Hope everyone is having a great April so far. You are catching me right in the middle of one of the busiest travel times in my entire life. Never fear, I never forget about my favorite people, the readers of Narrow Bridge Finance. I have lots of goodies for you below.

What’s Eric Up To

I just returned from Las Vegas for my bachelor party (fun fun fun!) and was in Denver the weekend before. In less than two weeks I’m off to San Diego for my friend’s bachelor party, then the big trip starts.

In six weeks, I’m getting married! Crazy, right?

We start our adventure in Santa Barbara for the wedding, then go to Vancouver, BC for a fun honeymoon north of the border, then we are off to Denver the next weekend for a friend’s wedding. Then back to Portland and reality.

Selling My Condo

When we moved to Portland, our plan was to rent out our condo in Denver to make a little extra cash in real estate. After trying with two property managers and getting no response, we listed the place for sale.

In only two days, we had an offer. Two days later, we were under contract. That deal fell through and the place is back on the market. When it sells, I will be 100% debt free for the first time since I got my car loan in 2007.

New Project: Finance Lifestyle

I am excited by the progress at Finance Lifestyle. I am adding posts a little more slowly, but they focus on the personal side of personal finance and have been getting great feedback. I have posts on beating debt, building wealth, saving for retirement, and how I am able to fly for free.

The best place to start is with the Finance Lifestyle Manifesto discussing the main ideas of the new site: conquering debt, building wealth, lifehacking, traveling the world, and entrepreneurship. The manifesto is free when you join the community.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Over the last month I worked through an in depth, online course on HTML and CSS. I am working hard to advance my skills for web design and increase my freelance work outside of my main job. I re-branded my web design site, and you can view it at Narrow Bridge Media.

Revenue

- Freelance Earnings – $757

- Affiliate Payments – $463

- AdSense – $

- Advertising & Partnerships – $641

- Premium Plugin Sales – $0 (Thesis Post Image Converter available at CodeCanyon)

- Book Sales – $1 – Buy here or Amazon

Expenses

- Freelance Writers – $140

- Email List – $19 (Provided by Aweber)

- Web Hosting – $21 (Money making sites hosted with LiquidWeb, others with Hostgator – both paid annually)

- Domain Fees – $9

- Conferences & Events – $183

Total Revenue: $1,863, Total Expenses: $565, Total Profit: $1,298

Denver Flash Mob – Flash Mob Consulting and Planning

Denver Flash Mob is officially back online and things are going great. Lots of fun happening in Denver!

Revenue

- Flash Mob Down Payments – $100

- Flash Mob Final Payments – $350

Expenses

- Flash Mob Manager – $100

- Choreographer – $0

Investments

Retirement

I just hit 90 days at my new employer in Portland, and I was able to register for my new 401(k) account with Fidelity. I will be investing 4% of my pre-tax income with a 100% match of that 4% by my employer. I am also investing $211 per paycheck automatically to max out my Roth IRA. Read more about my automatic investing in my retirement accounts to see how it all works.

Once my condo in Denver sells, I plan to increase my savings. I am paying rent in Portland and mortgage and HOA in Denver, so cutting my costs will let me invest a lot more.

Investment Analysis

The best tool I have found to help me keep my portfolio balanced is Empower. The site helps me track and manage my bank accounts and credit cards too, but the site has helped me save hundreds of dollars per year by showing which investments are charging the biggest fees and how to balance my portfolio for my goals and risk tolerance. The site is completely free.

I have been very happy with my most recent stock purchases. My most recent three buys are Starbucks, Amazon.com, and Wynn Resorts. I have no plans to sell at any point in foreseeable future, and I plan to keep riding these up and up. Remember that most people should not start investing by buying individual stocks. Broad index funds like an S&P 500 fund are best for getting started.

Outside of the stock market, my net annual returns at Lending Club are 11.6%. I currently have 49 active loans, 1 past due, 0 in funding, and 23 fully paid. I recently had one loan past due which I sold on the secondary market for a discount. I have earned $202 in interest, so even if one loan goes bad I’m still doing great.

If you want to know exactly how I make 12% with Lending Club, check out my in depth guide to making money with Lending Club.

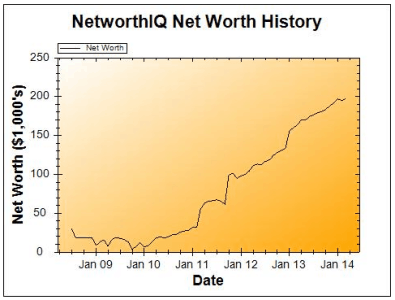

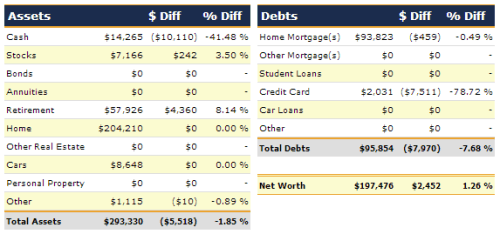

Net Worth

My cash flow has been tighter than normal since I moved to Portland. I am still paying for two homes even though I only live in one, so I am not saving like usual. I have paid all of the moving expenses and now I’m just waiting for the condo to sell in Denver to re-balance my automatic cash flow process.

I update all values monthly with the exception of my car value and my condo value, which is updated annually with the value from Zillow.