December was an exciting entrepreneurial month for me, but also an expensive one. I didn’t go anywhere out of town, so I had plenty of time to work on my closet remodel and a new business project.

Banking, Debt, and Investments

This month, I set up a new business account for my new project, but did not make any changes to my own banking and investments. The only major change in my investments is in my work 401(k) plan. On January 1st, my vesting increased by 33%. The company encourages employees to stay longer by vesting our 401(k) balances over 3 years.

I am now depositing $25 automatically each month into Lending Club account. My annual returns at Lending Club are more than 10%, so I plan to do more with P2P over time. I am also keeping my eyes on my new $100 investment in my new Prosper account. You can get started with either Lending Club or Prosper with only $25. I am investing in slight more risky loans as my portfolio grows to increase my returns.

Liberty Fund Update

I have a $30,000 savings goal for my liberty fund. Saving up $30,000 is not easy, but it is a goal that I know I can attain as long as I keep focused. This month, I was not able to add much, as I used some of my money for my closet remodel project. The current balance is $17,597. My liberty fund is in a high interest savings account. I suggest Ally Bank savings for this type of savings. This is an increase on my$5,000 emergency fund goal.

I am planning on installing hardwood floors in three rooms in my condo, and may need to take about $3,000 out of the liberty fund to pay for it.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ad Placements and Freelance Work – $413

- AdSense – $31

- Affiliate Payments – $0

Expenses

- Freelance Writers – $0

December is often a bit of a slow month, as there are fewer visitors and many businesses have staff on vacation. I expect things to pick up a bit in January.

Denver Flash Mob

- Revenue – $150

- Expenses – $0

I completely rebuilt the Denver Flash Mob website this month to help my new strategy. I am focusing less on large, public events and more on flash mob consulting. I also require a $100 down payment up front to ensure I don’t get burned on an event, which happened once before. This month, we had a successful event and I was paid the balance of the fees.

DJ Yofi

- Revenue – $0

After a successful wedding this summer, I am planning to work with a wedding coordinator to find more similar events to increase my DJ income. I did two shows this month, one as a volunteer for a non-profit and one as part of my new Denver Underground Parties project.

Denver Underground Parties

I started a new project with two friends called Denver Underground Parties. We had our first successful event on New Year’s Eve, and it was a profitable party. We have not paid ourselves from the earnings yet, so I will hold off on sharing the profits.

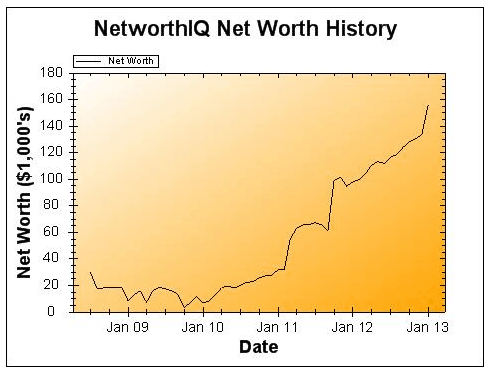

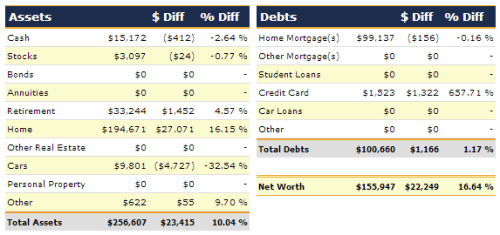

Net Worth

In total, my net worth was flat based on income, expenses, and investments. I did an annual update on my condo value from Zillow and updated my car value based on Kelley Blue Book. Including those annual adjustments, my net worth was up $22,249 or 16.64%.

Wow, love the vertical looking chart at the end Eric!

I wrote a net worth goal update today, but mine is so slow like a turtle 🙂

HNY!

Sam

Thanks Sam. I bet your are building on a bigger base, so getting a vertical line is a bit more difficult. Also, as I am only updating the real estate value annually for consistency month-over-month, it makes it look a little inflated. Overall, I am happy with where it has gone since grad school.

Now that is an impressive-looking chart, in both design and upward trajectory! Interesting to see that private ads are doing more than 10x as much as AdSense.

Mike

Would you believe that AdSense (even at that level) has been picking up lately compared to usual?

Nice work so far!

Thanks!

Great job on continually increasing your net worth. It is a really impressive graph which I hope to emulate one day.

Keep pushing forward and making good financial decisions and I am sure you can make it too.

How can anyone who claims to be an experienced investor advocate p2p lending? 10+%? What does that mean? 10.4%? 12%? There are established mutual funds with long histories that have average annual returns of 12%. American Funds Investment Company Of America is one of the more widely known…The risk involved in peer to peer lending is similar to going to a casino and putting your money on black instead of red. Pimco has closed end bond funds that trade at a premium to their nav (due to consistent performance), yet yield consistent 12%+ dividends paid out in monthly increments since 2003. Hence the justification for paying the premium. PHK is one example. I’d put my trust in a fund managed by Bill Gross than betting on a farmer in Uzbekistan.

You are talking about microlending, not peer-to-peer. I have done some microlending through Kiva, but that does not pay a return, it is just for the warm, fuzzy feeling. I am talking about Lending Club or Prosper, where you make money on the loans. My Lending Club net annualized return is 10.69%, which fluctuates as I add new loans over time.

Peer-to-peer lending does have risks, but far less than putting your money on black. Also, most of the time Index Funds beat fund managers, so the grass is always greener somewhere.

The key is to find a good mix of investments to spread out the risk while positioning yourself to make the best long-term gains. There is no single “best” investment vehicle.

I didn’t have much luck with Prosper. It’s a good idea, but I had enough people borrow money and then declare bankruptcy that I had a loss. I only lent to people with good credit, but maybe they didn’t feel beholden to repay loans to anonymous lenders on the internet.