Taking out a loan is an almost unavoidable part of life. Whether it’s for a car or a home, you’ll need help affording a significant purchase. When this happens, you will undoubtedly have loan questions you need answered.

But what should you know before looking for (or accepting the terms of) a new loan? We answer some common loan questions to help you begin your financing journey.

What Are Balloon Payments?

A balloon payment is a deferred amount paid in a lump sum at the end of a loan or lease. For most people, the balloon payment is usually somewhere in the range of thousands of dollars.

The time value of money shows that deferring payments is beneficial because you can earn interest on your money rather than giving it to someone else to earn interest with. For example, if the loan interest rate is 4.95% and you can earn 5% or more with another investment, you are better off deferring the payment.

Some people may struggle with balloon payments because they forget to save enough money to make the payment at the end of the loan. Consequently, it’s essential to make sure you save money each month to ensure you can pay off your balloon payment.

If you can’t earn more in interest than your loan interest rate, it is in your best interest to prepay your loan as fast as you can. Otherwise, if you can do better elsewhere, such as the stock market or bond investments, delaying payments as long as possible is best.

What Is Loan Amortization?

Anyone who has ever had a loan has seen the statements updating you on your progress. Early on, it is often disheartening to see that the bulk of your payment went to just the interest, and a small amount went to the outstanding loan balance.

Several important factors determine the amortization schedule, or schedule of payments, including the interest and principal reduction, loan length in years, number of payments per year, beginning balance, and ending balance.

The ending balance is usually zero, and 12 payments are made yearly. Based on these factors, a loan amortization schedule can be created.

Based on the inputs above, a loan amortization calculator will determine the monthly payment needed for the loan to have the desired ending balance depending on the interest rate, starting balance, and loan terms.

The loan is broken up so that you can see what interest is required and what the principal balance remaining would be after each period. An easy calculator that gives an annual amortization can be found here.

If you understand how loan amortization works, you know about 90% of critical financial concepts. Bonds, loans, and anything with an interest rate use the same formulas to calculate present and future values.

How Can You Improve Your Odds of Getting a Loan?

There are ways to improve your chances of getting a loan, and understanding how bankers underwrite loans to decide whether to approve or deny prospective customers can help. Here’s how you can increase your odds of getting a loan.

Get Your Free Credit Report

Get a copy of your annual credit report for free from annualcreditreport.com.

Remember that your credit score is more of a screener than an approval tool. If your score is bad, you will be screened out right away. If it is fair or good, you will go through the process below.

Once you have your credit report in front of you, start at the top and cross out any credit account that says “authorized user” next to it. Those are generally accounts for which someone else is a primary user, and the bank assumes that you do not pay for those.

Look for Late Payments

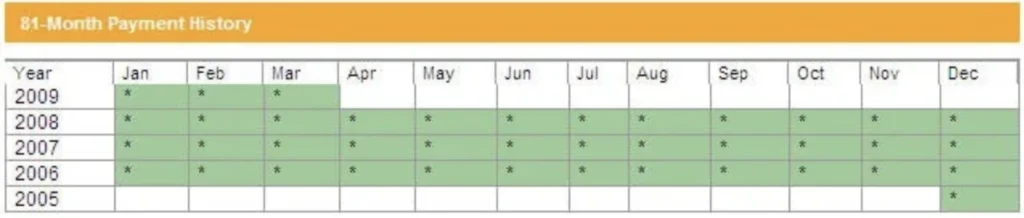

Next, go back to the top of the report and highlight any late payments. The report usually makes it easy to find those in your payment history. Look for a grid with stars representing on-time payments and 30, 60, 90, etc, representing the number of days late.

My report looks like this since I have no late payments.

If you have late payments, highlight them with a bright pink highlighter or circle them with a red pen to denote them as bad. If all payments on the account were on time, put a checkmark next to them.

Ensure every account is crossed out (authorized user), checked off (on time only), or marked for late payments.

Look at Account Balances

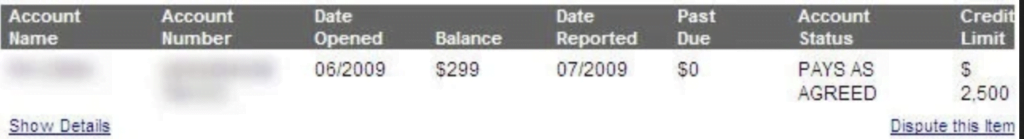

Next, you need to look at your balances. Evaluate your accounts and circle any account balances with a black or blue pen or highlight it with a color that is not what you used for the “bad” items. Make sure every balance is highlighted.

For revolving credit accounts, such as a credit card, highlight the credit line amount as well. Add up all your balances and credit limits separately and write them at the bottom of the report.

The account below has a balance of $299 and a limit of $2500. Look for something like that as an example.

Then, highlight all the minimum payments on your installment loans, such as a car loan, mortgage, or any loan with a fixed payment and end date. Add those up and write that number at the bottom.

Calculate Your Credit Utilization

Divide your outstanding credit card balances into your credit limits. This gives you a utilization percentage. In the $299/$2500 example above, you would have an 11.9% utilization rate, which most banks accept.

Any number over 25% might hurt your chances of getting a loan. Anything over 75% will almost certainly disqualify you. If your total outstanding revolving balance is over $10,000, you will probably have a tough time getting a loan as well.

Now, multiply your outstanding revolving balances by .1 to give you 10% of your balance. For example, 10% of $299 is $29.90, or about $30. That is what most banks will assign you as a minimum monthly payment.

Add that to your installment minimum payment, and you will have a total debt servicing payment amount. For example, if you have $300 in revolving balances and a car loan that requires a $220 monthly payment, your debt servicing payment is $250 monthly.

Calculate Your Debt-to-Income Ratio

Write down your monthly regular income. You can include child support, alimony, or social security if you receive payments. Then, subtract your monthly rent or mortgage payment and fixed expenses from that number.

Next, divide your debt servicing number by your income after fixed expenses. That gives you a debt servicing ratio. If you have a $250 payment and your monthly income after fixed expenses is $2000, your ratio is .125. Any number below .1 is excellent.

Many banks would consider any number below .3 acceptable. If you are over .5, you probably will not get the loan.

Evaluate Your Findings

Look at the whole picture. Past performance is the best prediction of future performance. If you have many late payments, high balances on your credit cards, or are using 90% of your available credit, most banks will not give you a loan.

A single issue might be overlooked, but the big picture is what will make or break you.

How Can You Find an Unsecured Loan?

When I worked in banking, customers regularly asked about unsecured loans. While many banks do not offer personal loans, there are ways to find unsecured loans if you know where to look.

Credit Unions

Many credit unions offer their members personal loans. These will have a higher interest rate than a mortgage or auto loan because the credit union is risking that you will not pay them back. They have no collateral or recourse if you stop paying.

A recent, unscientific survey of credit unions put the average interest rate around 12% for this type of loan.

Big Banks

Credit unions are not-for-profit institutions that have their member’s best interests in mind as they operate. Big banks are in it for the profit. They may offer personal loans if you are a low-risk borrower and think they can make money.

A quick search online will give you options for banks near you.

Social Lending

A newer option, but certainly one worth considering, is looking to a social lending site. These sites offer competitive rates for unsecured loans. They are crowd-funded by investors who choose your profile on the site.

If you are compelling and have a good risk profile, you can usually get a loan quickly and pay a lower rate than banks or credit cards.

Credit Cards

Credit cards are the default personal loan, though most people don’t think of them that way. However, most credit cards charge extremely high interest rates compared to other loans. You can easily pay over 20% annual interest on a credit card.

I suggest avoiding this option unless you already have a great interest rate on your account.

Is 0% Financing Helpful?

When done correctly, you can rule 0% financing to come out on top. It doesn’t matter if you have the money saved or if you don’t have the money saved. Here’s how you can benefit from 0% financing.

If You Already Have the Money Saved

Let’s take a look at the numbers. Assume you have $15,000 saved up in a car fund and are buying a car that costs $15,000. When you pay for it in cash, the $15,000 is out the door, and you own the vehicle.

If you get the car for 0% interest with a 25% down payment, you spend $3,750 on day one. From there, you can keep the remaining $11,250 for five years.

What is $11,250 worth over five years? If you are responsible and keep it in a savings account, you can earn at least 1% per year with a savings account. With compounding interest, after five years, $11,250 becomes $11,826.55.

By saving the money, you get $576.55 in interest over five years. That is not chump change. Even after taxes, you get to keep about $430.

This works with any zero-percent interest offers. Whether you are shopping for a car or furniture, make sure to stash the money in savings to earn the interest you would have been giving away.

If You Don’t Have the Money Saved

If you don’t have the money already saved up, you should take advantage of a 0% offer. Why pay interest when you can borrow money for free?

However, use the 0% to your advantage to create a “loan sinking fund” just as businesses have “bond sinking funds.”

To create your fund, start a new savings account with the goal of having the right amount of money to pay off the entire loan when the 0% period ends. We will stick with the car example from above for the numbers.

Use a time value of money calculator to plug in your situation to find your specific savings amount.

If you know you will need to pay back $11,250 at the end of five years, work backward to find what you need to save every month to have that at the end. Without interest, you need to save $187.50 per month.

With interest, you only have to save $182.78. I know it’s only $5 per month, but every dollar counts.

If you put away the entire $187.50 in the 1% savings account for five years, you pay off the loan, plus you have a bonus amount saved up thanks to compounding interest. Your saved amount after the 60 months is $290.

The Power of Savings

Albert Einstein is famously (and likely incorrectly) quoted as saying, “The most powerful force in the universe is compound interest.”

Whoever coined that quote was on to something. As you can see, saving money with interest while borrowing without interest allows you to save real money.

What Happens When Loans Move to New Lenders?

Sometimes, people with student loans, mortgages, and auto loans get a letter that their loan has been transferred to a new lender. This can be a surprising letter to receive in the mail, but it happens for important reasons and should not cause you extra stress.

Why Loans Move

When a bank accepts a deposit from you, it records the deposit as a liability on its balance sheet. Federal banking regulations allow the bank to lend out most of those balances in the form of loans.

However, a portion of those balances must be held to return to their customers when they want to make a withdrawal. This cash balance that the bank must maintain is called the reserve requirement.

When banks want to make more loans than their reserve requirement allows, they can sell those loans to other banks, financial institutions, or investors to free up capital. This also offloads the risk of defaults from the bank, so some banks sell loans to reduce risks.

When a bank sells a loan, it gets a payment for the outstanding loan balance. In some cases, they also get a premium for future interest payments. If the loan is particularly risky, the bank might sell it at a discount to avoid future loan losses.

What To Know if Your Loan Transfers

When your loan transfers, the loan terms are the same. You owe the same amount each month, and you are legally bound by the same promissory note that you signed to start your loan.

If you are set up for autopay, you may need to set up your payments again for the new servicer. Otherwise, if the same bank still services the loan, you do not need to make any changes.

When you make payments through your bank’s bill pay, you must add the new servicer so the right institution receives your payments if your servicer changes.

It is critically important for your credit to update your information and set up payments for the new lender. You don’t want a late payment to hurt your credit score.

Should You Take a Loan From Your 401k?

Most anyone with a 401(k) account can “borrow” funds from their retirement account. The IRS allows you to withdraw money from a tax-deferred 401(k), stipulating that you pay it all back within a certain period to avoid tax penalties.

In general, it is a horrible idea to take money out of a 401(k) until you are retired. This is mostly a psychological issue, not a financial one. I am in the mindset that my 401(k) funds do not exist. Those funds are not accessible until I retire. Period.

From a financial perspective, it is easier for many 401(k) borrowers to skip paying it back and take the tax hit. This is often a lower dollar amount than paying the fund back.

The Finances of the Situation

Mechanically, it is probably better to take out the money to pay off the 27% credit card. If you would pay yourself back at the rate you were paying the credit card companies, taking the money out is a slam dunk.

However, there are alternatives to a 401(k) loan that you might consider. The first thing I would do is call the bank and ask for a lower rate. It is often that simple.

If I could not get a lower rate, I would look around for balance transfer opportunities. Do you have other credit cards that would let you do a balance transfer? If you will save more than the transfer fee by moving to the lower rate, go for it.

In the event you are a homeowner, you can take out a “second mortgage,” which would be secured to your home and offer a much lower interest rate. However, your home is at risk if you don’t pay that loan.

If you have never looked into social lending (also called peer-to-peer lending), you might be surprised by a good deal from sites like Lending Club or Prosper. Depending on your credit score, you might get a great rate compared to a credit card.

How Can You Make the Most of a Loan?

Here are some recommendations for people who use loans to ensure they make the most of their financing without hurting their financial future.

Read the Terms

It’s important to know what to expect with a loan. Companies that lend money provide literature that is essential to read to avoid surprises.

Be sure to review all of the terms of your potential loan before committing to borrow any sum of money, and review the terms regularly to ensure you don’t violate them.

Shop Around for Interest Rates

Make sure you understand the interest rate associated with your loan. The interest rate is the additional cost on top of the money you borrow.

When paying back your loan, the lender will profit off your interest charges, so it’s best to shop around for the lowest rate possible. Short-term loans usually have higher interest rates, but getting a rate that works for you is possible.

Borrow Only What You Need

Most credit and lending industry experts, like Don Gayhardt Of Curo, recommend only borrowing the amount of money you truly need. A short-term loan is best used sparingly when you only need a little cash to fulfill your financial responsibilities.

Like any loan, your cost increases if you borrow more. Borrowing a small amount that is just enough to help you stay financially fit can be more beneficial than taking out a larger loan.

Make Timely Payments

Borrowers need to pay back their loans in the allotted time. Missing a payment or having a late payment can negatively impact your credit.

For a short-term loan, a missed payment may also mean a higher interest rate or more penalties and fees that don’t help your financial situation.

Pay Off Each Loan Completely

For short-term loans, in particular, it’s essential to pay them off as quickly as possible. You can try various payoff strategies if you have other monthly obligations. This way, you don’t have to worry about taking out a second loan if another financial emergency happens.

It’s better to get a clean slate and clear your debt burden as fast as possible to prepare to build up your savings over time.

Make Arrangements During Tough Times

Sometimes, consumers experience a financial disaster before paying off their loans. If this happens to you, and you can’t make your loan payment, talk to your lender about an extension or other arrangement.

Not all companies will agree to change the terms of your loan for a short period of time, but it is worth a shot to at least ask.

Budget Your Expenses Effectively

As you navigate the ins and outs of paying off a loan, developing a plan to budget your monthly expenses is vital. See where you can cut costs on your daily spending, and look for ways to add more into your pocket each month to help.

The Bottom Line

Taking out a loan may sound complex or like a bad strategy to afford a big purchase. Fortunately, that’s not the case, and knowing the answers to these loan questions can help you use loans to your advantage.