This month was uneventful in my personal finances, but very good in my business finances. I had a week long out of town trip with my family, and it was nice to get away. I also booked a 100% free flight to visit my girlfriend’s family for Thanksgiving using free miles. Here is how everything worked out in October.

Banking, Debt, and Investments

This month, I sold two ETFs in my Roth IRA and bought a high yield dividend stock fund from Vanguard to replace them. The fund is primarily blue chip stocks, and matches better with my long term investment goals. I am also excited by the very low fees in this fund.

I am now depositing $25 automatically each month into Lending Club account. My annual returns at Lending Club are more than 10%, so I plan to do more with P2P over time. I am also keeping my eyes on my new $100 investment in my new Prosper account. You can get started with either Lending Club or Prosper with only $25.

Liberty Fund Update

I have a $30,000 savings goal for my liberty fund. Saving up $30,000 is not easy, but it is a goal that I know I can attain. This month, I was able to able to add about $1000, which brings me to a total of $17,593. My liberty fund is in a high interest savings account. I suggest Capital One 360 for this type of savings. This is an increase on my$5,000 emergency fund goal.

I had an unexpected situation with my carpet, and I have been considering adding hardwood and remodeling my kitchen for a while. I am planning on paying for this major expense out of my Liberty Fund.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ad Placements and Freelance Work – $425

- AdSense – $39

- Affiliate Payments – $113

Expenses

- Freelance Writers – $50

Certainly not a stellar month, but still had enough revenue to cover my mortgage payment. Having low living expenses means I can usually cover my basic monthly costs with my side project income.

Denver Flash Mob

- Revenue – $200

- Expenses – $0

I completely rebuilt the Denver Flash Mob website this month to help my new strategy. I am focusing less on large, public events and more on flash mob consulting. I also require a $100 down payment up front to ensure I don’t get burned on an event, which happened once before.

DJ Yofi

- Revenue – $0

Net Worth

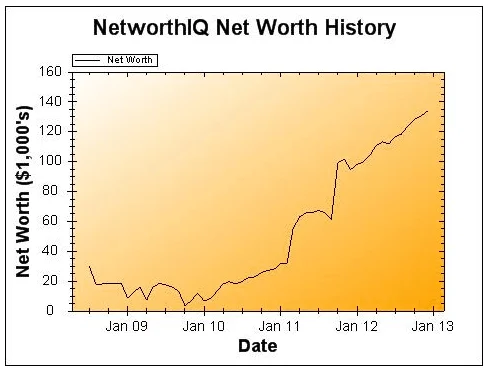

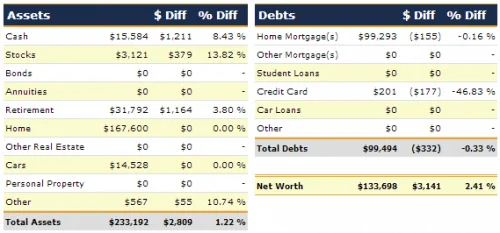

In total, my net worth was up $3,131, or 2.41% in November. I’ll take it! I plan to update my home value annually to allow for consistent monthly analysis. According to Zillow, my home value is up about $30,000 since my last update.

Love the rocket ship chart!

Out of curiosity, do you share these posts with your dates by any chance? That would be a good post! S

I never shared my net worth on a date, but I recently shared it with my girlfriend. We are talking about the future of our relationship and hit a point where money could be a factor in what we do next.

great work!

Thanks!

Wow nice jump in the home value. How confident are you in Zillow?

Thanks Lance. I know Zillow can be somewhat suspect, as it is based on a set of algorithms. However, it is a pretty great gauge on property movement over time. I live in a condo, so sales in my building get extra weight in the calculation and it should be a decent guide.

Nice looking chart for your net worth! Always fun to see how people are meeting their goals 🙂

Thanks! I love watching it go up, up, up!

Awesome chart. My net worth is flattening out since I quit my job, but that’s expected. Hopefully, it’ll improve after a couple of years. At this point, I’m happy with flat. 🙂

That makes sense Joe. Do you have investments that you expect to help generate more income, or are you looking more to side project businesses?