I love bonus month! It feels nice to get an extra boost in my net worth and income each year, and March happens to be that month for me.

Banking, Debt, and Investments

March was the only full month I had between my roommate and my girlfriend moving in, so I had to foot 100% of the cost of my mortgage, at the new, higher, refinanced rate (I went from a 30 year fixed at 4.25% to a 15 year fixed at 2.875%), HOA fees, utilities, and bills all by myself.

No worries, though, as I received my bonus at work. The bonus was paid 40% cash and 60% stock. I sold the stock right away as I have big plans for the cash and my overall savings goals. My personal performance percent increased year over year, which is awesome.

I am also continuing to add $25 automatically each paycheck into my Lending Club account. My net annual returns at Lending Club are 11.09% and steadily growing as I diversify into more risky loans. I currently have 32 active loans, 1 in funding, and 10 fully paid. I love Lending Club as an alternate investment vehicle.

Liberty Fund Update

I have a $30,000 savings goal for my liberty fund. Thanks to my bonus, I was able to make my biggest contribution to date. I started saving in August and the fund balance is now at $25,079. The end is in sight! However, I do plan to use $2,500-$5,000 on some home remodeling projects.

The bulk of my liberty fund is in a combination of high interest savings accounts and a stock investment account. I suggest Ally Bank for this type of savings. I began this fund with a $5,000 emergency fund goal.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ad Placements and Freelance Work – $435

- AdSense – $18 (AdSense lower due to some development work on the sites)

- Affiliate Payments – $75

Expenses

- Freelance Writers – $60

- Web Expenses and Development – $0

This was a decent month, but only about half of my $1,000 per month goal.

Denver Flash Mob – Flash Mob Consulting and Planning

- Revenue – $300

- Expenses – $0

The completely rebuilt the Denver Flash Mob website is sending me more business leads, but I don’t always have the ability to meet the requests. I currently have 4 events in the works. My March revenue was all down payments for future events.

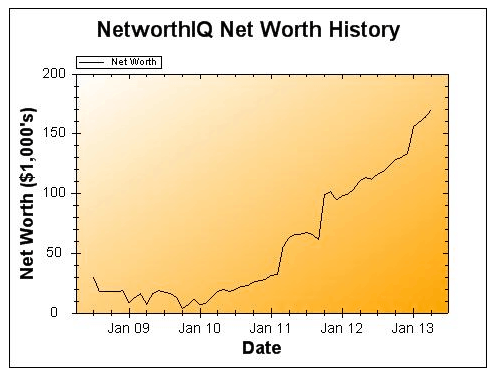

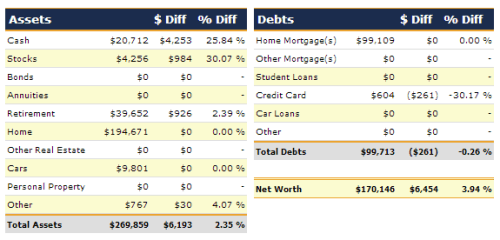

Net Worth

In total, my net worth was up $6,454, or 3.94%. I update my condo value from Zillow and update my car value based on Kelley Blue Book annually in January. I pay off my credit cards in full each payday.

Great refinance rate! Congrats on the hefty bonus.

I worked hard to get that rate, but I am glad I did. I’m also glad that the place will be paid off so much faster with such a lower interest cost.

Looks like you’re doing awesome! 🙂

I do what I can! It takes a lot of hard work and focus, but anyone can do it. Just use common sense to manage your money.

Great job! It looks like you’re growing your net worth nicely.

It seems like just a year ago I became a $100,000aire for the first time…