I first wrote about FutureAdvisor Beta in October, 2010. At that time, the site offered tools to project your retirement performance over time. In the eleven years since, the site has grown to be a full featured investment planning and management platform. Here’s what you need to know about Future Advisor.

How FutureAdvisor Works

FutureAdvisor is an investment advising and management service. The idea of how it works is very simple, which makes it stand out above other, more complex investment advising tools. While Empower offers an in-person consultation and someone to manually keep your accounts up to date. With FutureAdvisor you are with a 100% robo-advisor platform.

When you sign up for a new account, your first steps are to link all of your investment accounts with to the platform. When you are done, FutureAdvisor presents a summary of your accounts, a basic account analysis, and grades your account based on projected performance, diversification, fee efficiency, and tax efficiency.

Next you’re taken to suggested investments for your account. You can view your suggestions for free, and there is no obligation to pay for anything or act on the suggestions. If you think the site is full of crap and you know best, you can stop right there. However, if you really like the advice, or even a portion of it, you can make your own account adjustments through your brokerage on your own or pay FutureAdvisor to do it for you.

What I Like

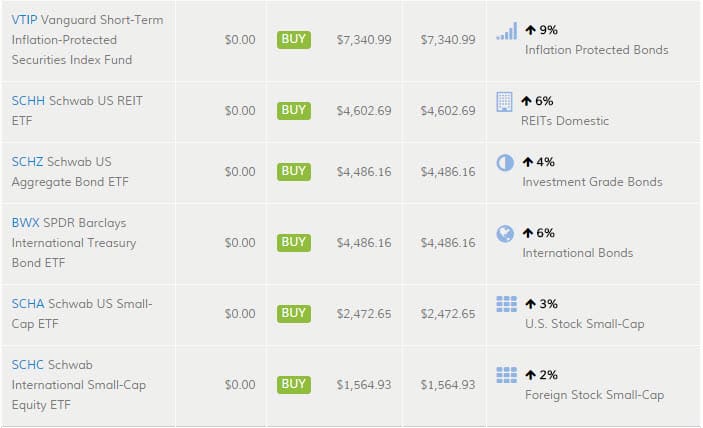

I like that FutureAdvisor looks at your portfolio and gives you specific advice you can use today. The site suggested specific REIT and international investment ETFs based on my brokerage account. I can invest in Schwab and Vanguard funds with no trade fees. Almost everything I was suggested fit into those two fund families.

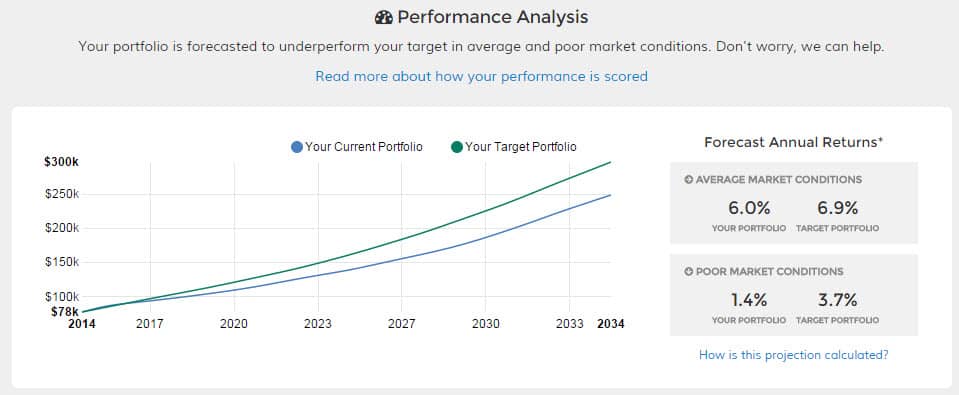

In addition, I also like that I can see a projection of my current allocation performance and projected future performance with both my current and suggested portfolio allocation. There is a great feature where you can look backwards at your performance compared to your target portfolio. You can see how you did and how you would have done with the suggested portfolio.

The site also gives you a pat on the back when you make investment choices in-line with their advice. In my IRA, it told me I did a good job picking SCHX, VGTSX, and VISGX. I like the acknowledgement and that the other suggestions take those holdings into account.

What I Don’t Like

There are a couple of downsides to the advice I received. I have three main investment accounts, an IRA, a Roth IRA, and a taxable investment account. The portfolio suggestions I was given were for each account, but clearly were a portfolio wide allocation, not account specific. This was glaringly obvious when I looked at the suggestion that I put 25% of my IRA in an emerging market ETF.

If you want to have one account as a “play money” stock investment account, FutureAdvisor tells you that you should sell all of your stocks and re-invest that cash in low fee funds. That is a great long-run strategy for most people. However, I didn’t appreciate that advice when it is clear that I have retirement accounts with very long-term goals and a taxable account with individual stock investments. You can click on a little lock icon to tell FutureAdvisor that you don’t want to change the investment. Keep in mind you have to do that for each stock individually. There is another workaround to not include an entire account in your investment advice profile, but may not be ideal either.

One last little thing. If you have a trade pending, your entire portfolio advice freezes and says it will re-calculate once everything has settled. For me, one stock purchase froze my suggestions for all of my accounts. I can come back later for the advice, but you may have to wait if you’ve been active in your accounts recently.

What It Costs

Everything I have written about so far is completely free. If you want to take it to the next level, you can join FutureAdvisor premium. The fee is 0.5%, which is very, very low for an investment advisor. For a $100,000 portfolio, that cost would be around $1.40 per day.

For that fee, you get two major benefits over the free account. First, FutureAdvisor will make trades and manage your account for you, including automatic rebalancing. With the click of a button, your investments are on auto-pilot and you hardly have to think about them at all. Second, you get to take advantage of tax loss harvesting. The robo trader will sell and buy to lower your tax bill and offset investment gains with investment losses.

Is FutureAdvisor Right For You?

If you have absolutely no idea what you are doing with your investments, FutureAdvisor is a great option. It is reasonably priced and can really take care of everything for you. And, based on what I’ve seen, the advice is pretty good.

If you want a more hands-on approach and want to track all of your finances through one tool, Empower is the way to go. However you pay a little more to work with a person instead of a computer. If that benefit is worth the cost is up to you.

For me, I am glad I joined the free version but do not plan to sign up for the paid version. I am perfectly happy managing everything myself. But I did like a couple of the platform’s suggestions, so my portfolio will be getting a bit of an upgrade over the next few weeks.

Posted October 11, 2010. Updated May 8, 2021

.