If you had told me four years ago that my car insurance was about to go down by half, I might not have believed you. But that’s exactly what happened when I dropped my traditional car insurance and switched to Metromile.

Here’s a look at exactly how pay per mile insurance works, when it makes sense, and how it saves me money every single month compared to my old insurance policy.

How pay per mile is different from traditional auto insurance

With old-school car insurance, you pay a fixed amount every month to insure your car. While it’s important to have comprehensive coverage that meets your needs, with traditional insurance policies, you have to pay the same amount whether your car is sitting around at home or driving back and forth to work and running regular errands around town.

Pay per mile insurers realized that you probably will not get into a car accident when your car is sitting still, so you shouldn’t have to pay as much if your car is parked.

With pay per mile, you unbundle the cost of insuring your car while sitting around and insuring it while driving it around. This means people who drive less will save a lot. People who put a lot of miles on their cars might do better with traditional insurance. Your driving habits are the main factor in which type of insurance makes the most sense for your unique needs.

When pay per mile car insurance makes sense

With traditional insurance, you always know exactly what you’re going to pay for coverage each month, but you won’t save anything if you drive a lot less, as many of us are since the start of the COVID-19 pandemic. Even many people who drive to the office five days per week could save with pay per mile, but those who now work from home full-time or part-time may be more likely to find significant savings.

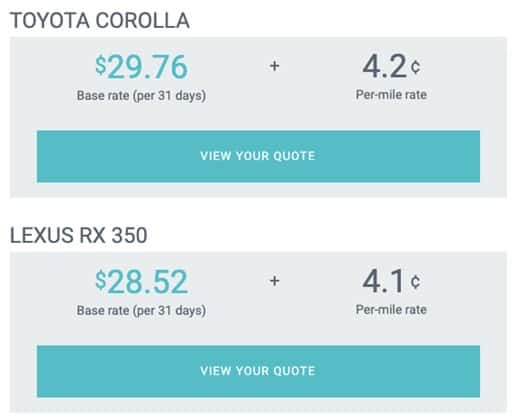

With pay per mile, you pay a much lower fixed rate every month and pay a few cents for every mile you drive. If you drive more, you pay more. If you drive less, you pay less. Anyone who drives less than 10,000 per year may be able to save money with pay-per-mile. During COVID and beyond, there’s a very good chance that includes you.

This kind of insurance isn’t right for everyone, but for many people, particularly those who work from home or have very short commutes, pay per mile could save you a small fortune compared to traditional insurance. College students, seniors, public transit riders, and anyone who drives less than 30 miles a day on average will save.

For me, switching to pay per mile insurance with Metromile led to huge savings. Honestly, my only regret is that I didn’t switch sooner!

How I saved half with pay per mile insurance

As a personal finance writer, I’m a big fan of saving money – but who isn’t? One of my favorite parts of getting married was saving money every month on my car insurance. But even having tied the knot and proven that I was a low-risk driver, my wife and I still had to pay what felt like an arm and a leg to stay insured.

It was actually a bad customer service experience that led us to shop around and discover Metromile. While bundling and “saving” with our previous insurer, we paid $155 per month for our two cars and two drivers with perfect records for about a decade.

We both drove old, paid-off cars, and neither had (or have) a regular commute. That means we didn’t rack up a lot of per-mile charges regularly. However, if we do decide to take a road trip, there’s a limit to how many miles we pay for per day. If you go over 250 miles in a day (or 150 if you live in New Jersey), any additional miles are free.

For October 2016, our first full-month bill with Metromile, we paid just $87. That’s a fairly average bill for us. However, we have some months where we’ve paid less than $60. Assuming an average bill of $85 per month, which we generally paid our first year at Metromile, that’s a 45% savings, or nearly half!

Our costs have crept up very slowly over time, and we got a new car, so now we pay around $100 per month to insure both cars. But our most expensive month ever with Metromile when we’ve taken long road trips have always been less than what we paid to our old insurer.

Over the four years we’ve been with Metromile, I estimate that we’ve saved about $3,000 so far, and that would be assuming our old car insurance company wouldn’t have raised their rates, and they almost certainly would have. Thanks to dumping our traditional car insurance, we can add more to our savings every month.

Are you living the pay per mile lifestyle?

You may already be living the pay per mile lifestyle and not even realize it! We saved money driving an average of around 700-800 miles per month between the two of us. That’s about 25 miles per day. But even if we had driven quite a bit more, we still would have saved.

Take a look at how much you really drive in a typical month. You may be able to save hundreds of dollars per year. Pay per mile can make it work. You decide what to do with the savings.

(This post was written by me and includes my own opinions, but was coordinated with Metromile.)