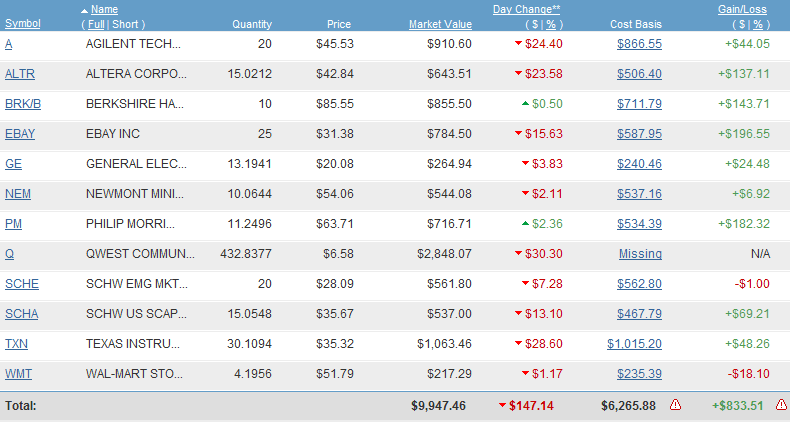

It has been a while since I shared my portfolio progress with all of you, and today seems like as good a day as any. The day change column is stinging today, but that has been the markets lately. Just remember, I was up more last Friday than I am down today. Also note that the chart below is in net. Reinvested dividends are reflected as a share purchase and gains from dividends are not included in the gain/loss total.

Stocks:

Agilent Technologies (A) – Agilent is a company in a growing industry. Bio-tech has grown for years, and the momentum is only increasing. A strong balance sheet and positive net income swing in 2010 are evidence of a strong future.

Altera (ALTR) – Altera is a semiconductor manufacturer. In a world with growing chip needs to run our servers, PCs, phones, clocks, cars, music players, calculators, home appliances, and a growing number of products reliant on semiconductors, this industry is only going to see growth for the foreseeable future. While the industry is capital intensive, Altera is appropriately leveraged and poised for increased profits.

Berkshire Hathaway (BRK.B) – I have written about my trip to see the Oracle from Omaha, Mr. Warren Buffet, at the annual Berkshire Hathaway shareholder’s meeting. I am already planning my second annual pilgrimage to hear what Warren Buffet and Charlie Munger have to say about the company and economy. The conservative, value oriented investing style has led BRK on a journey unlike any other company. Recent acquisitions have driven revenue growth and turnaround expert David Sokol has been on a tear fixing up Berkshire’s ailing investments. I am in this one for the long haul.

eBay (EBAY) – I purchased eBay shares after doing a lengthy fundamental analysis in my MBA program last year. I was right on. I am up 33% on my investment over one year. While its traditional marketplace business has seen better days, PayPal is performing incredibly well and StubHub is a growing venue for online event ticket sales. I am watching this company closely, but it seems to be holding steady.

General Electric (GE) – Buying General Electric is like buying an economy wide ETF in some ways. GE is in a wide range of businesses from the financial sector to the manufacturing sector. They build light bulbs and nuclear power plant reactors. They make vehicle loans and, until recently, TV shows and movies. GE is a beast of a company to understand, but you can expect it to follow the overall economy. People and companies always need the staples sold by GE.

Newmont Mining (NEM) – Newmont has been a roller coaster for me. At one point I was up nearly 30% on this stock, but today I am only up about 1.5%. Newmont, a Denver based gold mining company, has seen production below expectations in some mines. However, gold has trended upward during economic uncertainty. This is another one to watch closely.

Phillip Morris International (PM) – This one is controversial, but I have no regrets. As Warren Buffet once said about RJ Reynold’s tobacco’s cigarette manufacturing, it costs a penny to make, you sell it for a buck, and it is addictive. What better business exists than that? I chose PM over American sister company Altria Group (MO) due to US efforts to decrease smoking and downward trends. In Europe, Asia, and Africa, smoking is growing and the company is a cash cow.

Qwest Corporation (Q) – This is the last time you will likely see me write that name. My former employer, Qwest, has agreed to be purchased by Louisiana based CenturyLink. The merger is expected to close on April 1st. The combined company will continue to struggle with landline losses, but increased high-speed internet demand and business markets will allow free cash flow to hold steady and maintain the high dividend yield. This one is a hold in my book. A small arbitrage opportunity exists between Qwest and CenturyLink shares.

Texas Instruments (TXN) – While TI is known for their calculators, they do a lot more than that. This company is a semiconductor manufacturer as well, and I already discussed that industry. TI chips are common in wireless products. You might have one in your pocket right now.

Walmart (WMT) – I love Walmart, but you already knew that. This is the biggest company in the world. It is a retail superpower. While growth as a percentage of sales will level off as the company has fewer new markets to expand, international sales and domestic sales make this blue chip a solid investment choice.

ETFs:

I hold two ETFs in my portfolio. SCHE and SCHA are emerging markets and US small cap growth funds, respectively. These give me a range of exposure and growth potential. While I would love to see SCHE perform better, I plan to hold both of these investments for the long run.

Questions, Comments? Please share in the comments.

Good mix of stocks in there! I treat BRK like a Mutual Fund but with the world's best fund manager managing my funds!

My recent post Had You Bought Apple Shares Instead Of Apple Products…

I think of it that way too to some extent. Like GE, BRK has businesses all over the economy. I'll see that fund manager in two months in Omaha!

My recent post Portfolio Update and Analysis