Long before I had this blog, I had a car loan. My old car, a hand-me-down 1990 Volvo Station-wagon with about 200,000 miles, decided to stop working while driving west on Belleview Avenue one summer morning. Fixing it would have cost as much as the car was worth, so I decided to get a brand new one.

Long before I had this blog, I had a car loan. My old car, a hand-me-down 1990 Volvo Station-wagon with about 200,000 miles, decided to stop working while driving west on Belleview Avenue one summer morning. Fixing it would have cost as much as the car was worth, so I decided to get a brand new one.

After all, I had a good job and was living at home with my parents. It seemed like a good idea. Now, two and a half years later, it still seems like it was a good idea. I still love the car and I was able to pay off the loan two and a half years early. That is half of the scheduled time for those of you who are math impaired.

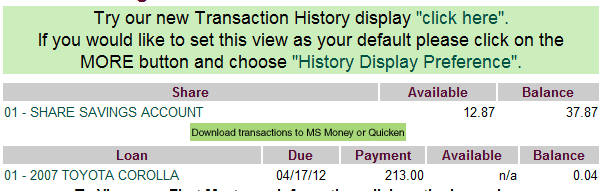

Over the lift of the loan, I paid a total of $675.53 in interest to the credit union for my $10,995 loan. That is not too bad. I like to think of that $675 as my car rental fee for the roughly 30 months I have been using the car so far. That is a savings of $573 from the total interest if I had only made minimum payments.

I took a screen shot to commemorate my last online payment. Silly me, I didn’t check the “payoff amount” and was left with four cents that I could not pay online. A quick phone call took care of that though.

I plan to keep this car for many, many years and I am glad I have it.

What am I going to do with all of the money I had been putting into the loan? I am sticking to my own advice. My debt snowball leads me to student loans from here. I have just about $21,900 left there. I am still in school, so most of the loans are not accruing interest for another 7 months. I have paid about $20,000 into my student loans while I have been in school, so paying down the rest shouldn’t take more than another two or three years.

Do you have any good loan payoff stories? Please share in the comments.