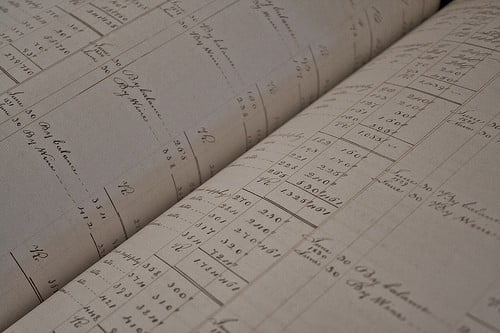

Over the last couple of years, I have been very entrepreneurial. I have started three small businesses and the IRS requires that I track the income and expenses for tax reasons. While this may sound daunting, it is actually not difficult if you know where to start.

Pro Option – QuickBooks

If you want to jump in headfirst with the Cadillac of financial software, you need look no further than Quickbooks. Quickbooks is an intensive suite of financial tools that allows you to track income and expenses by account, assets, liabilities, and even payroll from one dashboard.

The biggest benefit of QuickBooks is the extensive capabilities. You can create an income statement, balance sheet, and budget reports from a powerful dashboard. You can easily download statements from most financial institutions to conduct account reconciliations. (Note for bloggers and online businesses, PayPal is not an option for automatic statement downloads) You can do everything you might need to do in one place.

The biggest downsides are the cost and complexity. If you are just starting out, you might not want to spend hundreds of dollars to get the relevant version for your needs. You also likely do not need the flexibility of the program. It is complicated to learn when you are starting out, and something simpler might be quicker if you do not have many transactions or accounts to track.

Web Savvy Option – InDinero

Web Savvy Option – InDinero

I gave InDinero a test drive when I started my flash mob business. It is free if you have a low volume of transactions per month and has increasing fees depending on your activity and to keep a long history.

InDinero is the Mint.com for business. It automatically links into your bank and credit accounts and updates transactions daily. It will create simple financial reports and can track your budget. It does what most online personal finance software does; however, it has a business focus.

I love how easy, simple, and clean the InDinero interface is, but it is not powerful enough for a large company. Small online businesses with a low transaction volume could benefit from the time saving and simple interface from InDinero. Another great feature is the accountant access so your bookkeeper or professional accountant can access your books too.

Old School Option – Microsoft Excel

If your business is simple and has low reporting requirements, Excel may be adequate for your needs. The biggest advantage of Excel is the flexibility (you do everything yourself) and the low cost, as most business owners already have Office installed. If you are familiar with Office, you can do great things quickly.

The downside is that everything is completely manual. You track everything on your own and create your own reports. I would avoid this option unless you plan on keeping a low volume, low income business for the long run.

Where Should You Start?

If you have big aspirations, I would start where you think your needs will be in the long run. Converting between accounting software and methodology takes a lot of work and can be expensive. If you think you are going to be big, start with the most flexible and powerful option you think you will need.

I have QuickBooks installed on my laptop already, so each time I start a new entrepreneurial adventure, I just boot up and start a new QuickBooks business file. The worst that can happen is I wasted a little time if the business does not do well. On the bright side, when the business starts to take shape and grows, I am already set to scale.

Your Thoughts

Do you have any thoughts or questions about small business accounting? If you have started a business in the past or run one today, how do you track everything? Please share in the comments.

Image by futureshape.

Web Savvy Option – InDinero

Web Savvy Option – InDinero