For the first time in years, I totally forgot to update my net worth on the first of the month. I guess all of the changes in my life are a bit distracting. Here is my slightly belated March net worth update.

Banking, Debt, and Investments

My refinance is behind me, and I am now in the two months between my roommate leaving and my girlfriend moving in. That means that all of my condo costs are falling on me. I would not have refinanced my mortgage to a higher monthly payment if I were not able to afford it on my own (and the bank would not have approved it), so everything is fine, but I’m saving a bit less than usual.

I am pushing forward adding $25 automatically each paycheck into my Lending Club account. My net annual returns at Lending Club are 11.01%. I currently have 31 active loans, 1 in funding, and 10 fully paid. I love Lending Club as an alternate investment vehicle.

Liberty Fund Update

I have a $30,000 savings goal for my liberty fund. Saving up $30,000 is not easy, but it is a goal that I know I can attain as long as I keep focused. This month, I was able to keep adding despite living alone.

I started saving in August and I am excited to hit one major milestone. I now have $15,000 in savings accounts. I am planning to put the remainder in higher interest investment accounts.

My current balance is $19,005. The bulk of my liberty fund is in a high interest savings account. I suggest Ally Bank for this type of savings. This is an increase from my $5,000 emergency fund goal.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ad Placements and Freelance Work – $1,058

- AdSense – $26

- Affiliate Payments – $140

Expenses

- Freelance Writers – $60

- Web Expenses and Development – $110

Good month overall. Always like beating the $1,000 revenue mark.

Denver Flash Mob

- Revenue – $150

- Expenses – $0

The completely rebuilt the Denver Flash Mob website is sending me more business leads, but I don’t always have the ability to meet the requests. I have a couple of events in the works for the spring and early summer!

DJ Yofi

- Revenue – $0

I did one show on New Years Eve for Denver Underground Parties (see below).

Denver Underground Parties

I started a new project with two friends called Denver Underground Parties. We had our first successful event on New Year’s Eve, and it was a profitable party. We have not paid ourselves from the earnings yet, so I will hold off on sharing the profits.

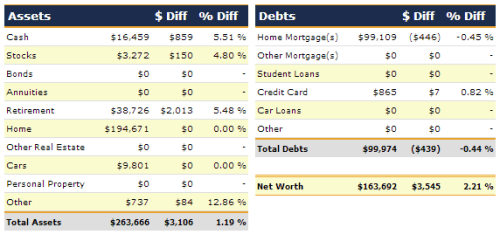

Net Worth

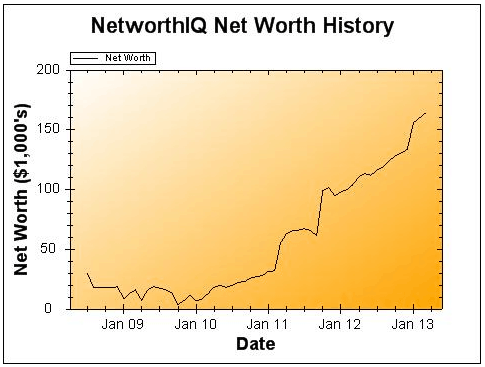

In total, my net worth was up $3,545, or 2.21%. I update my condo value from Zillow and update my car value based on Kelley Blue Book annually in January. I pay off my credit cards in full each payday.

I’m always in awe of your net worth updates. I started doing mine at the start of the year, but forgot to keep it up to date as the months have screamed past.

Ha ha, thanks Glen. I don’t think I do anything too special. I just work hard to earn more and spend less every month. I save and invest everything I can to build for the future.

So what is the benefit of using this networthIQ against Mint.com? I would suspect that mint.com would generate quite similar graphs you have in here.

Mint gives you a net worth, but it cannot track over time with the detail that Net Worth IQ offers. I use both, but only log into NWIQ once a month for the update.

I can’t wait until I can get my blog income over $1k – pretty far from it at this point lol. Nice work on upping your net worth this update. I want to start doing it monthly but am still a little nervous about it haha So for the time being quarterly it will stay 🙂

It took me a long time to get there, but it does feel great.

What is the worry about updating your net worth monthly? It doesn’t take long if you use a good tool and you can find great information about your own financial situation.

This is a great jump in the value, very impressive and inspirational. I am amazed with your freelance revenue. I hope one day I get there too.

It is not all freelance, it is intermingled with other blog revenues. It took about five years to get to this point. Lots of patience and hard work. Nothing was over night.