The battle of the financial aggregators continues here at Narrow Bridge. In the past, we did an in depth comparison of Mint.com and Thrive. Today, we look at another alternative to these services, PageOnce, and compare it with current leader Mint.com.

What They Have In Common

Both sites are designed to bring your information to one place with a single log in. After an initial setup process, both sites pull in balance and transaction data from your various bank, credit card, and investment accounts. Any financial account is fair game.

That is about as far as I would compare them.

What Sets PageOnce Apart

What Sets PageOnce Apart

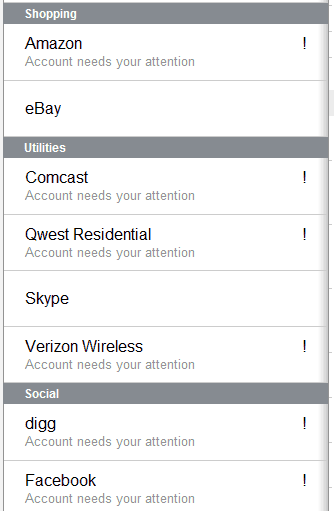

PageOnce is focused on bringing a wide variety of accounts into one place. This goes far beyond financial accounts. For the life hacker in you, PageOnce can be a great tool.

In addition to my financial accounts (I only loaded a limited number as a test), I have added shopping accounts such as eBay and Amazon, services like Netflix (limited queue management), utilities such as my home internet, cable (canceled), and wireless phone provider, various social accounts like Facebook, Twitter, Digg, StumbleUpon, and LinkedIn, and my Gmail.

While it is fun to have my social media accounts accessible with one login, I can’t do anything with them through the PageOnce interface, it juts provides me links to visit and edit those sites.

What really sets PageOnce apart is the ability to pull in utility bills, insurance accounts, and travel rewards accounts.

With one log in, I can see updated data on my airline and hotel points and miles along with expiration dates. Managing travel rewards is a huge pain in the ass if you use multiple hotel and airline reward programs. PageOnce makes it simple and easy.

The “alerts” feature is also a benefit, but it has also proved to be an annoyance. On one page, I can see new e-mails, bills coming due, and other important information. However, the default settings and updating system have proved to be a bit buggy. I got the same e-mail that I had paid my Qwest bill every day for a week.

What Sets Mint.com Apart

What Sets Mint.com Apart

I have written about Mint.com many, many times on this site. I have been using it for well over three years and have seen features come and go.

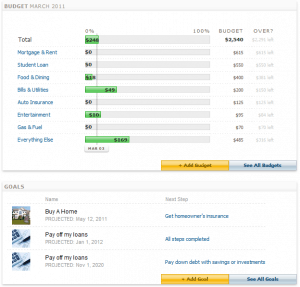

Mint’s financial analysis features blow PageOnce out of the water. Mint.com offers tools for budgeting, investment tracking, long term spending tracking by category, goal tracking, a transaction history search function, and net worth tracking.

Mint is a full service financial tracking system and has been improved over time to include more features and better account and transaction tracking systems.

To highlight a few prominent features:

- Mint.com imports your transactions and automatically categorizes them. You can view historical charts of your spending by category over a specified time period.

- Mint fills in a budget throughout the month comparing your spending to your pre-set budget limits.

- You can set a goal, such as paying off a credit card or saving for a vacation, and designate accounts tied to the goal. Mint does the math and coaches you through the steps to reach your goals.

- Mint tracks your investments and their performance over time. (I have found many bugs in this feature)

The biggest problems I have with Mint are around bugs and customer service. While I did not need to report anything to PageOnce, as it all just worked, over the years I have had many account connection and update issues with Mint. Over time, their customer service has severely degraded. While I get an auto-response that I will hear back from Mint staff in 24-48 hours if I file a bug report, I rarely hear back at all. Some accounts go for months without updating correctly. Luckily these have been less important accounts, but if my primary checking or credit card stopped updating I would be up a creek without a paddle. A company owned by such a reputable company (Intuit) should have its act together better than Mint does today.

The Verdict

The sites have different focuses. Mint is primarily focused on personal financial tracking. PageOnce is a general aggregation service. However, this is a personal finance site. Mint.com is a clear winner due to its extensive budgeting and financial modeling tools.

To compete, PageOnce can increase its budget and transaction offerings on its site. Mint can learn a few things from PageOnce, however. First, have your product actually work 100% of the time. The constant bugs are unprofessional and the customer service is terrible. Also, Mint could add a new feature to track travel points accounts and some major billing providers. However, they should focus on doing what they already do better before they add new features.

Another alternative that I have begun to love is Empower. If you are focused on tracking investment accounts and your retirement, be sure to check it out!

How do you guys feel about Thrive vs. Mint now that Mint was bought by Intuit and the bugs and customer service issues have escalated?

I still feel that Mint is a better designed product on the top level, but there are frustrating days when I am tempted by Thrive. I keep an account at both for nerdy finance blogger reasons, so I can always jump back and forth.

My recent post Yakezie March Madness – Blogger of the Year!

I just don't see how you can promote Mint at all, much less as a "better designed product"!!! Read the user comments and count the number of unanswered bug reports & problems – the 🙁 unhappy faces clearly outnumber the 🙂 happy ones.

I've used the site for about a year, and it has started making mistakes that render it unusable; debit transactions are entered as credit transactions, for one thing, and I recently noticed a raft of duplicate entries. I won't even mention its currency conversion problem that results in entries for 8 million dollars for that pair of Italian shoes I ordered – oops, guess I just did!

Mint was a great idea, but appears to suffer from poor management, lack of planning & transparency, and almost no communication or visible strategy (unless it's to sink Intuit). I pity the poor employees trying to keep that boat afloat! Hint: the rats have jumped ship, I suggest you do the same.

Go fish.

It still works very well for me. Other than customer service issues, everything is always fixed and comes back around. I am still always trying new products (keep your eyes open for more reviews). Until I find something that works better for my very complex needs, I have to call it how I see it.

Seems like the moment Intuit took over, Mint started going down. Some of Mint users suggest that Intuit is destroying Mint on purpose, to promote their other products.

How long before we find out hackers have cracked Pageonce and now have every bit of information about you? Not a far cry away from reality.

Sites like Pageonce and Mint have incredibly strong security practices. They use the same levels of encryption that banks do, so I am not too worried.

thanks man, most useful article I found on this (read 3), good for you

you didnt mention how mint basically is US only. So like um…yeah that’s a big minus for me.

I have used Mint for years. It went down from a very reliable system to just a pretty system. I wish I had time to tell you how many issues I have. The bottom line is, if you want accuracy, Mint is NOT the way to go.

I love mint and have been using it from the beginning and as much as I like the new features the bugs have been getting worse. My main accounts have trouble updating every day plus I have found random transactions disappearing and can only guess how many have disappeared without me noticing.

You should mention in your review the accesability over mobile devices. While i’m still investigating process, I have seen criticts on Mint on how they are not hearing the Blackberry comunity on their request that Mint.com creates an App that runs on the Blackberry. It is sad that Mint.com is focusing application development on Iphone and Andriod and just ignore development on other mobile devices.

I will definitely take a look. I am an Android user and everything works great for me. As of the most recent numbers reported today, Blackberry is only 11% of the smart phone market compared to iOS (29%) and Android (52%). I think most developers, Mint included, will focus on that 80% of the market in the future.

I’m a 17 year Quicken user and ready to dump it because of the continues bugs and lack of support. If Intuit runs Mint anything like Quicken, I would stay away from it. When you are trying to pay bills and the system is messed up and you can’t get support… it doesn’t get more frustrating that that. GREAT ARTICLE!!

Glad you enjoyed it. What are you looking at as an alternative?

My Review of Mint.com

PROS1. FREE automatic downloads & sync from banks, credit unions and brokerage firms. (with Quicken you have to pay $10/mo. average per bank)2. Categorizes downloaded items automatically for you3. Let you export downloaded items in CSV format4. Let you add transactions by hand5. One button to filter and display all bank feesCONS1. No balance column2. No reference code column that helps you reconciliate, enter check numbers and transaction ids3. Can’t import data at all4. No reports facility period5. The All Accounts view does not display a column indicating which bank or account the item comes from.6. Can’t export to Quicken (Web Connect) or MS Money Format7. CSV exports are unusable. One Amount column and one transaction type column (credit or debit) as opposed to one Credits and One Debits columns. No balance column.CONCLUSIONUnusable for most people

PROS

1. FREE automatic downloads & sync from banks, credit unions and brokerage firms. (with Quicken you have to pay $10/mo. average per bank)

2. Categorizes downloaded items automatically for you

3. Let you export downloaded items in CSV format

4. Let you add transactions by hand

5. One button to filter and display all bank fees

CONS

1. No balance column

2. No reference code column that helps you reconciliate, enter check numbers and transaction ids

3. Can’t import data at all

4. No reports facility period

5. The All Accounts view does not display a column indicating which bank or account the item comes from.

6. Can’t export to Quicken (Web Connect) or MS Money Format

7. CSV exports are unusable. One Amount column and one transaction type column (credit or debit) as opposed to one Credits and One Debits columns. No balance column.

CONCLUSION

Mint.com is unusable for most people