Fall is falling and winter is on its way. Happy November everyone! I hope you had an excellent Halloween. I had quite an October filled with the Financial Blogger Conference, a mega Halloween party, a trip to Santa Barbara, and, oh yeah, I got engaged!

Banking, Debt, and Investments

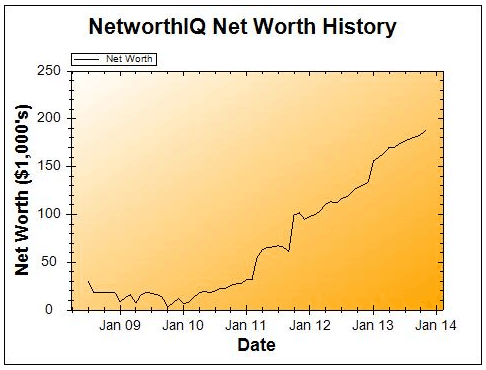

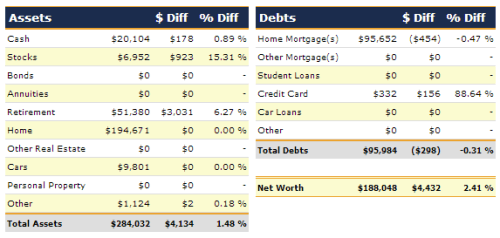

My investments have been rocking over the last month. Along with the rest of the market, my retirement portfolio and individual stock portfolio is going up, up, up! My stock account is up $923, including $500 from a cash transfer. My retirement accounts were up $3,031 over the last month. In total, my investment accounts were up almost $4,000 this month! Even with a cash transfer to investments, my cash balance was still up about $200.

I’ve seen great results over the last few months with Lending Club. My account has now led to an account balance of $964. I turned off the automated investment at Lending Club and have begun investing more with Prosper. My net annual returns at Lending Club are 12.19% and I have no plans to withdraw a cent in the near future. I currently have 48 active loans, 0 in funding, and 17 fully paid and I have earned $148 in interest.

If you want to know exactly how I make 11+% with Lending Club, check out my in depth guide to making money with Lending Club. I have $150 with Prosper and have earned an annualized return of 10.64% so far.

I have no plans to slow down my investing in the near future. My biggest focus in general is my automatic investing in my retirement accounts.

Liberty Fund Update

I have a $30,000 savings goal for my liberty fund. I started saving in August, 2012 and the balance is now at $25,871. I’m making great progress saving.

The bulk of my liberty fund is in a combination of high interest savings accounts and a stock investment account. I suggest 360 Savings from Capital One 360 for this type of savings. I began this fund with a $5,000 emergency fund goal and have expanded it to give me more flexibility and a bigger cushion. Just don’t have too much cash in your emergency fund, and occasionally re-evaluate if your emergency fund is too big.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ads, Freelance Work – $834

- AdSense – $30

- Affiliate Payments – $170

- Premium Plugin Sales – $0 (will be reported only when paid by Code Canyon) – 8 sales to date, paid on the 9th sale

- Book Sales –

Expenses

- Freelance Writers – $70

- Email List – $19 (Provided by Aweber)

- Web Expenses and Development – $198

In total, I brought in $1,034 in revenue, just above my $1,000 goal. I love meeting my goals! The $198 cost was related to final payments with an old host and Google AdWords advertising for the Reusable Bag Store, a side project I am working on.

I created a new WordPress plugin a couple months back to solve a problem I had. I was trying to convert from the Thesis Theme to Genesis (did you notice?) and couldn’t move my Thesis post images as expected. My new plugin takes care of that and is available for $10, of which I get $6 per sale.

Denver Flash Mob – Flash Mob Consulting and Planning

Revenue

- Custom Flash Mob Revenue – $275

- Sponsorship Revenue – $0

- eBook Sales – $0 (How to Plan a Flash Mob eBook now available!)

Expenses

- Staff Payments – $0

- Web Expenses and Development – $0

The busy summer season is behind us. I don’t have any events on the calendar for the fall at this point, though I am in talks with a couple of potential clients.