but watched my 401(k) and brokerage account shrink along with the market in a horrible month for stocks. However, I did keep my student loan payments up and lowered my debt by over 6%.

I did make $57 this month from Demand Studios. I am trying to increase my diversified income streams, and this is a good step up from previous months. I am also writing more residual income articles than up front payment. I also earned about $40 from eHow that will be paid this week.

July 2010 Net Worth Update

I have cut back on spending from last month, but I watched the stock market sink further in the last week, so my investments are not performing as well as I would like. I am focusing on saving up in my “emergency fund” and aggressively paying down my student loans.

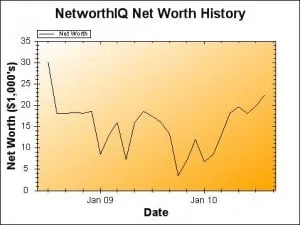

August 2010 Net Worth Update

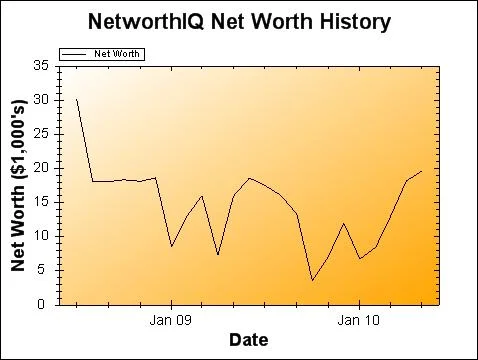

If you thought graduating from an MBA program that is incredibly expensive would not help your net worth, I have news for you, you are wrong. Since March, my net worth has continued to move on up. I am still on track to have my student loans paid in about two years and love watching my cash reserves increase (goal of $4,000 emergency fund by December 31st) and my investment accounts grow. Click the image below to enlarge.

I encourage all of you to check out the personal finance arsenal and personal balance sheet to find out why I do this and learn how to track your net worth yourself.

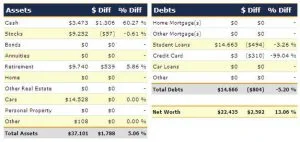

September 2010 Net Worth Update

I just realized that I have been tracking my net worth for over two years. In that two years I have had some ups and downs, but this month was fairly average. Want to know how and why I track my net worth the way I do? You should probably buy my new book that I launched today, the Personal Finance Arsenal.

October 2010 Net Worth Update

It was a good month for me on the net worth front. While I did splurge and buy a $500 TV, I saved a lot and my stocks had a nice month.

November 2010 Net Worth Update

Happy November. I hope you all had a great Halloween. No major news this month. I am excited to see my net worth almost back to where it was when I started my MBA program.

December 2010 Net Worth Update

I was surprised to see my net worth increased again this month. I spent a week unemployed with no income and took a vacation, which are usually not conducive to having more money in the bank. I am excited that my net worth is almost back to pre-MBA levels. I am up about 285% since my last MBA payment in January. I plan to keep it going!

January 2011 Net Worth Update

Monthly Result: +$3,837 or 13.74%

I hit a huge milestone this month in my net worth. I am back to the point where I started tracking my net worth. I made my first entry on my net worth graph in mid 2008, one month before making my first payment and taking out my first loan for my MBA.

I have worked hard throughout school and since to aggressively pay down the loans while saving for my retirement, storing cash for emergencies, and still having fun. This month, I broke a net worth of $31,000, putting me at an all time high.

The plan from here? Keep doing what I’m doing. Don’t fix what’s not broken. I will continue to save and invest while paying down debt and working on projects to increase my income.

February 2011 Net Worth Update

Despite a little frivolous spending, I ended up .5% during January. I bought a plane ticket, a DJ system, and had to fix my car. On the other hand, I got a payout from my former employer’s pension fund, which is now in my IRA, which helped offset the spending. I also made extra student loan payments to help bring the balance down over $600.

| Assets | Dollars | $ Diff | % Diff | Cash | $4,427 | ($927) | -17.31 % | Stocks | $11,291 | ($347) | -2.98 % | Bonds | $0 | $0 | – | Annuities | $0 | $0 | – | Retirement | $15,376 | $2,781 | 22.08 % | Home | $0 | $0 | – | Other Real Estate | $0 | $0 | – | Cars | $14,528 | $0 | 0.00 % | Personal Property | $0 | $0 | – | Other | $163 | $26 | 18.98 % | Total Assets | $45,785 | $1,533 | 3.46 % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | Dollars | $ Diff | % Diff | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash | $4,427 | ($927) | -17.31 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks | $11,291 | ($347) | -2.98 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bonds | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annuities | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retirement | $15,376 | $2,781 | 22.08 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Real Estate | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cars | $14,528 | $0 | 0.00 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Property | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | $163 | $26 | 18.98 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $45,785 | $1,533 | 3.46 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Debts | Dollars | $ Diff | % Diff |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $11,623 | ($636) | -5.19 % |

| Credit Card | $2,241 | $2,007 | 857.69 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $13,864 | $1,371 | 10.97 % |

| Net Worth | $31,921 | $162 | 0.51 % |

Overall, not my best month but far from my worst. I expect to take over control of my “secret mortgage fund” sometime soon and include it in my investment or savings account reporting. More on that next time.

March 2011 Net Worth Update

This month, I took over control of my “secret down payment fund,” a savings and investment account that my father had maintained for me (with my money) since I was a child. Birthday money, Bar Mitsvah money, and several other sources funded the account. Since I have been looking at purchasing a home, I decided it was the right time to move the funds over so I have access.

Other than that, my big expenses were laser eye surgery, which I paid for out of pocket (will be reimbursed) and took a trip to Kansas City.

| Assets | $ Diff | % Diff | Cash | $25,155 | $20,728 | 468.22 % | Stocks | $11,589 | $298 | 2.64 % | Bonds | $0 | $0 | – | Annuities | $0 | $0 | – | Retirement | $15,813 | $437 | 2.84 % | Home | $0 | $0 | – | Other Real Estate | $0 | $0 | – | Cars | $14,528 | $0 | 0.00 % | Personal Property | $0 | $0 | – | Other | $164 | $1 | 0.61 % | Total Assets | $67,249 | $21,464 | 46.88 % | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | $ Diff | % Diff | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cash | $25,155 | $20,728 | 468.22 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stocks | $11,589 | $298 | 2.64 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Bonds | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Annuities | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retirement | $15,813 | $437 | 2.84 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Home | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other Real Estate | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cars | $14,528 | $0 | 0.00 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Personal Property | $0 | $0 | – | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other | $164 | $1 | 0.61 % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $67,249 | $21,464 | 46.88 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $11,548 | ($75) | -0.65 % |

| Credit Card | $838 | ($1,403) | -62.61 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $12,386 | ($1,478) | -10.66 % |

| Net Worth | $54,863 | $22,942 | 71.87 % |

April 2011 Net Worth Update

I kicked ass in March. Final result: +14.80%

Here is how I did it:

| Assets | $ Diff | % Diff | |

| Cash | $29,697 | $4,542 | 18.06 % |

| Stocks | $10,593 | ($996) | -8.59 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $17,588 | $1,775 | 11.22 % |

| Home | $0 | $0 | – |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $165 | $1 | 0.61 % |

| Total Assets | $72,571 | $5,322 | 7.91 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $9,250 | ($2,298) | -19.90 % |

| Credit Card | $336 | ($502) | -59.90 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $9,586 | ($2,800) | -22.61 % |

| Net Worth | $62,985 | $8,122 | 14.80 % |

May 2011 Net Worth Update

Guess what? I paid off student loan #1! That was nearly 20% of my outstanding student loan balance from the beginning of April. It was a good month overall.

My total net worth was up $2,610 or 4.14%. I would call that a success. That also comes despite paying my annual car insurance deductible in April. Here are the details. If you want to make a personal balance sheet yourself, be sure to read up on how I do it.

| Assets | $ Diff | % Diff | |

| Cash | $31,404 | $1,707 | 5.75 % |

| Stocks | $10,139 | ($454) | -4.29 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $18,302 | $714 | 4.06 % |

| Home | $0 | $0 | – |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $166 | $1 | 0.61 % |

| Total Assets | $74,539 | $1,968 | 2.71 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,613 | ($1,637) | -17.70 % |

| Credit Card | $1,331 | $995 | 296.13 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $8,944 | ($642) | -6.70 % |

| Net Worth | $65,595 | $2,610 | 4.14 % |

A quick question for the readers: Do you like my monthly net worth updates? Does my open sharing give me credibility, or does it make me look like a pompous asshole? If you like the updates, or not, please let me know in the comments.

June 2011 Net Worth Update

I was going through my budgets over the last couple of days preparing the post on Mint.com vs. Adaptu, and I realized that I need to follow my own advice. While my net income continues to slowly increase (emphasis on slowly the last couple of months), my spending has increased with my income.

While my savings has increased as well, I need to get things back into line with where I was a year ago. The biggest spending category increase has been on food and dining. I need to eat out less and cook more. I have suffered from lifestyle inflation and need to deflate a little bit.

Net worth change in May: $433 or .66%

One category that had a big increase in my Lending Club account. I am still averaging over a 10% annualized return, so I see no reason to slow down my investments there. There are risks, but I have seen no defaults and I am very picky with my loans. If you sign up through this link, you can get $25 for free to get started with peer-to-peer lending. You can get a more detailed breakdown on my recent Lending Club update. Here is my net worth breakdown for the end of May:

| Assets | $ Diff | % Diff | |

| Cash | $30,304 | ($1,100) | -3.50 % |

| Stocks | $10,262 | $123 | 1.21 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $18,607 | $305 | 1.67 % |

| Home | $0 | $0 | – |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $293 | $127 | 76.51 % |

| Total Assets | $73,994 | ($545) | -0.73 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,562 | ($51) | -0.67 % |

| Credit Card | $404 | ($927) | -69.65 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $7,966 | ($978) | -10.93 % |

| Net Worth | $66,028 | $433 | 0.66 % |

July 2011 Net Worth Update

This month my personal stock portfolio was down, but my conservative investment in my retirement accounts did not suffer. No major transactions. I came in under budget. Overall, not too bad. I did buy a new laptop which will show up in next month’s update. End results: + $1,219 or 1.85%.

| Assets | $ Diff | % Diff | |

| Cash | $31,023 | $719 | 2.37 % |

| Stocks | $10,164 | ($98) | -0.95 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $19,002 | $395 | 2.12 % |

| Home | $0 | $0 | – |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $320 | $27 | 9.22 % |

| Total Assets | $75,037 | $1,043 | 1.41 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,510 | ($52) | -0.69 % |

| Credit Card | $280 | ($124) | -30.69 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $7,790 | ($176) | -2.21 % |

| Net Worth | $67,247 | $1,219 | 1.85 % |

August 2011 Net Worth Update

Result: -1,524 or -2.27%

I spent entirely too much money over the last month, but I spent it on really good stuff. Paid for my new Alienware laptop, bought a plane ticket to New York, and had a ton of fun. However, time to tighten things up a bit.

The stock market bombed over the last couple of weeks, thanks to the Republicans in the House of Representatives, and I have lost about $1,000 from my peak portfolio value. That is about 10%.

This month I plan to spend far less outside of $600 toward a plane ticket to LONDON, PARIS, and AMSTERDAM!

| Assets | $ Diff | % Diff | |

| Cash | $31,020 | ($3) | -0.01 % |

| Stocks | $9,606 | ($558) | -5.49 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $19,015 | $13 | 0.07 % |

| Home | $0 | $0 | – |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $322 | $2 | 0.63 % |

| Total Assets | $74,491 | ($546) | -0.73 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,459 | ($51) | -0.68 % |

| Credit Card | $1,309 | $1,029 | 367.50 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $8,768 | $978 | 12.55 % |

| Net Worth | $65,723 | ($1,524) | -2.27 % |

September 2011 Net Worth Update

This month I paid for my flight to Europe, which was the single biggest expense. I also moved some cash from my stock account into my cash account.

This month I am going to buy a home. I am putting down 25% on the condo and will be paying most of the up front fees in cash, so my balance sheet is going to change quite a bit.

My cash and stock accounts will be near zero. My mortgage will go from zero to six figures, and my home asset will go from zero to whatever Zillow says it is worth.

The biggest cause of the decline in my total net worth is my investment accounts. Both my stock and retirement accounts took a big hit from the markets.

| Net Worth | $61,382 | ($4,341) | -6.60 % |

| Assets | $ Diff | % Diff | |

| Cash | $31,344 | $324 | 1.04 % |

| Stocks | $7,258 | ($2,348) | -24.44 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $15,351 | ($3,664) | -19.27 % |

| Home | $0 | $0 | – |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $324 | $2 | 0.62 % |

| Total Assets | $68,805 | ($5,686) | -7.63 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $0 | $0 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,408 | ($51) | -0.68 % |

| Credit Card | $15 | ($1,294) | -98.85 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $7,423 | ($1,345) | -15.34 % |

October 2011 Net Worth Update

I bought a home! I took one more step toward the American dream. I am a homeowner. If it were 1779, I just qualified to vote.

As you can see, I spent pretty much all of my cash. My down payment and closing costs came to about $34,000 all together. I sold stocks and used cash for the purchase, but I did not have to touch my Roth IRA and did not have to make any major changes to my spending or savings habits.

According to Zillow, I made quite a deal when I purchased my new condo. I had an instant equity gain by purchasing below the “market value” of the home. Of course, the value is really only what someone is willing to pay for it. But I also took on over $100,000 in debt from my new mortgage loan. All in, I am $110,000 in debt. That sounds like a lot, but I have big plans to pay it off quickly.

The breakdown is below:

| Assets | $ Diff | % Diff | |

| Cash | $1,904 | ($29,440) | -93.93 % |

| Stocks | $429 | ($6,829) | -94.09 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $17,420 | $2,069 | 13.48 % |

| Home | $175,000 | $175,000 | – |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $327 | $3 | 0.93 % |

| Total Assets | $209,608 | $140,803 | 204.64 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $102,983 | $102,983 | – |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,358 | ($50) | -0.67 % |

| Credit Card | $84 | $69 | 460.00 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $110,425 | $103,002 | 1,387.61 % |

| Net Worth | $99,183 | $37,801 | 61.58 % |

November 2011 Net Worth Update

I am getting used to owning a condo. I bought a bunch of stuff for the new home and ate out at restaurants way too much in the last month. Also started a new investment account which took some cash.

| Assets | $ Diff | % Diff | |

| Cash | $2,945 | $1,041 | 54.67 % |

| Stocks | $730 | $301 | 70.16 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $19,566 | $2,146 | 12.32 % |

| Home | $174,100 | ($900) | -0.51 % |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $328 | $1 | 0.31 % |

| Total Assets | $212,197 | $2,589 | 1.24 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $102,840 | ($143) | -0.14 % |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,204 | ($154) | -2.09 % |

| Credit Card | $442 | $358 | 426.19 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $110,486 | $61 | 0.06 % |

| Net Worth | $101,711 | $2,528 | 2.55 % |

December 2011 Net Worth Update

I have learned a new lesson on how your assets impact your net worth. As my biggest asset (and liability) is now in my home, I can see my net worth fluctuate with the markets. Zillow uses comparable home sales and nearby listings to estimate the value of your home. My value went down about $6,500 this month. It is not the end of the world and has no real impact to me, but I am now more cognizant of that issue.

Now that homeowner costs have leveled out, I took a fancy trip to Europe for two weeks. It was not a cheap trip, but it was worth every penny. I am expecting $400 back from a friend for the mutual costs I paid.

| Assets | $ Diff | % Diff | |

| Cash | $2,509 | ($436) | -14.80 % |

| Stocks | $475 | ($255) | -34.93 % |

| Bonds | $0 | $0 | – |

| Annuities | $0 | $0 | – |

| Retirement | $20,185 | $619 | 3.16 % |

| Home | $167,600 | ($6,500) | -3.73 % |

| Other Real Estate | $0 | $0 | – |

| Cars | $14,528 | $0 | 0.00 % |

| Personal Property | $0 | $0 | – |

| Other | $328 | $0 | 0.00 % |

| Total Assets | $205,625 | ($6,572) | -3.10 % |

| Debts | $ Diff | % Diff | |

| Home Mortgage(s) | $102,697 | ($143) | -0.14 % |

| Other Mortgage(s) | $0 | $0 | – |

| Student Loans | $7,100 | ($104) | -1.44 % |

| Credit Card | $1,108 | $666 | 150.68 % |

| Car Loans | $0 | $0 | – |

| Other | $0 | $0 | – |

| Total Debts | $110,905 | $419 | 0.38 % |

| Net Worth | $94,720 | ($6,991) | -6.87 % |

Continue on with my net worth and earnings updates starting in 2012

Continue the journey at my ultimate online income tracker that begins in 2012. I used NetWorthIQ for the net worth updates here, but when the site fell into disrepair I moved to NetWorthShare. I continue to update my net worth there monthly.