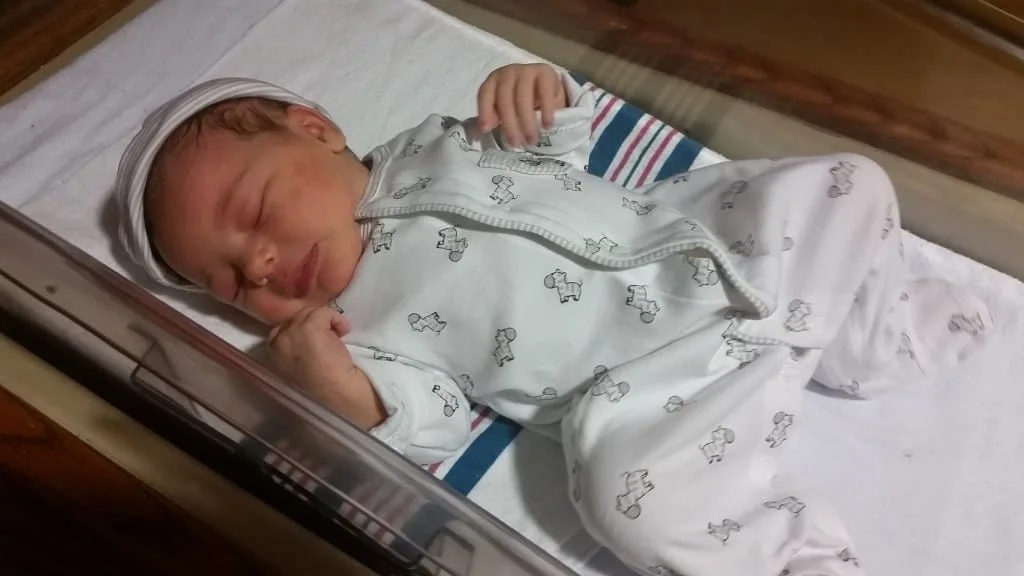

I have big news. I’m a dad!

What I’m Up To

I am sitting next to my wife and three-day-old daughter. Mom and baby are healthy and happy. Keeping this month’s update short so I can spend more time with my growing family.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

We are down to the last quarter of income for the year, and I’m running out of time to make any major changes. With a new daughter, my side income may go down a bit over the next few months as I focus on her more than finding new clients.

My online income tracker shows how volatile freelance work can be, particularly when doing it part-time. I updated with every prior earnings report I have ever posted, and it worth a look if you’re into online income.

Revenue – Goal: $40,000 in 2015 ($3,333 monthly average).

- Freelance Writing – $3,203

- Web Design & Support Earnings – $702

- Affiliate Payments – $100

- Advertising & Partnerships – $50

- Product Sales – $1 (Thesis Post Image Converter available at CodeCanyon, eBook here or Amazon)

Expenses

- Email List – $19 (Provided by Aweber)

- Web Hosting – $13 ($8.33 per month for MediaTemple and $5 per month for Hostgator – both paid annually)

- Podcast Hosting – $12 ($12 per month for Blubrry Podcast Hosting)

- Outsourced Workers – $57

- Domain Fees – $37

- Conferences & Events – $0

- Computers & Software – ($17)

- Misc – $229

Total Revenue: $4,055, Total Expenses: $350, Total Profit Before Tax: $3,705

If you are new here and want to see more history, check out my earnings by month since 2012 at my online income tracker.

Denver Flash Mob – Flash Mob Consulting and Planning

My wife has officially taken over duties running Denver Flash Mob, which is giving me more time to work on freelance projects and this website. She’s doing an excellent job so far as the Chief Operating Officer / Chief Mob Officer. We have two events in the works right now, more than we’ve had at once in a long while.

Revenue

- Custom Flash Mob Payments – $0 (includes pre-payments)

- 7 Step Flash Mob Planning Workbook Sales – $0

Expenses

- Outsourced Workers – $250 (for pre-paid events)

- PayPal Fees – $0

- Website Expenses – $0

- Business Registration – $0

Total Revenue: $0, Total Expenses: $250, Total Profit Before Tax: ($250)

Automatic Savings

A few months back I signed up for Digit, and automated savings account that you manage via text message. Here is how my savings have added up with zero work on my part. The more I use it, the more I love it for how easy it is to use. Each time I hit enough for a new stock purchase, I move the funds right to my investment account.

- Total Savings Since Joining: $2,306

- Number of Transfers: 101

- Average Transfer Size: $23

If you’re interested, sign up for Digit here.

Investments

Retirement

My automatic investing in my retirement accounts has been going along as planned. It is nice to see so much cash going into our savings for the future. I have been debating funneling some money into a regular taxable account that could support early retirement, but for now this is the setup I’m sticking with:

- 401(k) Contribution – 6% automatic from paycheck

- 401(k) Match – 3% automatic by employer

- Roth IRA – $5,500 of $5,500 max for 2015 – Made maximum contribution on February 13 from savings

- Roth IRA (Spouse) – $0 of $5,500 max for 2015

- Employer Stock Purchase Plan – 3% with 15% discount on market stock price

If you have an opportunity to get any employer match, make sure you are taking 100% of that, or you are leaving free money on the table. If you have any old 401(k) plans from former employers, make sure to roll them over into an IRA where you can save on fees.

If you are not sure where to start with retirement investing, be sure to check out Betterment as an option. I have been a customer myself and recently joined their writing team.

Individual Stock Portfolio

Schwab Portfolio:

- AMZN – Amazon.com

- BLK – Blackrock

- BA – Boeing

- CSCO – Cisco Systems Inc

- GE – General Electric

- GOOGL – Alphabet Inc / Google

- JPM – JP Morgan Chase

- KR – Kroger

- PM – Phillip Morris International

- SBUX – Starbucks

- TEVA – Teva Pharmaceutical Industries ADR

- WMT – Walmart

- WYNN – Wynn Resorts

Fidelity Portfolio

- Company stock from ESPP

In addition to Charles Schwab, I have an account at Loyal3. Loyal3 offers 100% fee free trades and the ability to participate in IPOs, also with no trade fees. Here is a post all about how Loyal3 works.

If I did not have such great benefits from Schwab, I would seriously consider moving my primary investment account to TradeKing. I met their team at FinCon, and their product has grown to be a top notch investment account offering. And trades are less than $5!

My Favorite Investment Analysis Tool

The best tool I have found to help me keep my portfolio balanced is Empower. The site helps me track and manage my bank accounts and credit cards too, but the site has helped me save hundreds of dollars per year by showing which investments are charging the biggest fees and how to balance my portfolio for my goals and risk tolerance. The site is completely free.

The stock market continues to reach new highs, and there seems to be little getting in the way of more growth ahead. There are always bad days, but over the long run the stock market has always gone up. If you are new to investing be sure to check out my in-depth guide to the stock market to get started with investing.

After my first defaults, my Lending Club account is still chugging along making over 9% interest on my investment. My current adjusted annual return is 9.59%, a much better performance than any bank account and most investments. I have earned $434 in interest, so even with my losses and the potentials on the horizon, I am still way up overall. Including cash, my adjusted account value is $1,111.

My Notes at a Glance:

- Not Yet Issued – 0

- Issued & Current – 56

- In Grace Period – 0

- Fully Paid – 42

- Late 16-30 Days – 0

- Late 31-120 Days – 2

- Default – 0

- Charged Off – 6

If you want to know exactly how I make consistent returns with Lending Club, check out my in-depth guide to making money with Lending Club.

Wow, congrats!!! Your daughter is beautiful. You must be so proud and over joyed. I hope you guys hang in there with the lack of sleep. So happy for you!!

I am a very proud and happy Dad! We love our little girl so much. She’s doing great!