Knowing how to choose a credit card is an important skill since credit is a critical part of your financial health. There are many cards on the market, so knowing what factors to consider is a key component in safeguarding your finances.

Beyond that, you must know how to use your card safely and effectively. Here’s what you need to know to choose and manage a new credit card.

Why You Need a Credit Card

I once wrote a post explaining why you need to stop using credit cards. That is not entirely true. Understanding the risks and dangers of using credit cards irresponsibly is essential, but it is also important to understand and take advantage of the benefits.

Reason #1: Your Credit Score

The first reason you need a credit card is your credit score. If you are in your 20s or 30s, you are likely renting your home. When you want to purchase a car (with a loan) or buy a house (with a mortgage), you need a good credit score.

You probably can’t pay in full for a new car or have the entire cash amount needed for your first home purchase. The first thing a bank will look at when deciding on a loan is your credit score.

A credit score is not generated overnight. It is not created in a month or a year. Building a good score takes years, though it can take only weeks to destroy it.

I have had perfect credit since I was 18, when I got my first card. During that time, I used and paid off my cards in full every month. I have taken out a car and student loans, ensuring I am always early on my payments.

I paid off my car loan and student loans early and have never missed a payment date for any credit card or loan. In fact, I have paid my cards off in full each month and never paid a cent of interest.

Reason #2: The Perks

When I started this blog in 2008, I hesitated to use my credit cards too much because I have seen what happens when people spend more than they can afford. However, I’ve learned that using cards responsibly can lead to good credit and amazing perks.

I’ve written about my experiences with my favorite credit cards, which I have used to get free flights to Europe and around the United States, free hotel nights, and other perks.

How To Choose a Credit Card

There are a few things you should consider when choosing a credit card to make sure you opt for the one that is best for your needs.

What You Qualify For

Before applying for a credit card, you need to know your credit score. Many credit cards will have minimum credit score requirements to be approved.

Since your credit score can be impacted by inquiries into your score (which happens when you apply for a credit card), it’s important to only apply for cards you know you qualify for. This way, you don’t needlessly hurt your credit score when applying for a new card.

Interest Rates

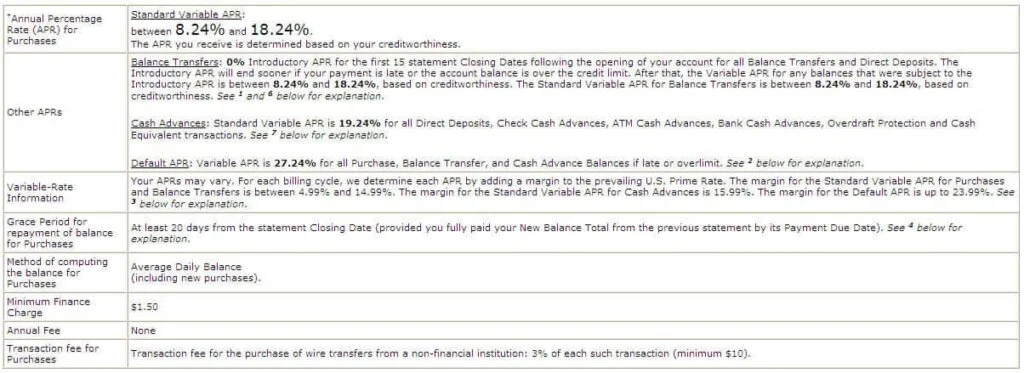

While the interest rate may not be a significant issue when choosing a card if you plan to always pay your card in full each month, it does come into play. You should always see a table like the one below when looking at credit card terms.

This is a standard disclosure for all cards and is an example of a Bank of America credit card. Notice the major important numbers, including interest rates for standard purchases, balance transfers, and default.

The default APR will go into effect if you make late payments or do not follow standard credit card procedures. Variable rate information discusses potential rate changes in the future. The grace period is how long you have from the billing date to pay.

One good resource for understanding the dozens of pages of disclosures is the Credit and Charge Card pamphlet from the Federal Reserve of San Francisco.

Fees

There are some key fees you should evaluate before choosing a card. These can include:

- Annual fees

- Foreign transaction fees

- Late fees

- Balance transfer fees

Why is it important to understand these fees? Because they will directly impact how valuable the card is to you. For example, if you choose a card with an annual fee but the rewards you receive don’t exceed the fee, the card isn’t worth it.

Or, let’s say you travel internationally frequently and plan to use your card overseas. If this is the case, avoiding cards with foreign transaction fees is wise.

Rewards

One of the big considerations when choosing a card is the rewards it offers. I’ve had a few conversations with friends about cash back credit cards vs. miles credit cards and recorded a video blog post to explain which one I think is better.

Full transcript:

“Hi everyone, this is Eric from Narrow Bridge Finance here with my first video podcast, video blog post rather, so welcome. We’re excited to have you.

So, I’m here today to talk to you about the difference between cash back credit cards and rewards credit cards with miles and points. I talked to a few people about this lately, and some people think the cash back’s better, some people think miles is better, so I wanted to clear up the difference and explain a few things about it.

So, first, I want to talk about the benefits of cash back credit cards. They’re pretty simple, you get the idea. You spend money, a certain percent you get cash back in your account, you get that as a check, you can spend that however you like. It’s money in the bank. Pretty straightforward.

Miles and points are a little more complicated. There is often big signing bonuses, you get more miles one place than another. There’s a lot of different options; you can use the points for expensive flights, cheap flights, first class, coach. The miles have a lot different value structure than the cash, which is pretty straightforward.

And myself, I prefer to use miles and points. Why? As one example, I went to Israel last year, 100% covered by miles other than $200. Less than $200 a person. I know that’s pretty crazy, right? I flew a kind of complicated route from Denver to New York to Germany to Israel, but I got to the other side of the world for less than $200 a person, so I was able to take my girlfriend with me on a great trip to my cousin’s wedding.

So I think the value of those miles, where I could get a flight that might have been $1200 a person, so $2400 total, I could get for $400 total. Now, you might think, “Well, if I spend enough money on my cash-back card, I’ll have enough cash to buy those flights.” You know, that might be true, but it takes a lot longer depending on how you do it. Because most cash-back cards give a flat 1% back, maybe two, three, four, even 5% on some bonus category, whereas on my special mileage card, you can get five times on whatever you spend on office supplies or your cell phone bill in points.

So, for every $200 phone bill you pay, you get a thousand miles, and I know a thousand miles doesn’t sound like a lot, but that adds up pretty quick. For example, I’m going to Las Vegas tomorrow for the weekend. YEAH! Party in Las Vegas! It cost me $5 out of pocket and about 11,000 miles on Southwest. I was able to do that by spending on my Sapphire Preferred card, transferring just the number of miles I needed, and getting that flight and everything squared away. So I think the miles card and miles credit card options are much better than cashback, and that’s why.

If you have any questions, feel free to comment, and I’ll be happy to answer. Have a great day.”

Why You Should Skip Store Credit Cards

My first job in high school was at Target, and I was one of the top employees in the store for selling Target credit cards. Since I can do simple math, I just told people what the 10% they could save would be for large purchases.

People would almost always take the savings on large purchases. If you could save $100, I bet you would say yes.

However, we must remember why not to apply for these types of cards, including:

- Complexity: Simplicity is important in finance. I am a big advocate of automated and simple personal finance. One less card makes life easier.

- Most offers are limited: At Target, you save 10% one time. A one-time deal is an excellent tool to pull you in but is a short-lived reward.

- You may spend more: This is pretty self-explanatory. If you can spend, you might do it.

- Impacts on your credit score: New credit lowers your credit score. It takes a while for that new credit to be “incorporated” into your credit report and for your score to go back up.

- High Interest Rates: Most store cards have rates well over 20%.

- Bad Terms: Most store cards have questionable terms. The marketing is dirty, and the interest rates are high. They are just not good for consumers.

How Should Millennials Start With Credit?

I attended a FinCon many years ago and was interviewed by the credit reporting agency Experian. They asked me about starting with credit for college students and young professionals. Here’s my advice!

Full transcript:

“This is my 3rd FinCon, and I’m super excited to be back. Not only is it an opportunity to reconnect with friends and other bloggers around the blogosphere, but I also run the Ignite event here, which brings speakers together for short, quick, fun talks. That’ll be a great night event.

It’s important for millennials to understand and know that when they get out of college, they’re already running full speed towards a good credit score. That actually starts even before they graduate when they take on their first student loan or get their first credit card. So, it’s important to know when you get your first card, that credit card will impact your ability to maybe buy a house later in life, so you have to manage it responsibly right from the beginning.

A lot of young people get out of college, and they want to go buy everything they can. They think they have a new shiny job, it’s time to go spend, spend, spend. And the easiest way to do that is to put the money on a credit card. They don’t understand that you really have to pay that back, and the interest rates can be quite high. So, it’s important to manage your credit and use it wisely so you’re not paying a lot of interest, and you’re building a high score for your future.”

Should You Get a Smart Credit Card?

EMV, an acronym for Europay, MasterCard, and Visa, the companies responsible for the chip’s design and standardization, is the most common style of smart chip credit card. The small electronic chip is generally 3mm tall by 5mm wide and is embedded into the card.

Each time an EMV card is used, the terminal uses the chip to fully authenticate the card. Card skimmers have become a popular method of credit card fraud since replicating a magnetic bar is easy and inexpensive. The chip prevents that type of fraud and protects against others using high-tech analysis, authentication, and verification.

While EMV wasn’t always a common feature on credit cards, it’s more widely used today. In fact, it’s reported that over 13 million credit cards worldwide have EMV. As a result, it’s more likely than not that your credit card will be a smart card, whether you like it or not!

Ways To Be Smart With Your New Card

Getting a new credit card in the mail can be exciting. That said, it’s important to be responsible when your card arrives.

Set Bill Reminders

The first thing you should do when you get a new card is to sign up for online access and turn on email reminders when your bill is due. Setting up a system of reminders will help you keep from missing a payment.

Missed payments result in fees and potentially higher interest rates. They also lower your credit score, which can keep you from getting new credit in the future or raise the cost of a loan.

Pay In Full Every Month

Don’t just pay your bill each month. Pay it in full. Paying your bill 100% in full each billing cycle means you don’t pay any interest at all. You only pay interest on outstanding balances at the end of the billing cycle, so save money by paying it in advance.

Never buy anything you can’t pay for in full with cash, and find a system that works well for you to keep your credit cards under control. I pay my bills in full each payday to make sure I’m always on top of the bills before they arrive and to match my income with my expenses.

Read the Fine Print

The fine print is boring, but ignoring it can cost you big time. You can miss out on great benefits like bonus miles, rental car insurance, free concierge service, purchase protection, extended warranties, and more.

Beyond that, you could miss important terms related to what the card costs you and end up paying unexpected costs and fees. The fine print for credit cards may even protect you from the credit card company if something goes wrong.

Put Annual Fee Reminders on Your Calendar

If your card carries an annual fee, it is important to decide each year if you are getting enough value for the fee to keep the card open.

I have more than one card with a fee, and I put a reminder on my calendar a few weeks before the fee date to decide if I want to keep the card open. If I don’t, I call the bank, convert the account to a no-fee version, and throw the card in the back of a drawer.

Keep It Open

Unless it has a high annual fee, always keep your accounts open as long as possible. The average age of accounts and your open credit limit are two factors that impact your credit score, so you should always keep your cards open (unless they cost you money).

The Bottom Line

When you are getting started with a new credit card, be smart. From choosing the card that best fits your needs to always paying your bills on time, using your credit card effectively can benefit your overall financial health.