It’s February! We are already almost 10% of the way through the year. Are your side hustles coming along as well as expected? Here’s how my January went, and some new plans for 2016.

What I’m Up To

January had me as busy as any month I can remember, though not all work and not all good news. I had a serious laptop damage issue that put me on the sidelines for side income for a couple of weeks, bad news about our very sick dog, a work trip to Atlanta, and a very stressful few weeks overall. On the upside, though, we have had visits from family and have dug into some serious planning for 2016 and beyond.

As part of my long-term plan, I’ve decided it’s time for me to learn to code more on the backend of websites, and I’m over 60% of my way through a PHP course I’m taking online. I already know HTML and CSS, so building a static website and updating a WordPress theme is a piece of cake. At the end of the PHP course, I’ll also know how to create my own custom WordPress plugins, and my very own apps and dynamic websites. My first project is going to be an app for people to quickly look up whether a fish is Kosher or not. Check out the very premature landing page for Kosher Fish.

Once that is complete, I’m going to pick back up on a couple of other projects that have been waiting in limbo, most notably Podtuber. I had planned to hire someone to build out Podtuber for me, but with my fancy new PHP skills, I can build it myself and save a ton on development.

Side Business Income

Narrow Bridge Media – All Online Income Projects

My online income tracker shows my entire history of online income since I began tracking, and it shows how volatile freelance work can be, particularly when doing it part-time. I update the page monthly with all of my online income histories since I began tracking monthly.

Now that 2016 is underway, I need to start living up to my revenue goals for the year. I’m setting myself a goal of $52,000 this year from my online businesses. That is $1,000 per week. Let’s take a look at January to find if I have any catching up to do.

Revenue – Goal: $52,000 in 2015 ($1,000 per week average).

- Advertising Income (Affiliate + Direct) – $581

- Freelance Income (Website Support & Freelance Writing – $2,280

- Product Sales – $1 (Thesis Post Image Converter, eBook here or Amazon)

Expenses

- Computer and Website Expense – $334 (Includes ConvertKit Email, LiquidWeb, and Hostgator)

- Continuing Education – $3

- Meals & Entertainment – $0

- Outsourced Labor – $182

- Telecom – $57

- Travel – $0

Total Revenue: $2,861, Total Expenses: $773, Total Profit Before Tax: $2,088

If you are new here and want to see more history, check out my earnings by month since 2012 at my online income tracker.

Denver Flash Mob – Flash Mob Consulting and Planning

My wife has officially taken over duties running Denver Flash Mob, which is giving me more time to work on freelance projects and this website. She’s doing an excellent job so far as the Chief Operating Officer / Chief Mob Officer. We have run into some schedule issues being remote owners, but we’ve been working through them.

Revenue

- Custom Flash Mob Payments – -$100 (includes pre-payments/refunds)

- 7 Step Flash Mob Planning Workbook Sales – $0

Expenses

- Outsourced Workers – $150 (includes payment for pre-paid events)

- PayPal Fees – $2.90

- Website Expenses – $75

- Business Registration – $0

Total Revenue: -$100, Total Expenses: $228, Total Profit Before Tax: -$328

Automatic Savings

A few months back I signed up for Digit, and automated savings account that you manage via text message. Here is how my savings have added up with zero work on my part. The more I use it, the more I love it for how easy it is to use. Each time I hit enough for a new stock purchase, I move the funds right to my investment account.

- Total Savings Since Joining: $3,663.93

- Number of Transfers: 139

- Average Transfer Size: $26

If you’re interested, sign up for Digit here.

Investments

Retirement

My automatic investing in my retirement accounts has been going along as planned. It is nice to see so much cash going into our savings for the future. I have been debating funneling some money into a regular taxable account that could support early retirement, but for now this is the setup I’m sticking with:

- 401(k) Contribution – 6% automatic from paycheck

- 401(k) Match – 3% automatic by employer

- Roth IRA – $5,500 of $5,500 max for 2015

- Roth IRA (Spouse) – $5,500 of $5,500 max for 2015

- Employer Stock Purchase Plan – 3% with 15% discount on market stock price

If you have an opportunity to get any employer match, make sure you are taking 100% of that, or you are leaving free money on the table. If you have any old 401(k) plans from former employers, make sure to roll them over into an IRA where you can save on fees.

If you are not sure where to start with retirement investing, be sure to check out Betterment as an option. I have been a customer myself and recently joined their writing team.

Individual Stock Portfolio

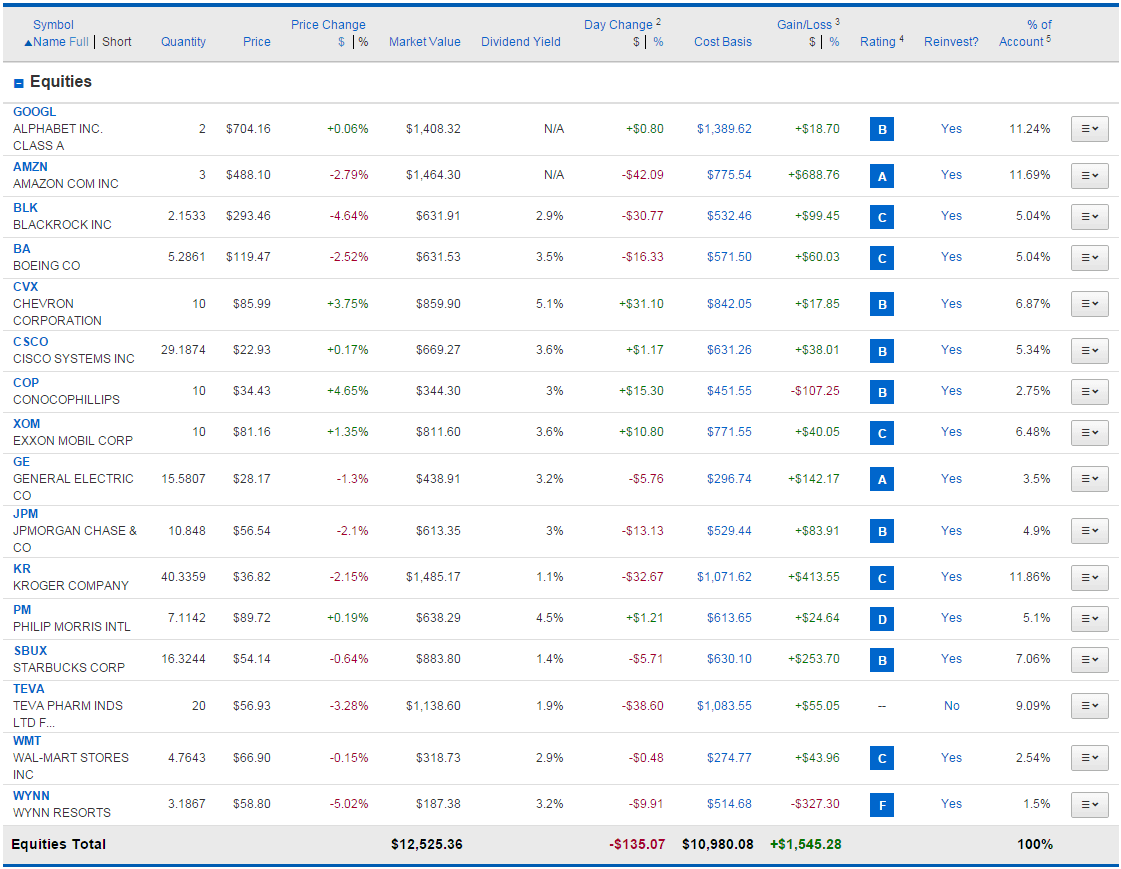

While I think most people are better off investing in low-cost funds or through a service like Betterment, I have a lot of financial education and do my best to make what I can in the stock market. I’m not perfect, but I’ve done pretty well. If you want to learn more about investing, check out my complete beginner guide to the stock market.

I have my individual stock portfolio details below. In addition, I have (much more sizeable) investments in diversified funds for retirement and a holding of my full-time employer company stock in an employee stock purchase plan account. This month, I picked up a few oil stock while they are way down. This is the “buy low” part of “buy low, sell high.”

In addition to Charles Schwab, I have an account at Loyal3. Loyal3 offers 100% fee free trades and the ability to participate in IPOs, also with no trade fees. Here is a post all about how Loyal3 works.

If I did not have such great benefits from Schwab, I would seriously consider moving my primary investment account to TradeKing. I met their team at FinCon, and their product has grown to be a top-notch investment account offering. And trades are less than $5!

My Favorite Investment Analysis Tool – It’s Free!

The best tool I have found to help me keep my portfolio balanced is Empower. The site helps me track and manage my bank accounts and credit cards too, but the site has helped me save hundreds of dollars per year by showing which investments are charging the biggest fees and how to balance my portfolio for my goals and risk tolerance. The site is completely free.

The stock market has taken a beating so far this year, but that doesn’t mean all is bad. The stock market moves in cycles, and time and again we see that timing the market doesn’t work. Instead, remember to focus your investments on the long-term return. If you are new to investing be sure to check out my in-depth guide to the stock market to get started with investing.

I have seen a big step up in my default rate, but my Lending Club account is still chugging along making over 8% interest on my investment. My current adjusted annual return is 8.82%, a much better performance than any bank account and most investments. I have earned $470 in interest, so even with my losses and the potentials on the horizon, I am still way up overall. Including cash, my adjusted account value is $1,099.

My Notes at a Glance:

- Not Yet Issued – 0

- Issued & Current – 47

- In Grace Period – 0

- Fully Paid – 48

- Late 16-30 Days – 1

- Late 31-120 Days – 2

- Default – 0

- Charged Off – 8

If you want to know exactly how I make consistent returns with Lending Club, check out my in-depth guide to making money with Lending Club.

Good job on the side income and it seems like you do well with keeping expenses low. Im still trying to increase my side income to at least 1K a month. Here’s to surpassing goals in 2016.

Thanks! Growing that side income is great. Keeping expenses under control in 2016 is one of my big goals across the board. Getting over the $1,000 per month hurdle takes some serious work, but I’m convinced that anyone can do it if they put their mind to it and commit to take the needed time and effort.

May we both double our goals in 2016!

Hey Eric, sorry I am late with this comment. I am a regular reader but I do not comment much. A couple of questions here:

1) Nice on the online income. My goodness, $2,861 is just great. You list your expenses and net income but what is the general tax liability if you don’t mind me asking? I am contemplating a blog so I am sort of getting interested in this type of thing. I realize you get most of your online income from other work (outside the blog) but I am curious about the tax thing and how that works in general. What does that do to your net income?

2) I know you are near me in Portland, so I am interested in your company’s stock offering. Since you are buying, you must think it a solid company? I am always on the look out for local companies to invest in. I want very much to add NWN (NW Natural Gas) but its too expensive at the moment. I look for dividend payments to eventually pay all my bills and it would be sweet to have my utilities paying my bills for me via dividends. I do realize you may not want to disclose where you work, or your company so that is OK too. You can send me an email outside this forum as well.

3) I note you are picking up some oil stocks. I think that is very wise. I think the bottom is near, but I also think it will be rocky going forward and maybe even flat for a few years. That does not worry me as long as the dividends continue to be distributed. COP just cut its dividend by 66%, so it will be interesting to see what XOM & CVX do. I don’t own either, I own BP and RDS.B. but I feel like I have bought near enough the bottom that I am in good shape. I also am ready for the cut if it happens. It is good money while it doesn’t!

I just bought BA today at $114 and change and I own PM & WMT that are in your portfolio. I don’t buy companies that don’t pay dividends so I don’t own any of the FANG stocks. JPM and SBUX are on my watch-list, but I am leery of big bank stocks. Try looking at Regional Banks such as CTBI and SBSI. One is a Champ and one is almost a champ (Champ = 25 years increasing dividends). Nice fundamentals, yield’s and dividend increases even through the recession. I own both. I think you might work at a bank so do some research you might like what you see. Good yield, safe capital, steady eddy.

Anyway, always enjoy your blog, always read, seldom comment. Thought I would my $0.02 FWIW. Mike

Hi Mike, thanks for another thoughtful comment. I have some big news regarding the side income coming in the next few weeks. Stay tuned 🙂

1. Taxes for the side income are taxed at your marginal tax rate. For most people, that is about 25% of your net income after expenses. With a business, you can deduct all related expenses (for blogging that includes computers, a portion of your cell phone and internet bills, office supplies and electronics, business travel, business meals, and sometimes a home office). I use H&R Block online to do them myself with Quickbooks desktop as my bookkeeping system.

2. I’ll send you an email directly.

3. I totally agree. This one was a riskier buy given the current market conditions. I knew that there was some downside risk before the turnaround will happen, but I don’t see the world’s dependency on oil and gas going anywhere for at least a few decades. It is a long-term buy, and I’m happy to be patient for long-term gains.

Regional banks can be hugely profitable. I worked at one in Colorado that was privately held, but would love to buy stock in that company if I could. I saw the daily profit and loss reports and was blown away by the margins. And that was right in the beginning months of the recession.