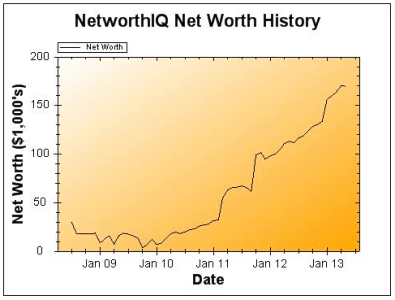

Now that bonus season has passed, my net worth leveled off a bit and I am starting to make future plans for my debt and savings for the rest of 2013.

Banking, Debt, and Investments

This month, I made a few changes to my money. First, I decided to pay an extra $200 into my mortgage. I did some math and found that, at this point, each extra $100 I put into my mortgage saves me about $50 in loan interest over the life of my mortgage. Might as well put in what extra I can to save a few extra bucks in the long run. I am going to have to pay the principle off at some point, so what better time than now?

I also decided to increase my 401(k) contribution by 1%. I took a look at my 401(k) portfolio to re-balance my investments. When I was in there, I decided to increase my 401(k) contribution from 5% to 6%. That is in addition to my company’s match (4%). I am now maxing out my Roth IRA with an auto-deduction and contribute a net 10% in my 401(k).

I am also continuing to add $25 automatically each paycheck into my Lending Club account. My net annual returns at Lending Club are 11.30% and steadily growing as I diversify into more risky, higher interest loans. I currently have 35 active loans, 1 in funding, and 10 fully paid. I love Lending Club as an alternate investment vehicle.

Liberty Fund Update

I have a $30,000 savings goal for my liberty fund. Thanks to my bonus, I was able to make my biggest contribution to date. I started saving in August and the fund balance is now at $22,994. The end is in sight! However, I do plan to use $2,500-$5,000 on some home remodeling projects.

The bulk of my liberty fund is in a combination of high interest savings accounts and a stock investment account. I suggest Ally Bank for this type of savings. I began this fund with a $5,000 emergency fund goal.

Side Business Income

Narrow Bridge Media – All Blogs and Online Activities

Revenue

- Private Ad Placements and Freelance Work – $775

- AdSense – $27

- Affiliate Payments – $145

- Premium Plugin Sales – $0 (will be reported only when paid by Code Canyon)

Expenses

- Freelance Writers – $60

- Email List – $19 (Provided by Aweber)

- Web Expenses and Development – $95

This was a pretty good month. My goal is $1,000 per month, and this month I made $947 in revenue. Maybe an increase in freelancing will help make up the difference? Also, in case you were curious Premise is a plugin that allows on-site payments and digital product sales. I am trying to incorporate it into a few different sites I own.

I created a new WordPress plugin to solve a problem I had. I was trying to convert from the Thesis Theme to Genesis (did you notice?) and couldn’t move my Thesis post images as expected. My new plugin takes care of that and is available for $10, of which I get $6 per sale.

Denver Flash Mob – Flash Mob Consulting and Planning

- Revenue – $150

- Staff Payments – $100

- Other Expenses – $144

The completely rebuilt the Denver Flash Mob website is sending me more business leads, but I don’t always have the ability to meet the requests. I currently have 3 events in the works. The $144 spent this month was for Event Espresso, an event signup tool allows me to setup events outside of Facebook, control all aspects of the event, and automate signups to the email list when new people join a flash mob. You can take a look at the new calendar and new event pages if you want to see where the money went.

I am considering selling this business to free up time for other projects, but I’m not really sure where to start.

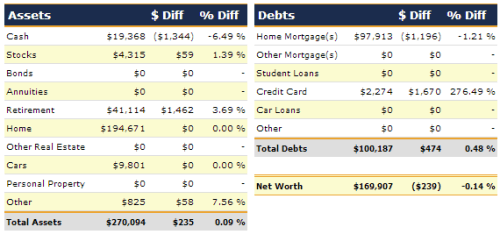

Net Worth

In total, my net worth was down $239, or -.14%. (My IKEA visit put me over!) I update my condo value from Zillow and update my car value based on Kelley Blue Book annually in January. I pay off my credit cards in full each payday.

Good job on the side income! 🙂

I do my best! My goal is to cover my mortgage with side business income.

your affiliate sales were not bad!

I keep trying to grow. If I can trend upward, even by a little, I know I am on the right track.