Today I want to compare two top personal finance tracking websites. We are going to look at long-time industry heavyweight Mint.com and a newer entrant: Mint Alternative Empower. I have accounts with both and I have used each site extensively. Here is what you need to know when choosing between Mint and Empower.

Interface and Accounts

One place where Mint has always stood out from Mint alternatives is the interface and design. The site always focused on a clean, intuitive look and feel, though I found the improvements pretty much stopped shortly after Intuit acquired the company in 2009.

I have also found that, over time, Mint has had increased bugs with account synchronizing to my banks, hurting its functionality. For example, the link to my small business checking account causes duplicate transactions regularly, and for some of my older accounts like Chase and Schwab, I have completely duplicated accounts where EVERYTHING shows up twice.

Empower was the first entrant to the space with a design to rival Mint. Past competitors such as Adaptu had great aggregation data, but the designs did not quite compare with Mint, making it harder for them to thrive. Empower has a very clean, professional approach that exudes the same feelings as major Wall Street investment companies.

One place Empower wins is account support. Mint has had problems with hackers and data breaches in the past. And while I’ve had many account connection issues at Mint over the years, many requiring contact with Intuit’s relatively frustrating support department, my account connections with Empower have always just worked. No extra hassle required.

Budgeting and Spending Analysis

The place Mint has always been strongest is in the area of budgeting. Mint’s budget tools for creating a clear financial account are unrivaled by any competitor.

When you sign up with Mint, the site will suggest a budget based on your average spending habits. From there, you can adjust, tweak, and add more budget categories you want to use to guide your spending habits and save money. Mint’s automated transaction categorization is generally pretty good, so you can get a snapshot of your credit card or debit card spending anytime you’d like, either on your desktop or with the mobile app. It’s a helpful resource for people of any income level, whether you’re a self-employed entrepreneur, full-time parent, or just starting a side-hustle hosting a podcast or being a blogger (like me!).

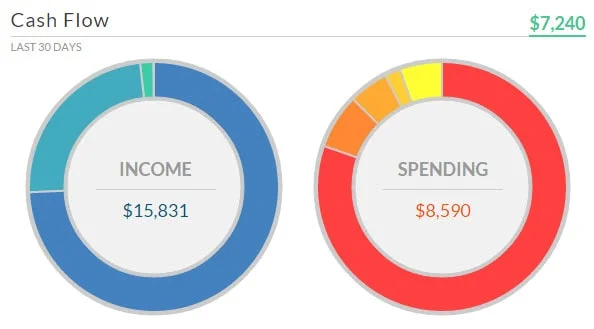

Empower is focused more on individuals with higher-paying day jobs and people with a net worth over $25,000, so budgeting is not quite as big of a focus. Instead, the site’s primary budget tracker focuses on a more business metric for income and expense, cash flow.

The site does not break down every transaction from your bank accounts into budget categories with the same focus as Mint. If you just care about one overall budget target, Empower does just fine. It does track each transaction and categorizes them on your cash flow tracker, but does not benchmark your categories against a budget. It is also great for focusing on growing your net worth through increased income and lower spending, but if you care about specific budget categories, Mint is the winner.

Investment Analysis

Mint first introduced investment analysis tools in October 2008, about a year after I started using the service. While I was excited about the new feature, Mint never really developed its investment tools to their fullest potential.

To this day, I have issues with how Mint tracks common things like stock splits and even the value of each investment in my account. When I logged in today, the site had replaced one of my stocks with the nickname of the account on Schwab, so instead of showing the stock ticker symbol, it says “Joint Investment Account.”

Investments are where Empower really shines. Empower’s investment analysis tools are the best I’ve ever seen in both paid and free tools ranging from online sites to desktop based software like Quicken.

Empower has a few unique investment tracking and check-up tools that I have grown to love.

- The “You Index” – Empower puts together your entire portfolio and tracks it as an “index” against the S&P 500, Dow Jones Industrial Average, a foreign stock index, and US Bond index. This compares your personal investment performance compared to the market.

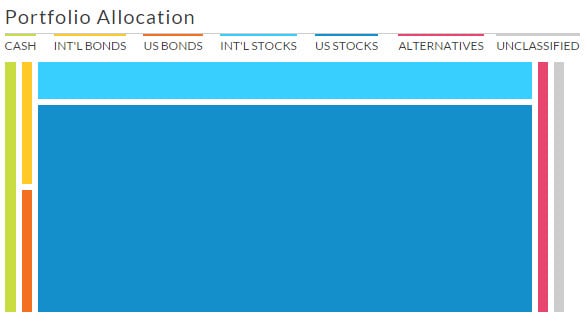

- Portfolio allocation – Empower creates a visual chart showing your investments by asset category and compares it to a suggested allocation based on a survey of your investment goals and risk tolerance.

- 401(k) Check-Up – The 401(k) analyzer looks at your current retirement investments and breaks down projected growth and fees to show you how your investments will fare over the horizon until you need to cash in during retirement. Keep in mind that even if your company doesn’t offer a 401(k), you can receive 401(k) style benefits by opening an IRA on your own.

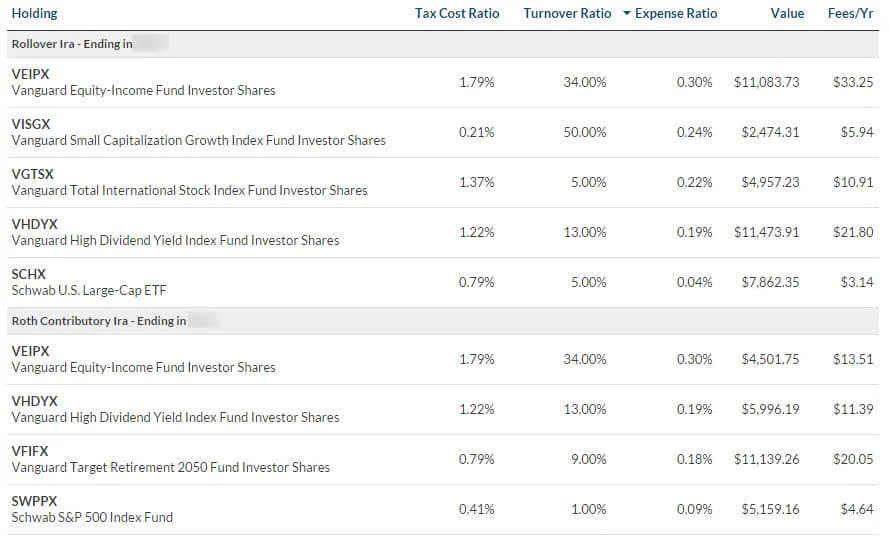

- Investment Checkup – This is the feature that really sold me on Empower. After adding my investment accounts, the site generated a report showing all of my mutual funds and ETFs and their related fees. I did some adjustments based on that report and moved most of my retirement savings into Vanguard funds and Schwab index funds. I saved over $300 per year, worth thousands over the life of my investments, based on that report alone.

Understanding the Big Picture

Both sites take different approaches to show you the big picture. While most of the results are the same, they are laid out differently.

Mint.com offers a net worth calculation on the bottom of your account balances. Overall, I would say that Mint offers a more dashboard style approach and gives you highlights from each part of your personal finances, including credit score, budget, investments (when they are accurate), and upcoming bills to expect all on the homepage.

Empower is more about growing wealth and tracking your portfolio. Your net worth is front and center when you login. Other parts of the dashboard on the homepage are your cash flow tracker, portfolio balances over the last 30 days, and your investment allocation by category.

For the big picture, Mint focuses more on the day-to-day transactions and budgeting while Empower focuses more on growing wealth and investments.

One Last Thing – A Personal Financial Advisor

There is one offering from Empower that really jumps out from any other service I have reviewed here at Narrow Bridge Finance. For all users, Empower is completely free. However, if you have investible assets of $25,000 or more, you qualify for a free consultation with a professional investment advisor.

When I sold some real estate, I had a big cash influx into my accounts that pushed me over the $100,000 mark (since changed to $25,000), and I got a call shortly after from an Empower scheduler. That led to a meeting with an Empower advisor at no cost to me.

Unlike most people, I have an extensive background in investments through my education and professional experience back in Denver. So for me, Eric Rosenberg, the call wasn’t all that revealing about anything I should be doing differently. However, for people with less investing experience, including seasoned investors, a call with an industry professional for free can’t hurt. It can only help give you new ideas on how to manage your money and pursue greater financial freedom.

And The Winner Is…

Calling a winner in this battle is a very hard decision for me. In fact, I have active accounts with both sites and check in on them both regularly. I look at Mint for my budget and spending trends and look at Empower for my investments and long-term financial planning.

If you are going to pick one today, it comes down to your priorities and needs. If you are new to money management, topics like interest rates, and really need help getting a budget together and getting on track to pay down debt and build a savings account, Mint is a great option. If you have more assets and want to focus on your personal cash flow, investments, and growing your net worth, Empower is the clear winner.

So, the right choice is all about your priorities and personal profitability goals. If I were going to start over today and didn’t have an account with either, I would go with Empower as it more closely fits my needs. And if you are a serious money junkie like me, you might even be happiest doing what I do and keep an account at both Mint and Empower.

If you want to give Mint a try, you can sign up at Mint.com. If you want to give Empower a try, I get credit for each new user I send. If you give it a try, here is a link to sign up for free and try it out.