There’s a lot that goes into managing your finances. From budgeting to saving to paying off debt and more, it can be overwhelming. Fortunately, knowing how to automate your finances can simplify things.

But what does this mean, and how do you do it? Here’s what you should know!

What is Financial Automation?

Automating your finances means using technology to manage your money more efficiently. This can include setting up recurring fund transfers so you don’t have to think about your money. From your paycheck to your mortgage payment, you shouldn’t have to do a thing.

Many people don’t realize you can automate more than your direct deposit. You can set up transfers between your accounts or automatic bill payments to other banks and companies. You can automate everything!

In my financial life, I have automated investments, savings, credit card payments, auto loan payments, student loan payments, and mortgage payments.

Automating means you don’t have to worry about moving your money around or going to the bank. Everything simply happens for you the way you set it up.

How To Create an Automated Plan

In order to automate your finances, you have to create a plan. Luckily, this process doesn’t have to be too complex!

Draw an Automated Money Map

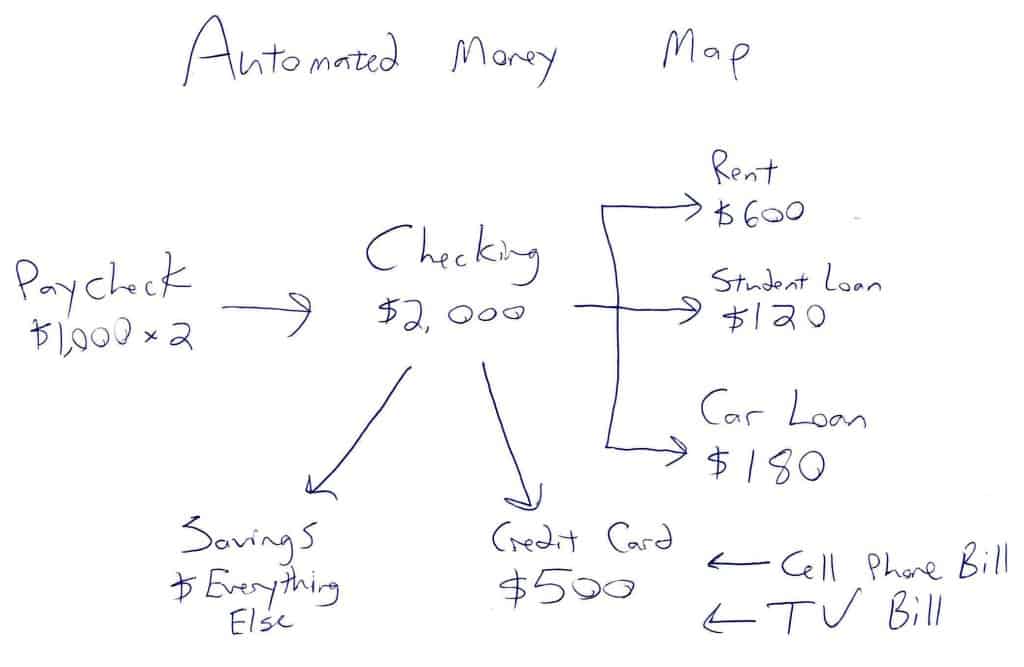

To visually see where your money is flowing, I suggest drawing an automated money map. You can make it fancy and draw it out with a computer or do it by hand to make it quick and easy.

Your map should be a step-by-step diagram tracing how your money comes in and goes out each month. It should start with your direct deposit paycheck and end with bills and savings.

To understand how it should look, look at my example map below. These are all made-up numbers for what a typical automated plan should look like.

Automate Your Account Tracking

Once you have done a full account inventory, it is time to make tracking your accounts and organizing your statements easier. I use a few free tools to keep my accounts and transactions organized, and it only takes a few minutes to set them up.

Empower

Empower is my personal finance hub. It is a free tool that gives you your account balances, recent transactions, spending patterns, and an investment analysis all in one place.

Signing up is an easy, fast process. Once you are signed up, link Empower with your online banking, credit card, and investment accounts. Empower takes care of the rest.

Empower will refresh your data with each account’s newest balances and transactions every time you log in. Rather than logging into each bank website whenever you want to check in on your money, you can log in to one site.

Empower also offers a mobile app for iOS and Android so that you can check your balances on the go.

When I signed up for Empower, I did a deep dive into the fees on my investments and found ways to save over $300 per year on mutual fund fees in my retirement accounts. This free tool is well worth using!

Award Wallet

While you are automating your finances, keep it going with your travel rewards tracking. If you enjoy travel, it is part of your personal financial circumstances. As a result, you should treat your travel rewards like money.

For my miles and points, I use AwardWallet. AwardWallet is a free site that works like Empower for tracking frequent flyer miles and hotel points.

It is easy to set up and helps me track my balances and expiration dates.

TripIt

Since we are already talking about travel, I use one other site all the time that is free and saves me time when tracking my actual travel. TripIt automatically imports my flight and hotel information from my Gmail account and creates an itinerary complete with directions, weather forecasts, and anything else I need to know.

Having everything all in one place makes it much easier to keep track of my travel and anything that will impact it.

Automate Your Paycheck and Savings

If you get paid every week, every other week, or twice a month, you can save yourself a lot of trips to the bank or time depositing checks on your phone by automating your paycheck with direct deposit.

Most employers offer direct deposit and may even allow you to split your check between multiple accounts. If you don’t split your paycheck between multiple accounts, consider setting up automated recurring transfers from your primary checking account to savings accounts to ensure you are working toward financial goals.

If your bank doesn’t offer free online transfers, it is time to look for a new bank. One of the most popular online checking accounts is 360 Checking from Capital One 360.

Set Up Autopay

Chances are, you have a bunch of bills to pay each month. For example, I pay my mortgage, credit card, power, phone/internet, student loan, and utility bills each month. All but one offers autopay (also known as direct debit), which is an automatic direct monthly withdrawal from my bank account.

Direct debits can be used for any monthly payment. People who are short on time and busy with work or their day-to-day lives often find direct debit to be a significant time saver. Instead of spending an hour or more to pay a bill, you can make a phone call or use online banking to authorize the payment.

The most obvious perk to automated payments is the “automated” part. Beyond that, you may have the option to get a discount by using autopay. Both of my student loan providers gave a .25% interest rate deduction for the duration I used autopay.

However, if you do not look at your bank accounts and you are hit with a bill payment you forgot about, you might overdraft. As a result, you’ll want to be careful with autopay and check your account balances each month to ensure you can cover your bills.

To set up direct debits, you can:

- Authorize the collector to get the money from your account by phone or email

- Instruct your bank to allow the debit to happen from the collector

- Enter your payment information into the collector’s payment portal

Here are some bills you can put on autopay.

Credit Card Bills

Auto-pay is the easiest way to ensure your credit card is paid on time. With auto-pay, the credit card company automatically pays the bill with an automated monthly withdrawal from your account.

If you get nervous about that, you can also use your bank’s bill pay. Each payday, I go into my bank’s bill pay and pay my bill in full. However, if I didn’t, I would get an email reminder from my bank to go in and pay my outstanding bills before the due date.

As another line of defense, you can use Empower to get reminders before your bills are due.

Utilities

Most utilities allow you to use autopay or your bank’s bill pay, just like your credit card company. However, I don’t like that route because I don’t get any reward points from paying out of my bank account.

Instead, I registered for auto-pay using my credit card. I get an email reminder each month before the bill hits my account. I have a high credit card limit, so I never worry about missing a payment or exceeding my limit.

Other Bills

Whether you have to pay for a doctor’s visit or a car repair, each biller has different rules about how you have to pay. Some make you pay online, others require a check. To deal with these, I set up a calendar reminder in Google Calendar to email me before it is due.

If I can pay by check, I add it to my bank’s bill pay so that it automatically sends it on the right day. Otherwise, if I have to pay online, I make sure to take care of it with plenty of time before the due date just to be safe.

The Bottom Line

Why is it important to automate as much as you can when it comes to your finances? To save time and effort in the long run! You shouldn’t have to spend much time working on your money. It should be simple and automated. Your money should work for you.