Yes, I included a Charlie Sheen Twitter reference in the post title. But when you are a personal finance #warlock with #tigersblood, it is only appropriate.

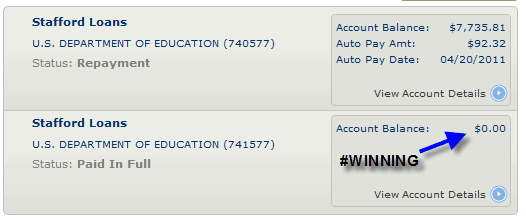

Why am I so egotistical on my financial savvy today? Why is today different from all other days? They say a picture is worth a thousand words, but in this case it is worth more like twenty thousand dollars.

Yes, loan number one is now paid off!

How and Why I Did It

Over the last six weeks, I have been doing well financially. I received a large reimbursement from a flex spending account for $3,400 from my eye surgery that I paid for out of pocket in advance, I had a few advertising sales come through, and I got my annual bonus at work.

I decided against buying a home right now, so I had extra funds to burn. Rather than actually burn them, I put the cash to good use and paid off the last $3,500 in my smaller student loan.

This saves me interest payments every month and opens up $65 in cash flow (minimum payment) if my financial situation were to change dramatically.

Loan Number #2

I have $7,735.81 left in total debt. That is all a 6.8% student loan with a monthly payment of $92.32. My goal was to pay off my student loans completely within two years of graduating. I am just over the one year mark and I am on track.

I might not pay this one quite as quickly as the original goal because my priorities have changed. I am trying to preserve capital and save up so I can make a good down payment on a home in the next year or two.

If you are looking to pay down your student loans, you can probably relate to one reader that wrote in to ask for help on a payment plan. (Lots of good tips in the comments on that post too!)

Have you conquered student loan debt? Are you in the process? Please share what you learned, and what you need help with, in the comments.

Zero is such a sexy number.

My recent post When Is It Okay To Dip Into Your Savings

I know! Right! Thanks for commenting Sandy.

Wohoo… Congrats. nothing I love more than a good loan payoff! Winning for sure!

Thanks!