What an exciting June! I visited Seattle, went camping in the Colorado mountains, rocked out with the Dandy Warhols, danced with Dada Life, and I have no plans to slow down in July. Here’s a breakdown of how my money treated me last month.

Banking, Debt, and Investments

After pondering the merits of paying off my mortgage early or investing, which I wrote about here, I made my first new stock investment in a little while. I bought the Coca Cola Company, which pays a dividend rate higher than my mortgage interest rate. While there is some risk, I am clearly earning more in interest than I am paying per dollar when investing. I wrote all about why I picked an investment in Coke here.

My $25 automatically deposit from each paycheck into my Lending Club account has now led to an account balance over $800. My net annual returns at Lending Club are 11.63% and steadily growing as I diversify into more risky, higher interest loans. I currently have 39 active loans, 3 in funding, and 11 fully paid and I have earned $110 in interest. I love Lending Club as an alternate investment vehicle. If you want to know exactly how I make 11+% with Lending Club, check out my in depth guide to making money with Lending Club.

I know some people are nervous about the stock market right now, but I like Warren Buffet’s philosophy: When everyone is scared, that is the best time to buy. When everyone is confident, you should be scared. In the long run, the stock market has always gone up, and I have no plans of pulling out any of my investments right now.

Liberty Fund Update

I have a $30,000 savings goal for my liberty fund. I started saving in August, 2012 and the fund balance is now at $25,809. I’m making great progress saving. I plan to use $2,500 from this fund on a new floor for my condo in the next couple months.

The bulk of my liberty fund is in a combination of high interest savings accounts and a stock investment account. I suggest 360 Savings from Capital One 360 for this type of savings. I began this fund with a $5,000 emergency fund goal and have expanded it to give me more flexibility and a bigger cushion. Just don’t have too much cash in your emergency fund, and occasionally re-evaluate if your emergency fund is too big.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ads, Freelance Work – $571

- AdSense – $7 (not sure why this has gone down the last 2 months)

- Affiliate Payments – $0

- Premium Plugin Sales – $0 (will be reported only when paid by Code Canyon) – 6 sales to date

Expenses

- Freelance Writers – $60

- Email List – $19 (Provided by Aweber)

- Web Expenses and Development – $20

This was a fair month, but not great. My goal is $1,000 per month, and this month I only made about $600 in revenue. I made about $1,500 last month though, so I can’t complain too much.

I created a new WordPress plugin a couple months back to solve a problem I had. I was trying to convert from the Thesis Theme to Genesis (did you notice?) and couldn’t move my Thesis post images as expected. My new plugin takes care of that and is available for $10, of which I get $6 per sale.

Denver Flash Mob – Flash Mob Consulting and Planning

- Revenue – $620

- Staff Payments – $100

- Other Expenses – $0

The completely rebuilt the Denver Flash Mob website is sending me more business leads, but I don’t always have the ability to meet the requests. I ran 3 events in June and have another 2-3 in line this summer. It is keeping me busy, but I won’t fight it!

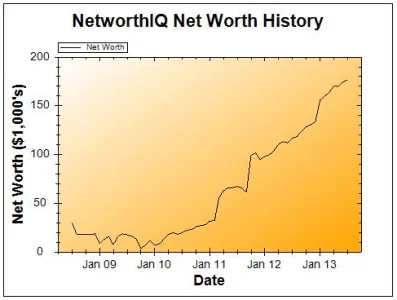

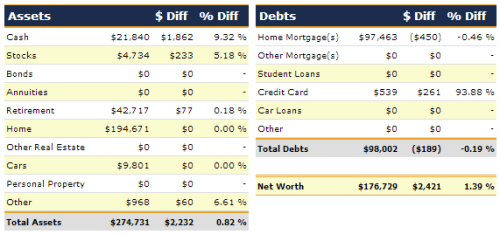

Net Worth

In total, my net worth was up $2,421, or 1.39%. I update my condo value from Zillow and update my car value based on Kelley Blue Book annually in January. I pay off my credit cards in full each payday.

When I read about your plugin I thought it was the kind of gig you could put on Fiverr, you could offer to convert up to X images for $5 and have an extra gig to get the permanent plugin for $10. I tend to go look more on Fiverr than for plugins.

I have not thought about using Fiverr for plugins. I tried to get this one on sale for $20, but you don’t control the list price on Code Canyon. I think this one is worth quite a bit more than $5, but for something that was easier/cheaper to put together, I may consider selling there.

Seatle’s a nice place to visit. Cool shot of Pike Place. Although you didn’t hit $1000/month, that’s still a nice chunk of change. Did you hunt down the private ads or did they find you? Nice progress on your investments. How do you find the time do work on your blog and planning flash mobs?

The private ad companies contacted me directly, To find time to have both a blogging company and flash mob company, I cut down on wasted time. We don’t have TV at home and I really buckle down when it is time to write and focus. I try to use the 80/20 rule to only focus on profitable tasks and projects.

Your lending club look like my Prosper account. I have a lot of loans. I was scared to have so many in the beginning but thats really what works. Nice job on the income stream. Still havent been to a flash mob but that is bringing in some nice money for you as well.

Flash mobs are a lot of fun, you should go find one in your city to try it at least once!