I kept going strong with my new cash flow strategy this month. My Roth IRA balance is high enough that I need to start looking at investing there again. I also bumped up my mortgage payment to get me within $100 of being below the six figure mark.

Banking and Debt

I figured out that I had a little extra cash this month (I love having all of my other debts paid off), so I nearly doubled my mortgage payment. I also got a check back from the bank for an escrow adjustment.

I have now saved $4,587 in interest over the life of my loan and cut 12 months from the end of my 30 year fixed loan. At this rate, it should be easily paid off in 10 years, not 30.

I continued with the automated investing in my retirement accounts. It ensures you don’t waste money that you should be paying into your future.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ad Placements – $720

- AdSense – $21

- Affiliate Payments – $410

Expenses

- Web Registration – $8 – Purchased ericrosenberg.me and narrowbridgefinance.net for one year with GoDaddy coupons

It looks like affiliate income is going to be a major part of my future online income and the revenue is starting to show up more often. I only support products I use myself publicly. If people sign up through me, I make a few bucks. Private ad placements look to be declining in the future, but I plan to continue with that revenue stream as long as possible.

Denver Flash Mob

- Revenue – $0

- Expenses – $0

- Net Income – $0

I have two outstanding past due invoices and one events in planning. I have changed the strategy of Denver Flash Mob from large, public events to Flash Mob Consulting. This puts the entire planning and execution of the event on me, but removes the burden of recruiting all of the dancers. I will test the waters and see how this goes moving forward.

I have also seen a need to change my accounts receivable policy. Starting with any new planned events, I will require the fees to be paid at least one week in advance of mob day or we will cancel the event.

DJ Yofi

No revenue or expenses this month. I have been booked for an upcoming wedding.

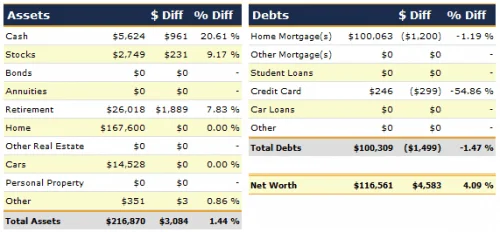

Net Worth

Overall, things were great this month. After last month’s lackluster result, I was happy to see my net worth increase by over 4% in June. Here’s to a great July!

Flash mob consulting? Really? That is the coolest job ever!

I try to keep it fun! I run flash mobs all over Denver.

Sounds like things are going well for you. It is always nice to see people’s net worth headed in the right direction. Keep it up.

Thanks Lance. The hard work is definitely paying off.

I hadn’t logged into networthiq for quite some time, used to love the website when I first became interested in finance in 2006, 4% is great progress!

I have been updating it every month for years. It is super helpful for long term tracking.

Good looking chart Eric! Well done!

Thanks Sam. If I am going to talk the talk, I have to walk the walk.