I remember first learning about Bitcoin in its infancy, but despite the excited chatter around this new cryptocurrency, I always hesitated to put my own money into the speculative digital currency. In September 2015, I went for a deal that offered me $37.50 in free Bitcoin if I opened and funded a new account at Coinbase, a major Bitcoin wallet provider. It was an interesting ride.

My First Bitcoin Investment: September 2015

My first attempt at buying Bitcoin was not an easy one. While I could use Bitcoin to make purchases at a few restaurants and stores around town, there was no practical use for Bitcoin in my daily life. In addition, it was not easy to buy or sell. That is why it took something special to get in into my first “investment” in Bitcoin.

Bitcoin is a very risky place to put your money. While it has been on an amazing run lately, the increase in value from Bitcoin is tough to quantify economically. It is a free market with a limited supply of Bitcoin and extensive demand, so the price of a Bitcoin tends to increase. This can lead to an investment return, but I look at Bitcoin more like gambling than investing.

I have been a user of the app Paribus since its launch, and while Paribus has not offered me much recently, I saw a note in the Paribus email newsletter on September 15, 2015, for $35 free.

I followed the link to the Paribus Blog titled: How to earn $35 in 5 minutes (repeatedly). I’m a big fan of easy money, and reading through the article I found that if I signed up for a new Coinbase account and bought over $100 in Bitcoin, I would get $37.50 for free. All that in five minutes, count me in!

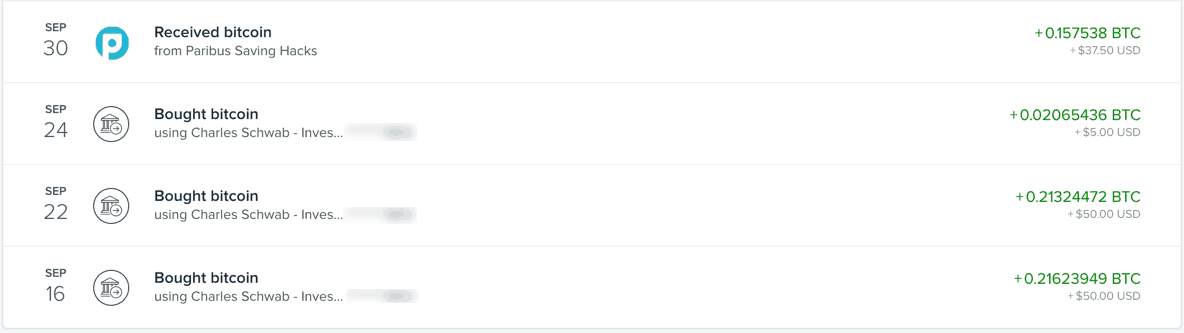

Well, it took longer than five minutes. I had deposit limits to my Coinbase account when I signed up and was only able to transfer $50 at a time and had to wait in between. The minimum transfer was $5, so I ended up funding my account with $105 from my checking account, though it wasn’t easy. I was finally able to buy the Bitcoin, and as promised $37.50 showed up in my account.

I made a purchase, and just like that was a Bitcoin investor. I was okay putting in $105 as a speculative investment that I was 100% willing to lose. If that $105 in Bitcoin fell to $5 in value, it wouldn’t have impacted my life. That is the right way to look at the risk of Bitcoin. Only put in what you are willing to lose.

I Forgot About it For Almost Two Years

After I bought Bitcoin and got my $37.50, I had about .60 Bitcoin. I wasn’t impressed all that much with my fraction of a Bitcoin, so I forgot about it. I left my Bitcoin in my Coinbase account and it just did its thing for a while.

I went on a family vacation in Victoria, BC with my wife’s family, and my brother-in-law asked me about Bitcoin. I said, oh yeah, I have some Bitcoin I bought a while back. I wonder what that’s worth these days.

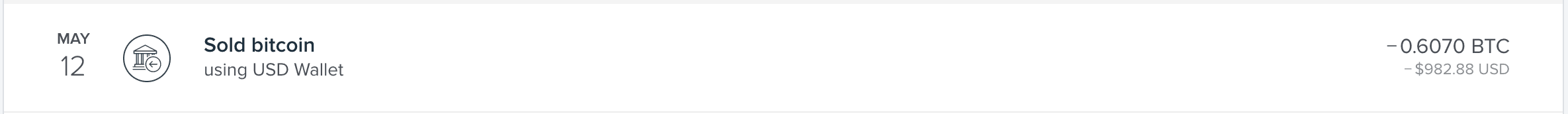

It took me a few minutes to download the Coinbase app, log in, and view my balance. When I did, my jaw almost hit the floor. I had about $1,000 in my account. Holy cow! My $105 was now worth just shy of ten times that much!

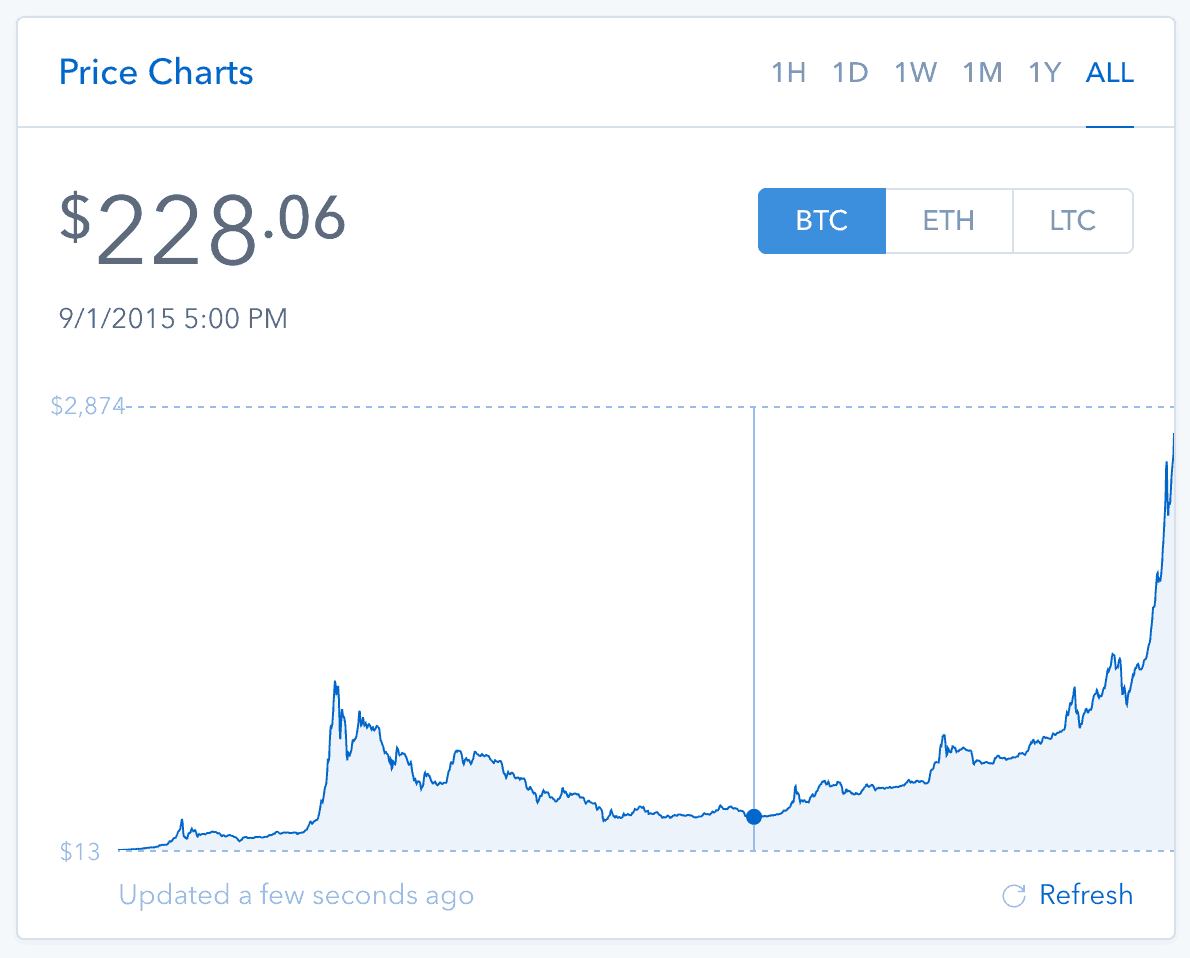

When I picked up my 60 Bitcoin in September 2015, the price per coin was a little over $200. Bitcoin has gone off on a meteoric rise lately. While I may be shortsighted, I’m a pretty conservative investor. I would rather put my money into investments that are long-term oriented. I have no idea what Bitcoin will do next. Maybe it’s in the middle of a bubble. Whatever it is, I decided that at a 10x return, I’m happy to take my money and run for the hills.

In the time since my Bitcoin “investment” would have gone up in value even more. As of July 2017, the price per coin was $2,876.01. I sold .6070 Bitcoin for $982.88, or $1,619 per Bitcoin. If I had held on until today, I would have had $1,745 in Bitcoin. Maybe I made the wrong decision to sell, but I stick with the logic I used to sell at the time.

How to Invest in Bitcoin

If you want to invest in Bitcoin, I can’t emphasize enough that this is a high risk. While Bitcoin could fly to $5,000 tomorrow, it could just as easily plummet back to $200 or less. Invest only what you can afford to lose.

Now that I am up and running with Coinbase, I happily suggest it to others. There are some significant fees for buying and selling, but with your Coinbase account, you can store and transact in United States Dollars, Bitcoin, Litecoin, and Etherum. Litecoin and Etherum are other cryptocurrencies that work like Bitcoin.

Just head to Coinbase or download the Coinbase app to get started. From your Coinbase account, you can easily buy and sell any of the three supported currencies. Beware there are some delays in processing, so don’t expect to day trade.

Is Bitcoin Investing Right for You?

Bitcoin has seen a crazy value increase over the last few months. I think there may be a Bitcoin bubble underway. Similar to the stock market during the tech boom of the 1990s and real estate just before the Great Recession, Bitcoin may come tumbling down soon. No one knows for sure, and I certainly don’t have a crystal ball, but my advice is to avoid Bitcoin and put your money into something more predictable and stable.

But for now, it’s anyone’s guess as to what will happen next. Are you a Bitcoin investor? Share your story and thoughts in the comments. A skeptic? I want to hear from you too! What do you think is happening next in Bitcoin? Share below.

Originally posted on July 6, 2017, updated September 29, 2021.

Good post Eric. I bought 10 BTC in early 2015 for about $198 each. I have sold 2 this year for an average of $1,700 each. So, I am now playing with house money. But I completely agree it is a speculative investment. Like you, I was prepared to lose my $2,000 investment in its entirety. I have decided to ride it out with no plans to sell any more any time soon. It will be fascinating to see what happens.

Thanks Peter! I find the whole world of digital currencies interesting. Because there is no one standing behind it and no asset behind it, it is interesting to watch how investors and speculators trade and use them. Too bad I only got that $100 and didn’t go in like you at $2,000!

I just read your email about bitcoin (and the subsequent blog posts) and I thought it was excellent content. 99% of the time, when anyone writes about bitcoin or blockchain technology, I find it politically repulsive, technologically illiterate, or financially absurd (or all of the above). I liked what you said and how you said it, though.

I don’t really have much to say about the posts other than to send you a big thumbs up and I wanted to throw an anecdote/question at you while I was at it.

Well, two anecdotes, I guess. The first is just the observation that I bought what amounts to a 1.5 million dollar laptop screen with bitcoin back when it was a newfangled science project, much like the million dollar pizzas one reads about on the web.

After I realized my mistake and the price of Bitcoin crashed after the MtGox/Willy debacle, I’ve been doing two things with bitcoin as a currency. The first is I’ve been getting paid for some short-lived side-hustles that I’ve had a hard time making permanent, and that has largely been my bitcoin spending money… I’ve used it for things like video games, web hosting payments, buying gold and silver, etc.

The Second is I’ve been essentially doing dollar-price-averaging. I’ve been buying the same dollar amount, month over month, regardless of market fluctuations, and I’ve been coming out on top using that method of “investment” so far. It’s certainly gotten better ROI than peer-to-peer lending has.

I guess I have two questions: the first is just “what do you think about that?”

the second is “what do you think (if anything) about diversifying BTC into other cryptocurrencies that are on the rise?

Thanks for the kind words and great questions!

For the dollar cost averaging approach, I like that typically when it comes to traditional assets in retirement accounts, but doing that in Bitcoin would make me nervous. While buying consistently is a great method to build up a large investment portfolio, with Bitcoin it is all in one asset. For example, doing this with an S&P 500 index fund, you are essentially buying into 500 stocks at once. With Bitcoin, it is a combination of the dangers of foreign exchange, the uncertainty of cryptocurrencies, and the risk of putting your eggs in one basket. If this is just one investment you are regularly buying in addition to many others, that could be a great approach. But I would make sure Bitcoin is a smaller percentage of your overall assets in terms of what you invest (if it goes up and becomes a larger portion, that’s all good!) rather than put too much of your family’s future on the line.

I have seen some interesting articles on other digital currencies. The one that I find most interesting is Ethereum because it has been catching on more and has a more active market. Beyond Bitcoin, every other digital currency is more risky and speculative. That doesn’t mean there is no value, but I would put even less in those because they have a higher risk of going to zero.

Etherium as a technology and as a political entity doesn’t seem sound to me, but time will tell.

I’m a little paranoid, so I treat all my investments the same way i treat cash I bring to the casino: don’t invest that which you can’t afford to lose. So far, bitcoin has just kept growing and the technology is sound. Eventually, a better competitor will emerge, but for now it’s king of it’s class.

I definitely wouldn’t put all my eggs in one basket, especially something as novel as cryptocurrency.

Thanks for the answer!

Oh, and P.S. your “website” field in the comments section doesn’t accept some of the newer doman suffixes. I know I should have a real URL, but the .xyz domain was much more affordable. Just thought I’d let you know.