Buying a car is an inevitable part of life. It is usually among the most expensive purchases you will make, and it will be a purchase you must make a few times throughout your lifetime.

But how do you navigate the financial aspects of purchasing a car? Should you buy new or used? How do you find a loan?

I break down what you need to know when you are buying a car so you can get on the road without breaking the bank.

New Car Myths Debunked

Typically, when people want to buy a car, they know that purchasing a brand-new vehicle is a bad idea. However, because they really want a new car, they trick themselves into believing that it would be the logical choice for them, even though it’s more expensive.

When people start thinking of why they should buy a new vehicle, this list is typically what they come up with.

1) New Cars Are Safer

Somehow, people get the notion that the current car they are driving is not safe. If your vehicle is less than 10 years old, it is probably perfectly safe.

But, if you own a 1960 Chevy Corvair, you should probably upgrade to a safer car. That said, it still doesn’t have to be a brand-new vehicle.

2) New Cars Get Better Gas Mileage

This might be true, but instead of dropping $40,000 to save $500 a year, why not buy a used Honda Civic that gets 35 miles per gallon and will cost you way less? Buying that new car to save on gas just doesn’t make all that much sense in this case.

3) I Will Drive My New Car Forever

Even though people don’t typically drive a car for more than five years, they somehow get themselves convinced that they will get their money’s worth out of a new car because they will drive it until it simply won’t run anymore. This hardly ever happens.

After a few years, you will get bored with your car and start drooling over the new ones. It is best to buy a used car so you don’t have to feel bad about selling it and buying something different after a couple of years.

4) New Cars Are More Reliable

Some cars come off the line and are reliable, but there are always those new cars that are mechanically worse than many of the used Hondas and Toyotas.

The problem with buying a new vehicle is you don’t know if your car will be one of the reliable ones or one of the lemons. If, however, you purchase a used car, you can read up on the many years of reliability results.

5) Payments Are Affordable

Do you realize why the payments are so cheap for new cars? It’s because they extend the loan for multiple years!

After all of those years, you will not only overpay on your vehicle because you bought it brand new, but you will also have paid thousands of dollars in interest.

Beyond that, new cars are more expensive not just at the time of purchase but also in terms of registration and insurance costs. While you might save on maintenance costs in the short term, all these added costs negate those potential savings.

Are New Cars a Good Investment?

When I worked at a bank, I noticed something interesting. All of the officers had cars worth less than the regular employees. I knew officers made more than non-officers, but I always wondered why people who make less have cars worth more.

One day, I found out why. One of the guys made a comment about it, saying, “Cars are depreciating assets.”

While the officers did not have flashy cars, they all had nicer homes and condos. The non-officers almost all rented.

If you buy a car for $25,000, it is worth less every day. If you buy a home for $500,000, it will generally be worth more. Cars go down, homes go up.

When deciding what to do with your money, do not put it in cars unless you can afford cars that go up in value (like a McClaren F1, only $1 million). But for most of us, real estate or securities are a much better option.

How Does a New Car Impact Your Net Worth?

We know that new cars are not good investments, but vehicles have become a status symbol that lets others know we are successful. For this reason, many of us overextend on our auto purchases. In turn, this kills our net worth.

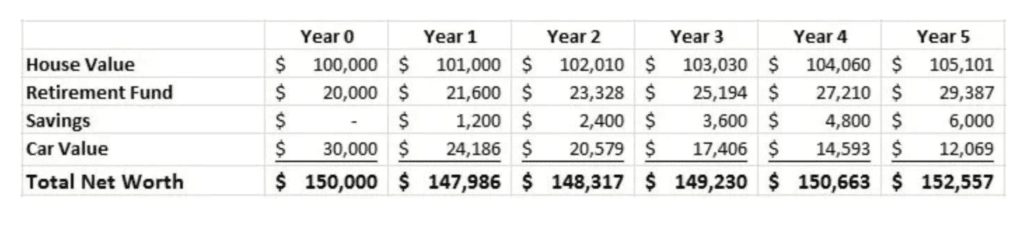

To show you exactly how much your new car is impacting your net worth, let’s set up a scenario. Let’s say you own a home, a new car, a retirement fund, and you put away some cash each month for a rainy day.

With the rising value of your home, retirement fund, and savings account, you would expect your net worth to rise, right? Well, that all depends on your vehicle. If you buy a brand-new car, your net worth won’t be on the rise any time soon.

Let me illustrate this:

- Your $100,000 home increases in value by 1% each year

- There’s an 8% annual increase to your $20,000 401k

- You add $100 a month to your savings account

- The brand new $30,000 car you purchased is depreciating each year

Here’s what happens to your net worth over the course of 5 years:

Your net worth doesn’t decrease, but it only increases by $3,000. That’s absolutely terrible!

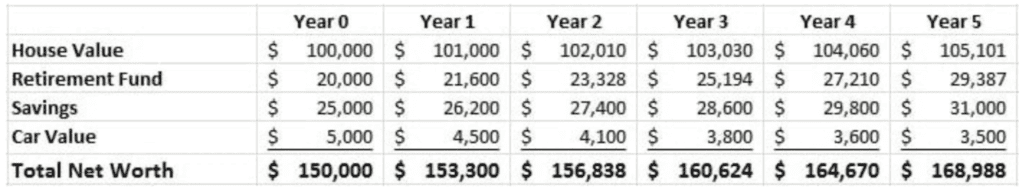

What if you purchased a $5,000 used car instead of a $30,000 new car? Here’s how that would impact your net worth:

By changing the type of car you drive, you could improve your net worth by over $16,000!

Plus, consider how much you would pay for insurance on your brand-new car. It’s certainly a lot more than if you had owned a $5,000 car! No matter how you look at it, a new car kills your net worth.

Purchasing Options When Buying a Car

Now that you know it’s important to avoid buying a new car in order to protect your net worth, you might wonder how to pay for a used vehicle. You can consider a few different financing options when purchasing a car.

Pay in Full

The best way to buy a car is to pay outright in cash. This will be the least expensive option since there is no interest or fees associated with the purchase.

However, unless you have a ton of money sitting around, this may require you to buy a less expensive car. It is up to you whether or not this strategy is worthwhile.

Leasing

Another option is leasing, but I would not recommend leasing a car. I will say that again to make sure you heard it. Do not lease a car!

Leasing is renting, so you have no ownership in the car. At the end of the lease, you have nothing and must return the vehicle.

Take Out a Loan

A third option is to take out a loan. While many people hate debt, this is actually the most common strategy people use when buying a car.

The good news is that installment loans like car loans are the fastest way to improve your credit score. My score went way up when I had a car loan.

Loans require a down payment and a good credit score. Plus, there are interest payments, which means you pay more than the actual retail value of the vehicle over the lifetime of the loan.

Keep this in mind when you consider this option, and make sure your credit score is as high as possible to reduce your loan’s interest rate.

How To Shop for a Car Loan

Taking out a loan to buy a car is the route most people will have to take. If you fall into this category, it’s important to shop wisely and ensure you get the best rates.

Here’s how to shop for a car loan.

Determine How Much You Can Afford

Look at your budget to see how much you can pay for a down payment and how much you can pay for your loan monthly. These are two critical factors that will impact your options in terms of what cars you can buy.

A critical rule to remember is not to buy more car than you can afford. If you don’t follow this rule, you may end up in deep debt.

Find a Car

Once you know how much you can afford to put down and pay monthly for a car, you can shop for vehicles within your budget. Ideally, you’ll want to consider a nice small car with good gas mileage.

Obnoxious SUVs and trucks are bad for the environment and can cost you a lot of money in gas expenses. Consequently, smaller cars can be the way to go when you want to protect and grow your net worth.

See What the Dealership Recommends

After you find a car you’d like to buy, the dealership will likely suggest a bank, credit union, or their finance subsidiary for a loan. Do ask the dealership what their best rate is.

While it’s okay to consider their financing offer, don’t immediately accept it. Keep it in mind as an option, and take the time to compare it to other financing options available.

Do Your Research

The dealership’s financing option likely won’t give you the best rate possible. As a result, you must do your own research.

When you shop around for a car loan, do not give each bank your detailed information. Every time you fill out an application, even if you don’t take the loan, you will get a hard hit on your credit report. One or two is not a big deal, but five or seven can lower your score.

When you fill out the first application, ask for your credit score. The bank cannot give you a copy of the report, but they can let you look at the report and score. This will be helpful when you shop around.

Then, ask other banks what their best rate is and what credit score you need for the rate. Also, find out what fees there are to get the loan. Some are imposed by the local government, while others are banking fees.

Choose a Lender and Make a Down Payment

Once you settle on a loan, your credit union or bank will work out the details with the dealership or broker. You might have to deliver papers between the two.

At this point, you will have to pay your down payment to the dealer. The bank will pay the dealer for the rest of the car and keep the title until your loan is paid off. A larger down payment means lower monthly payments and lower total interest costs over the life of the loan.

How to Pay Off Your Car Loan

Once your car loan is active and you’ve driven off the lot with your car, you must start working to pay off the loan as quickly as possible. This can reduce the amount of money you pay in interest over time, which, in turn, can improve your financial health.

Remember to do the following as you work toward paying off your car loan.

Pay On Time Each Month

It is critical to pay every loan payment on time. If you don’t, you might get hit with late fees, which can eat into your budget. It may also take you longer to pay off your loan, costing you more in interest in the long run.

Beyond that, late payments do not reflect well on your credit report and can hurt your score.

If you are worried about forgetting to make your monthly payments, setting up autopay with your lender or through your bank can be a helpful safety net.

Try to Make Extra Payments

Whenever you can put extra money toward your car loan, do it. For example, if you get a raise at work or take on side gigs, use that money to make an extra payment on your loan.

The faster you can pay off your loan, the less you pay in interest. This means you are saving money and growing your wealth.

Shop for Lower Rates

Just because you have a lender doesn’t mean you are stuck with that provider for the duration of your loan. It’s important to keep an eye on rates and shop around to see if you can get a better rate to save you money.

While this may seem like a hassle, it could save you hundreds of dollars in interest over the course of your loan.

What To Do After You Pay Off Your Car Loan

Once you pay off your car loan, you will have extra money in your budget to use for other expenses or financial goals. But, after you identify exactly how much you were paying toward your loan each month, what are some of the best ways to reallocate that money?

Pay Off Other Debts

Back when I paid off my car loan, I followed my debt snowball to my student loans. Your debt snowball might look different from mine (for example, maybe you have high amounts of credit card debt), but you can use your extra money to pay off your other debts faster.

Believe it or not, paying off your debts is one of the best ways to increase your net worth. So, once your car loan is paid off, start working toward getting rid of your other debts!

Save for a Rainy Day

If you’ve been living paycheck to paycheck, the money used for your car payment could go into an emergency fund. This can help you escape that stressful cycle while ensuring you don’t end up in debt due to having insufficient funds to cover emergency expenses.

Invest

One of the best ways to improve your net worth is to invest. If you’ve paid off your car, you can use your extra funds to invest and grow your wealth!

Fortunately, it doesn’t take thousands of dollars to get started with investing. You can buy fractional shares of stocks with certain apps or find other unique ways to invest your money.

The Bottom Line

If you are in the market for a car, you can get on the road without breaking the bank. The process of purchasing a vehicle might seem overwhelming, but it truly doesn’t have to be.

By understanding the importance of buying used vs. new, being a savvy shopper when it comes to loans, and being diligent about paying off your loan, you can stay in the driver’s seat and steer your net worth in the right direction.